Palantir Technologies (NYSE: PLTR) and Nvidia (NASDAQ: NVDA) have been lighting up the charts on Wall Street, with both stocks relishing a remarkable over 240% surge in the past year. Amidst fervent investor enthusiasm for these tech giants, the burning question remains: which artificial intelligence (AI) stock holds the trump card? In a closely fought battle, one emerges as the faint front-runner. Here’s the breakdown for savvy investors hungry for insights.

Knowing the Two Diverse Titans

While both companies have seen meteoric rises powered by robust business performance, they each occupy distinct niches in the tech cosmos. Nvidia’s ascent stems from years of dominance in high-performance GPUs tailored for data centers and AI applications. Bolstered by cutting-edge products and specialized CUDA software optimizing GPU performance, Nvidia has swiftly secured a commanding share – approximately 80% to 90% – of the AI chip market.

Conversely, Palantir specializes in crafting tailor-made software for both governmental and commercial realms. Operating on three key platforms: Gotham, Foundry, and AIP for AI, Palantir functions as an organizational system driving data utilization. The company’s ethos revolves around enhancing human intelligence rather than replacing it.

Delving Into Growth Trajectories

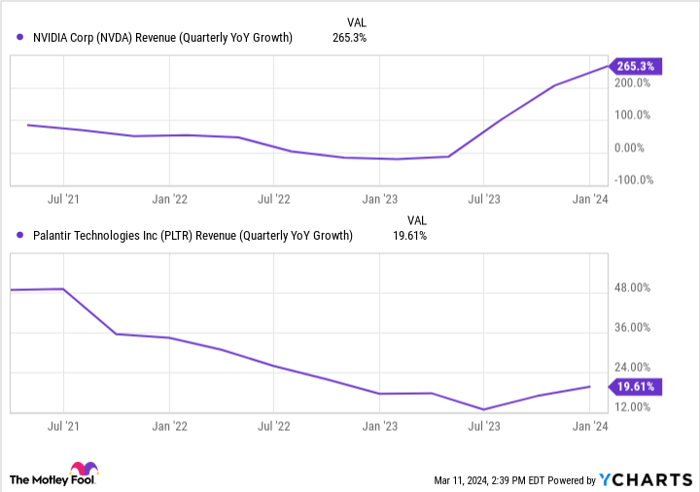

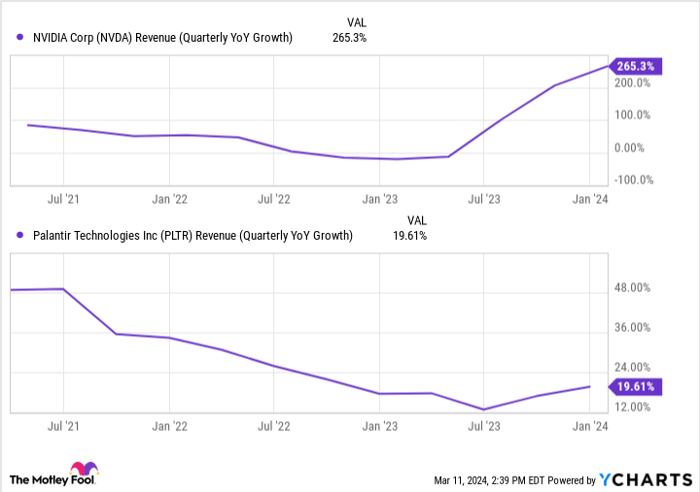

From a sheer numerical vantage point, Nvidia’s growth trajectory outpaces Palantir’s by leaps and bounds. The graph below illustrates how both firms accelerated revenue growth in mid-2023, with Nvidia riding high on expansive data center investments from tech behemoths, notably the “Magnificent Seven.” Yet, a pertinent query looms: How sustainable is this meteoric uptick in data center outlays from tech giants?

If these firms transition to in-house chip development, potentially diminishing reliance on Nvidia, the latter’s long-term growth might be jeopardized as it currently heavily banks on a few major clients.

NVDA Revenue (Quarterly YoY Growth) data by YCharts.

