With Wall Street marking down both Nike (NYSE: NKE) and Lululemon Athletica (NASDAQ: LULU) stocks this year, investors have a tantalizing ordeal ahead. In 2024, the two giants saw a 14% and 24% decline, respectively, while the S&P 500 hiked up 9% through late March.

While both stocks are expected to rebound, the choice of the better buy might dictate the pace of excitement in investors’ growth-focused portfolios. Let’s delve into which one comes out on top.

Expansion Strategies Unpacked

The late-March earnings call of both companies fell short of expectations. Nike faced dire challenges in the footwear domain, as they saw flat sales of $12.4 billion, with no growth in their retail and online sectors. The sluggishness in growth is linked to a faltering demand curve and a growing trend of inventory reduction among Nike’s retail partners. Addressing these setbacks, Nike recently unveiled a restructuring ordeal aimed at reigning in costs. “We are orchestrating the required changes to propel Nike towards the next phase of growth,” CEO John Donahoe iterated in a press statement.

On the other hand, Lululemon showcased robust expansion, with sales leaping 16% to $3.2 billion during the holiday season quarter. Notable sectors lifting the sports apparel maven include a 60% surge in the Chinese market and a 17% growth in the e-commerce stratum. Addressing investors on March 21, CEO Calvin McDonald seemed all smiles as he expressed satisfaction with their closure to the 2023 fiscal year.

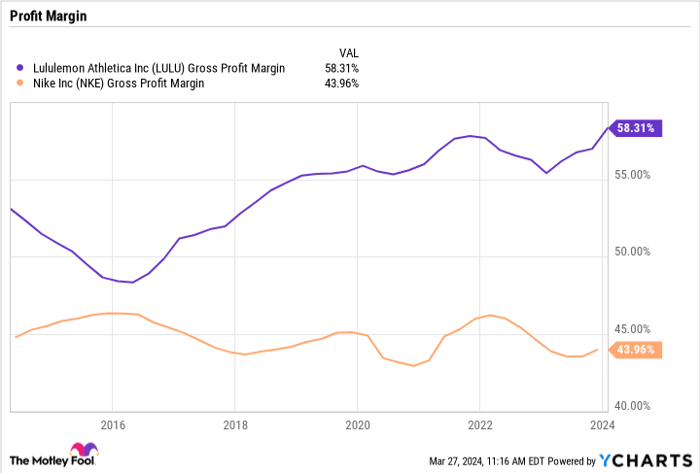

Comparing Pricing Power

Contrastingly, Lululemon asserts a stronger financial position compared to Nike, despite Lululemon’s smaller market presence and weaker seat at the industry table. Nike relies heavily on its retail partners for pricing decisions, leaving it less command over this vital metric. This downward tilt for Nike is glaring when investigating the gross profit margin, where Lululemon witnessed a 2% elevation to 59% of sales in the last quarter. Nike, in comparison, sits at a mere 45% of sales today. The higher concessions in certain areas are crucial reasons cited by Nike executives for scaling down their short-term growth projections.

The Crystal Ball: Outlook and Valuation

Predictably, Lululemon hinted at a cautious approach for the upcoming quarters, signaling to investors in a conference call that demands are dwindling in the U.S. core market. “We are navigating through a slower beginning to the year in this marketplace,” McDonald elucidated.

Analysts foresee a 13% sales upswing for Lululemon this year post a 19% spike last year, in contrast to Nike that is poised for a 7% revenue shrinkage. Naturally, investing in Lululemon comes at a steeper price tag – trading at 5 times annual sales – in comparison to Nike’s 2.8 times sales valuation.

Although both companies have undergone substantial valuation slash downs from their pandemic glory days, Lululemon bears the higher premium with grace. Despite projecting a less enchanting growth rate this year, all arrows point to Lululemon’s advancing trajectory through its expansion pursuits beyond the American border and its exploration into fresh product segments like footwear.

Should U.S. market growth for Lululemon slacken or if prevailing pricing pressures erode the gross profit margin, Lululemon’s stock might lose its intrinsic appeal. Brace yourselves to monitor these metrics in the approaching quarters for cues on underlying struggles. For now, the stock paints a compelling narrative for investors following its recent retreat.

Embark on a $1,000 Investment Journey with Nike?

Before leaping into acquiring Nike stock, contemplate this:

The Motley Fool Stock Advisor team hatched the top growth prospects, excluding Nike, in their inventory for investors to consider. The chosen ten show potential for monstrous returns in the foreseeable future.

Stock Advisor furnishes investors with a roadmap to prosperity including portfolio building guidance, regular analyst updates, and bi-monthly stock selections. Since 2002, the Stock Advisor service has tripled the S&P 500 returns*

Peek at the top 10 movers

*Stock Advisor returns as of March 25, 2024

Demitri Kalogeropoulos holds stakes in Nike. The Motley Fool has a vested interest in, and vouches for Lululemon Athletica and Nike. The Motley Fool extends recommendations for long January 2025 $47.50 calls on Nike. The Motley Fool upholds a disclosure policy.

Ideas discussed are personal viewpoints of the author and not necessarily synonymous with Nasdaq, Inc.