Surging Bond Yields Signal Economic Risks Amid Market Turmoil

Attention is fixed on the Stock market, and for good reason. The S&P 500 has plummeted 20% over the last two months, marking one of the sharpest sell-offs in contemporary history. Investors have witnessed some of the worst days ever recorded on Wall Street, alongside an occasional bright spot.

Stock prices are bouncing back and forth like a pinball. The Nasdaq fluctuates wildly, moving 4% up one day and 5% down the next. Such volatility can be enough to unsettle even the most seasoned investors.

However, there’s a critical truth that seems to be overlooked: the real risk isn’t the Stock market. The bond market is the source of concern.

Without some relief soon, we could face a dire economic scenario.

The Significance of the 10-Year U.S. Treasury Yield

The 10-year U.S. Treasury yield is widely regarded as the most crucial number in finance. Not only is it a key benchmark for Wall Street traders, but it also underpins nearly every major financing rate across the U.S.

From mortgages and auto loans to student debts and credit cards, virtually all consumer financing hinges on this yield.

When the 10-year yield changes, it impacts everything.

In early April, the yield soared from 3.8% to 4.6% in just a matter of days, marking one of the most dramatic increases seen in modern market history.

This situation has tangible implications:

- Mortgage rates may exceed 8%.

- Auto financing rates could surpass 9%.

- Interest rates on personal loans may enter double digits.

- Credit card APRs could approach 30%.

All this is happening in the context of a slowing economy.

The Economic Ramifications of Rising Bond Yields

Typically, bond yields decrease during major recessions. This is part of a natural economic cycle.

In challenging times, investors seek safe havens, purchasing U.S. Treasuries, which results in lower yields. These reduced yields lead to lower financing rates, stimulating consumer borrowing and demand.

For example, during the 2008 financial crisis, the 10-year yield dropped from 4.2% to 2%. In 2020, amid the COVID pandemic, it fell from 2% to 0.5%.

Both instances saw falling yields unlock the economy’s natural shock absorbers: affordable mortgages, accessible auto loans, and low-interest personal debt.

However, this time, those stabilizing factors are not functioning as expected.

As highlighted previously:

- Consumer confidence is nearing a 50-year low. The latest survey from the University of Michigan shows consumer sentiment fell 11% this month to 50.8, marking a 12-year low and the second-lowest level since 1952.

- Retail sales are slowing, especially when considering core indicators. Although sales rose 1.4% in March, this increase appears to be temporary as consumers rush to frontload tariffs. Retail sales increased just 0.2% in February, well below economist projections of 0.7%.

- Business investment has stalled, dropping $130 billion from Q3 to Q4 of 2024.

- The housing market remains frozen, with existing home sales down 1.2% year-over-year, according to the National Association of Realtors.

Now, we find bond yields on the rise.

The Troubling Disparity Between the Bond Market and the Economy

The economy appears to be in freefall, while borrowing costs are escalating.

This is a perilous combination.

The housing market is already stagnant. If mortgage rates rise from 7.5% to 9%, it could collapse entirely. A struggling housing market often leads to broader economic decline, as history has shown us from events like 2008.

Likewise, the auto market is facing challenges, and credit card debt has reached historical highs. Rising rates will strain household budgets, reduce consumer spending, and stifle economic growth.

If bond yields continue to rise while the economy stagnates, we may be facing more than just a mild recession.

We could be on the brink of a potentially historic economic collapse.

What’s Driving Bond Yields Upward?

There are two primary factors behind the surge in bond yields, neither of which are part of a natural economic process.

1. Inflation Fears Stoked by Tariffs

Investors are anxious that impending tariffs will reignite inflation.

When tariff-induced costs rise, so does inflation. In response, investors require higher yields on long-term debt to compensate for this risk. Nobody wants to hold a 10-year bond yielding 4% if inflation expectations are at 5%. This creates a guaranteed loss for bondholders—and thus, panic ensues, pushing yields higher.

2. International Selling Pressures

The U.S. isn’t the only country affected by the ongoing trade war. China’s reactions contribute to the uncertainty, adding further selling pressure in the bond market.

