Microsoft’s AI Ascendancy

Microsoft’s foray into the AI realm was swift, bolstered by a strategic partnership with OpenAI, the mastermind behind ChatGPT. This collaboration empowered Microsoft to seamlessly infuse AI-centric tools across their repertoire, including Azure Cloud, Windows OS, and the Microsoft 365 suite.

Microsoft’s AI-centric ventures reaped resounding acclaim. Notably, Microsoft Copilot, their generative AI assistant, witnessed a surge in demand across various domains. CEO Satya Nadella revealed that Copilot’s integration with GitHub attracted over 77,000 enterprise users, marking a robust 180% yearly uptick. Moreover, Copilot fuelled more than 40% of GitHub’s revenue growth in fiscal 2024 and orchestrated a 60% surge in Microsoft 365’s customer base.

Industry expert Piper Sandler predicts that Microsoft 365 Copilot alone could amass $10 billion in annual revenue by 2026. With the smart virtual assistant market set to burgeon by 27% yearly until 2032, translating to nearly $100 billion in revenue, from $10 billion last year, Copilot stands as a lucrative venture with immense potential.

Microsoft’s AI crusade also catalyzed growth in their cloud computing sector. Azure AI cloud service witnessed a 60% rise in clientele to 60,000 customers last quarter, with per-customer expenditure witnessing an uptick. Consequently, Azure revenue climbed 30% year-over-year, fueled in part by a substantial 8% growth from AI services, solidifying Microsoft’s position as the second-largest cloud infrastructure service provider, boasting a 20% market share.

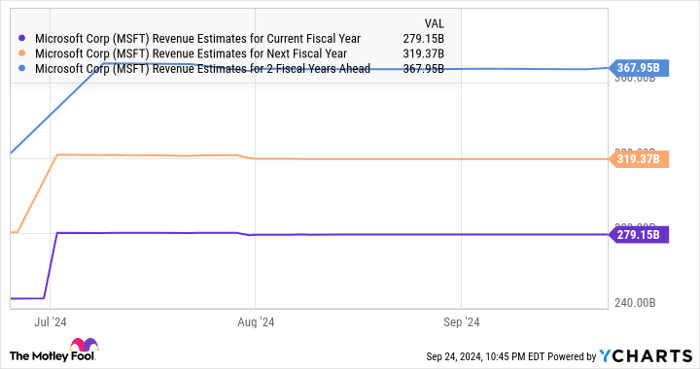

Microsoft’s strategic prowess in exploiting the flourishing cloud AI landscape, across diverse applications, foreshadows sustained revenue escalation in the coming fiscal years post a notable 16% surge to $245 billion in fiscal 2024 earnings.

Oracle’s AI Odyssey

Oracle, a relatively new entrant in the AI arena, has swiftly made waves, leveraging its cloud infrastructure for AI model training. The first quarter of fiscal 2025 saw a remarkable 45% surge in cloud infrastructure revenue to $2.2 billion, outshining the overall 7% revenue growth to $13.3 billion.

Oracle’s infrastructure-as-a-service division anticipates robust and sustained expansion for two pivotal reasons. Firstly, the infrastructure-as-a-service arena is projected to hit $580 billion by 2030, constituting a significant slice of the overall cloud expenditure pie. Secondly, Oracle is actively ramping up its infrastructure influx to bridge the widening gap between cloud infrastructure demand and supply.

The quarter witnessed an 80% spike in remaining performance obligations (RPO) for the cloud business, surging 52% year-over-year to $99 billion. As Oracle earmarks a doubling of capital expenditures to $15 billion in fiscal 2025, an estimation of 10% revenue growth to $58 billion for the fiscal year gains credence. This anticipatory surge, revised from a projected 7% uptick, sets the stage for an even loftier growth trajectory.

Oracle anticipates a 12% revenue boom in fiscal 2026 to $65 billion as they materialize on their RPO potential, with a long-term forecast envisioning a top-line soar to at least $104 billion by fiscal 2029, thereby registering annual earnings growth surpassing 20% for the upcoming five years.

Oracle’s trailblazing projections offer them a competitive edge over Microsoft, with Oracle’s annual earnings poised for an approximate 15% escalation, contrasting Microsoft’s projection hovering below the 15% mark.

The Ultimate Decision

Both Microsoft and Oracle, titans in cloud computing, stand to reap the rewards of the surging AI cloud frontier. Microsoft currently commands a swifter growth trajectory vis-a-vis Oracle. However, fueled by a robust revenue pipeline, Oracle forecasts a growth pace exceeding Microsoft’s in the foreseeable future.

Hence, the choice between the two juggernauts hinges on their valuations. A comparative analysis of their trailing price-to-earnings ratios reveals Microsoft as the more cost-effective option. Conversely, Oracle boasts a significantly lower forward earnings multiple, signaling a potent earnings boost to come in the near future.

Moreover, considering the price/earnings-to-growth ratio (PEG) unveils Oracle’s undervaluation compared to Microsoft, indicating a stronger earning capability in the offing.

For investors seeking an AI-centric entity primed to capitalize on the thriving cloud computing terrain, Oracle emerges as a compelling choice over Microsoft, as affirmed by the PEG ratio and forward-looking valuation metrics.

Investing in Oracle: A Prudent Move?

Before delving into Oracle’s stocks, weigh this advice:

The Motley Fool Stock Advisor experts pinpointed what they deem the 10 best stocks for investors to bank on, and Oracle didn’t make the cut. These chosen 10 hold the potential for mammoth returns in the imminent future.

Cast your mind back to April 15, 2005, when Nvidia made the list… If you forayed with $1,000 at our recommendation, you’d now be sitting on $760,130!*

Stock Advisor equips investors with a clear blueprint for success, proffering insights on portfolio curation, analyst updates, and bi-monthly stock recommendations. Since 2002, the Stock Advisor service has substantially surpassed the S&P 500 by over fourfold*

Explore the 10 stocks »

*As of September 23, 2024, Stock Advisor returns.

Harsh Chauhan is unaligned with the mentioned stocks. The Motley Fool stakes positions in and commends Microsoft and Oracle. The Motley Fool exhorts long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a stringent disclosure policy.

The expressed views and opinions herein are personal to the author and not synonymous with Nasdaq, Inc.’s standpoint.