Nvidia: Leading the Charge in AI Revolution

Graphic chip giant Nvidia has emerged as the powerhouse behind cloud computing’s insatiable hunger for artificial intelligence (AI) capabilities. Clients queuing for up to 11 months for Nvidia’s AI GPU testify to this fervor. Tackling this bottleneck head-on, Nvidia optimized chip production, slashing waiting periods to a more manageable 3 to 4 months.

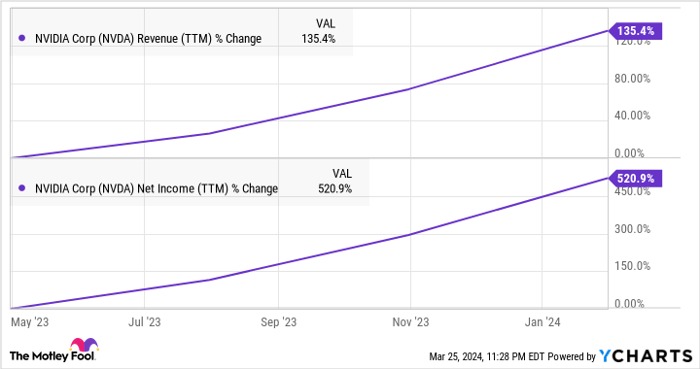

Not content with status quo, Nvidia escalated its game, with a phenomenal 265% year-over-year revenue spike to $22.1 billion in Q4 of fiscal 2024. Non-GAAP earnings went into overdrive, catapulting 486% to $5.16 per share. The upcoming quarter anticipates a 233% revenue leap to $24 billion, maintaining its momentum as the go-to AI hardware supplier.

Leading the next-gen market frontier, Nvidia’s Blackwell AI GPUs promise a 30-fold enhancement in AI inference performance. With a voracious appetite for the anticipated $91 billion AI chip market, Nvidia has Meta Platforms circling for future-gen Llama model training.

Micron Technology: Riding the AI Wave with Finesse

Micron Technology, hand in hand with Nvidia, powers up AI GPUs through its high-bandwidth memory (HBM). Demand for HBM chips propels Micron’s fortunes forward, earmarked for deployment in Nvidia’s H200 processors.

Selling out all capacity for 2024 with an overwhelming 2025 supply allocation, the future looks radiant for Micron. Sampling a potent HBM chip boasting 50% more memory, Micron amplifies the AI chip arena. HBM’s forecasted $17 billion revenue in 2024 signals hope for Micron’s protracted growth.

Recent fiscal strides like a 57% year-over-year revenue uptick in Q2 of 2024 to $5.82 billion position Micron as the underdog gaining momentum in the AI scramble.

Final Judgment: Micron’s Valuation Brings Home the Bacon

While Nvidia dazzles with a meteoric growth trajectory, Micron’s value proposition shines through. At 37 times sales, Nvidia appears inflated against Micron’s modest 6.4 price-to-sales ratio. Micron also outshines Nvidia on forward earnings multiples.

Though Nvidia spearheads the growth race, investors eyeing a budget-friendly AI venture may align with Micron’s attractive price point and burgeoning potentials.

Before dipping into Nvidia stocks, ponder this: Connoisseurs at Motley Fool Stock Advisor tout 10 superior stocks for investment, free from Nvidia’s fold. This exclusive list promises bountiful yields and peeked intrigue for the discerning investor.

Witness the stocks poised to shape tomorrow’s markets.

*Stock Advisor returns as of March 25, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.