China and Japan May Impact U.S. Bond Market with Sales

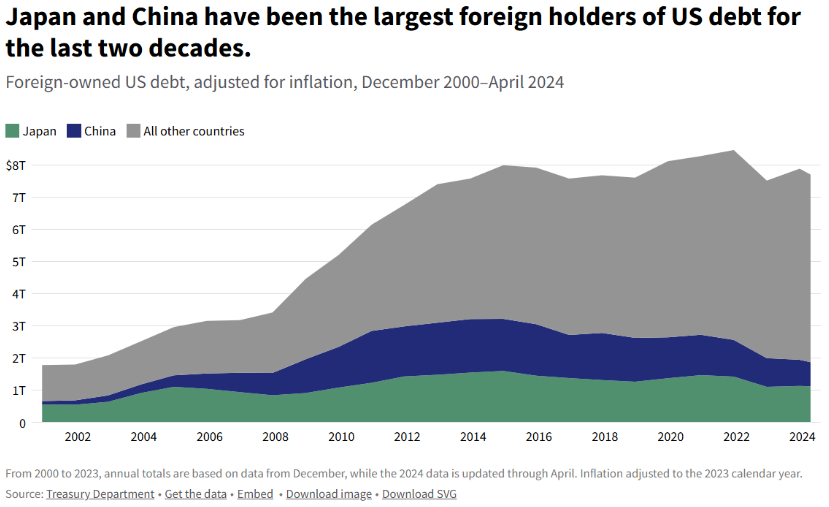

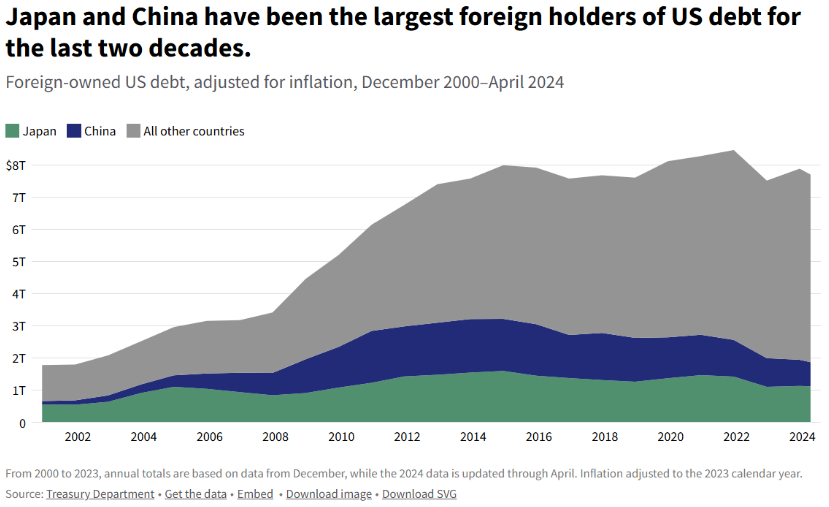

China and Japan, two leading foreign holders of U.S. Treasuries, might be offloading U.S. debt as a form of economic retaliation. This raises the question: why maintain investment in a country amid ongoing economic conflicts?

This wave of foreign selling exerts additional pressure, resulting in lower bond prices and higher yields.

Potential Relief in the Bond Market: An Overview

There is positive news amidst the turmoil: the current distress is not a permanent situation, but rather stems from an acute political issue.

Political challenges often have solutions. Should trade tensions ease, inflation expectations might stabilize, leading foreign investors to halt their Treasury sales. This scenario would naturally bring yields down.

With falling bond yields, financing rates would decrease, benefiting consumers and revitalizing the housing market. Such developments would stabilize the economy and support a stock market recovery. Therefore, there is no reason to panic.

While acknowledging the bond market’s substantial risks, it is crucial to recognize they are manageable.

We have advised our subscribers to consider buying into this dip in the stock market because we are optimistic about a resolution.

Recent advances suggest progress:

- A 90-day moratorium on new tariffs

- Exemptions for electronics on Chinese exports

- Discussions around an auto tariff exemption

- A more conciliatory tone from Washington

These signs are subtle, yet they are accumulating.

Understanding the stakes, the White House may be projecting strength for public consumption, but it also seems to be paving the way for a resolution.

Implications of Bond Market Disturbance for Stocks and the Economy

The U.S. faces a precarious situation.

Alarm bells are ringing in the bond market. If yields remain elevated, this trade war could undermine key economic foundations, impacting the housing market and potentially leading to wider economic issues.

Despite these concerns, we remain convinced that a resolution is imminent.

The mounting pressure is palpable, and the associated pain is significant.

Consequently, we project that a resolution to trade tensions is on the horizon.

As this occurs, bond markets are likely to stabilize, yields may drop, financing rates will normalize, and the recession threat will diminish, enabling stock markets to rebound.

If you’re planning to capitalize on the forthcoming market rally, consider investing in AI 2.0 stocks during this current dip.

This emerging AI technology exhibits embodied intelligence, capable of responding to real-world environments, including functionalities such as seeing, hearing, walking, talking, and learning.

The growing interest from tech giants in humanoid robots underscores the significance of these investments and their potential to drive future growth. We believe this sector offers sizable investment opportunities in the near future.

Discover the details of our top AI 2.0 investment pick.

As of the publication date, Luke Lango held no positions in the securities mentioned in this article.

Got any questions or comments? Reach out at [email protected].