Speaking of Palantir, though not experiencing Nvidia’s explosive surge, what garners attention is the firm’s burgeoning clientele. Palantir witnessed a 55% year-over-year and a 22% quarter-over-quarter spike in its U.S. customer base during the fourth quarter. This diverse customer expansion augurs well for sustained revenue growth in the long run.

Optimal Returns on Investment

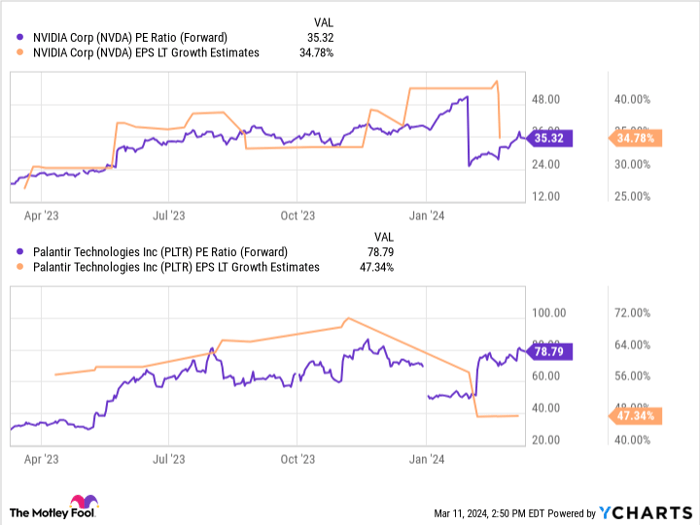

Analysts envisage significant earnings expansions for both entities in the near term, rendering both stocks more attractively priced than perceived after their staggering 200% ascents. The PEG ratio serves as a pivotal yardstick to evaluate the earnings growth cost efficiency. A PEG ratio below 1.5 is considered favorable, and Nvidia boasts a commendable PEG ratio slightly over 1, while Palantir lags marginally with a 1.6 PEG ratio.

NVDA PE Ratio (Forward) data by YCharts

In terms of being an astute investment, Nvidia currently emerges as the more cost-effective choice based on the anticipated long-term earnings expansion for each. However, the pivotal consideration is whether these firms will live up to envisaged performance standards.

The Verdict Unveiled…

Both Nvidia and Palantir stand tall as premier AI stock contenders in their respective domains, with revenue growth trajectories veering upwards. Analysts are brimming with optimism regarding the earnings expansions forecasted for both firms. Ultimately, the choice between the two pivots on which entity seems more poised to meet growth benchmarks over the coming three to five years.

Pitting the two against each other, this Fool modestly tips the scales in favor of Palantir. Why so? Palantir garners roughly half its revenue from government contracts, presenting a semblance of stability owing to its longstanding governmental ties, coupled with a potent upside from broadening its customer base. In contrast, Nvidia’s elevated customer concentration might prove precarious if a major client opts for an alternative chip provider.

Despite numerical indications favoring Nvidia as the superior purchase, one could assert that Palantir’s long-term growth trajectory appears marginally more dependable, particularly in the extended scheme of things.

Considering an investment of $1,000 in Palantir Technologies?

Before contemplating a Palantir Technologies stake, delve into this tidbit:

The Motley Fool Stock Advisor analysts have identified the purported 10 prime stocks investors should consider dabbling in right now, omitting Palantir Technologies from the shortlist. The 10 identified stocks hold the potential to yield monstrous returns in the upcoming years.

The Stock Advisor service furnishes investors with an accessible blueprint for success, replete with guidance on portfolio construction, routine updates from analysts, and two fresh stock recommendations each month. Since 2002, the Stock Advisor service has reportedly outstripped the S&P 500 returns by over threefold*.

Discover the 10 stocks

*Stock Advisor returns as of March 11, 2024

Justin Pope holds no positions in any of the mentioned equities. The Motley Fool maintains positions in and recommends Nvidia and Palantir Technologies. The Motley Fool endorses a disclosure policy.

The perspectives articulated herein are those of the author and do not necessarily mirror the stance of Nasdaq, Inc.