The electric vehicle (EV) revolution once surged like a runaway freight train but appears to be losing steam. Recent data reveals a slowdown in EV adoption, with U.S. sales growing at a modest 42% year over year in November, a notable drop from the robust 75% growth recorded in 2022. Despite generous federal and local subsidies, dealers struggle to move EVs off their lots. The shift towards hybrids compounds the challenge. In contrast, “Toyota,” which embraces an omnichannel approach involving gasoline, hybrid, and electric vehicles, has reaped the fruits of this dichotomy. The company’s stock has soared by a staggering 57% in the past year.

This deceleration is mirrored in the stock performances of EV pure plays. Both “Tesla” (NASDAQ: TSLA) and “Rivian Automotive” (NASDAQ: RIVN) have tumbled 20% in the last six months, while the S&P 500 has ascended. However, astute investors recognize that short-term tumult can portend lucrative investment opportunities for those with a long-range perspective.

Tesla: Erosion of Dominance and Inflated Valuations

Tesla, alongside Chinese carmaker “BYD,” stands as one of the global EV behemoths, dispatching 1.8 million vehicles in 2023. However, its dominance is ebbing as a deluge of EV competitors storms the market. Even though the company tallied a respectable 38% year-over-year delivery growth in 2023, this feat came at a cost. Tesla slashed prices on its new vehicles, sparking a 30% decline in the value of used Teslas over the last 12 months, vastly outpacing the 4% dip seen in the average used car in the U.S. To exacerbate matters, the pace of Tesla’s delivery growth has decelerated. In the fourth quarter, the company only managed a 20% surge, trailing the overall EV sector’s growth rate. CEO Elon Musk anticipates another year of languid growth in 2024, pending the debut of a more affordable model. The timing of this unnamed vehicle’s release is a critical metric for investors to monitor.

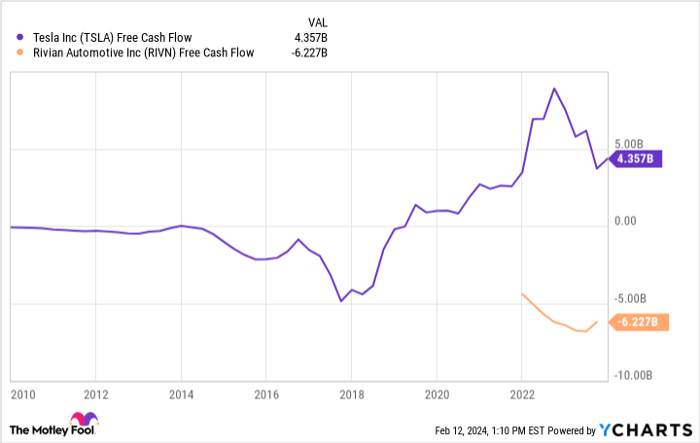

Despite its tribulations, Tesla trades at a premium, a paradox given its fiscal hurdles. In 2023, the company generated approximately $4 billion in free cash flow. Yet, with a market cap of $600 billion, Tesla carries a price-to-free cash flow (P/FCF) of 150, well above the S&P 500 average range of 20 to 30. Amid these circumstances, Tesla stock appears unappealing at current valuations in light of the company’s struggles. But is it superior to Rivian?

Rivian Automotive: A Profitless Odyssey

Rivian Automotive, a fledgling EV maker, burst onto the scene with panache, securing a market cap surpassing $120 billion during the 2021 bubble despite zero revenue. Today, it has made substantial strides in its high-end EV truck and commercial van business, churning out 57,000 vehicles in 2023. However, the company continues to grapple with an alarming absence of profitability. In the third quarter of 2023, it reported a staggering gross profit loss of $477 million on $1.3 billion in revenue. Over the past year, Rivian has hemorrhaged a massive $6 billion in free cash flow. With less than $10 billion in cash on its balance sheet, the company faces extinction within two years at its current burn rate. Rivian remains light-years away from achieving positive cash flow.

TSLA Free Cash Flow data by YCharts

Which stock should you buy?

Presently, Tesla is ostensibly in a stronger position than Rivian, by virtue of the lesser of two evils. Rivian has never recorded a positive gross profit, let alone free cash flow, and could be teetering on the brink if the EV sector endures a further cyclical slump. Thus, if compelled to choose between the two, Tesla is conceivably the safer bet.

The silver lining? You needn’t lay claim to either. In fact, prudence dictates eschewing the entire EV sector. The market is inundated with supply, steep competition, and exorbitant costs associated with the EV frenzy. This scenario spells customer value at the expense of dismal stock returns, reminiscent of the gasoline-powered car market throughout the last century. Exercise caution with EV stocks like Rivian and Tesla; instead, gravitate towards profitable blue-chip stocks to fortify your portfolio.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Tesla made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of February 12, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends BYD and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.