Market Volatility: Navigating the Ups and Downs of Investing

Editor’s note: “Beyond the Ups and Downs: Building Wealth in a Volatile Stock Market” was previously published in February 2025 with the title, “How to find Success in Today’s Volatile Stock Market.” It has since been updated to include the most relevant information available.

The Stock market continues its tumultuous ride, creating a challenging environment for investors.

Recent Market Trends

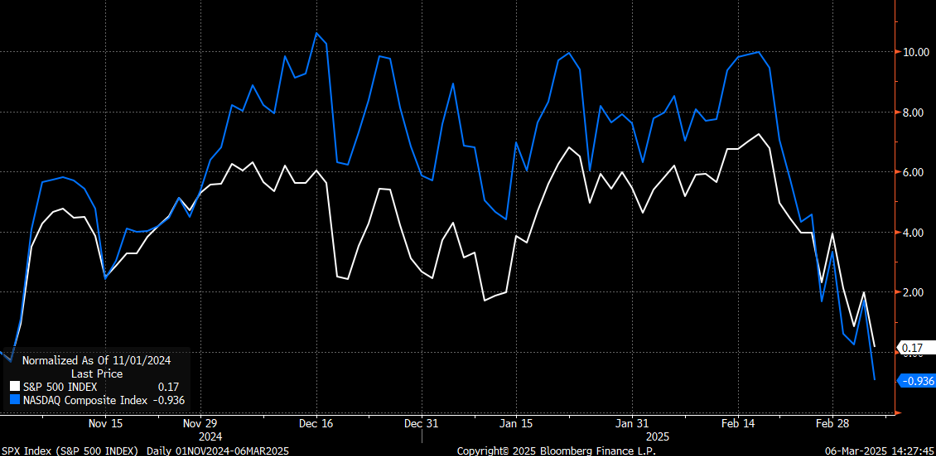

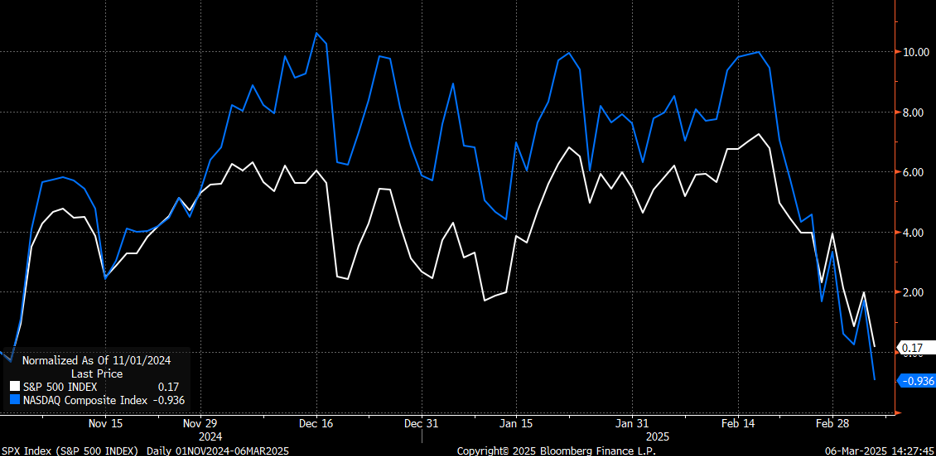

This volatility has increasingly characterized the market since Halloween. In November, the S&P 500 surged by 5.73%, marking one of its best months over the past year driven by optimism surrounding potential deregulation and tax cuts associated with the Trump administration.

However, sentiment swiftly soured in December as concerns emerged about a halt to interest rate cuts by the U.S. Federal Reserve, leading to a sharp decline of 2.5%. December ultimately became one of the market’s worst months.

As 2025 began, stocks initially rebounded through January and early February, buoyed by renewed economic optimism. Yet, fears regarding tariffs, federal spending cuts, and an impending economic slowdown weighed heavily on Wall Street. Since February 10, the S&P has plummeted more than 6%.

The volatility of stocks has resulted in significant fluctuations, with both the S&P 500 and the Nasdaq remaining largely unchanged despite the dramatic ups and downs.

This intense volatility may reflect what some refer to as Wall Street’s ‘new normal.’

A Bumpy Ride Higher?

Despite the turbulence, I maintain a belief that stocks will trend higher in 2025.

Even with rising inflation concerns and decelerating consumer spending, the economy seems to be on solid ground. Anticipation of deregulation and potential tax cuts could provide additional support in the upcoming months. The ongoing AI Boom also presents significant growth opportunities, likely benefiting the entire economy.

Additionally, the recently concluded fourth-quarter earnings season showed strength overall. According to FactSet, nine out of the eleven sectors reported year-over-year earnings growth for Q4. Notably, six sectors experienced double-digit growth: Financials, Communication Services, Consumer Discretionary, Information Technology, Health Care, and Utilities.

Strong Earnings Growth Ahead Amid Market Volatility

The blended earnings growth rate is nearly 17%, marking the highest profit growth for the index since 2021.

Trends show continued strength moving forward. For the upcoming quarter, earnings are anticipated to increase by about 8%, followed by another 9% in Q2. Projections indicate a near 15% rise in the third quarter and around 13% in the fourth.

Overall, corporate earnings are expected to rise through the remainder of the year, which should, in turn, uplift stock prices.

However, I anticipate challenges along the way.

A significant factor contributing to market fluctuations is U.S. President Donald Trump.

Expect Continued Stock Market Volatility

Pursuing numerous changes, President Trump plans to implement tariffs, renegotiate trade deals, reassess America’s military role, and cut federal spending. He also seeks to reduce taxes, expand borders, and reshore manufacturing, among other initiatives.

Clearly, his intentions signal considerable change.

This discussion is not about whether these changes are beneficial or detrimental; rather, it’s important to recognize that they introduce significant uncertainty. This uncertainty, often uncomfortable for investors, can lead to volatility in stock prices.

Market disturbances are likely to persist, mirroring the volatile conditions experienced in recent months.

Conclusion on the Stock Market Outlook

Since early November, the S&P has gained about 5%; however, this rally comprises various smaller movements, including four “mini-rallies” exceeding 2% and four corresponding “mini-crashes” of similar magnitude.

This trend of alternating gains and losses may characterize the stock market for the foreseeable future: ups and downs are to be expected.

Such dynamics imply ongoing volatility on Wall Street.

However, volatility often creates opportunities.

Our goal is to assist you in capitalizing on these market conditions.

In response to Donald Trump’s return to the White House and his partnership with Elon Musk, I have prepared an exclusive informational presentation. I believe it can significantly influence your investment strategy for 2025 and beyond.

This presentation addresses:

- Trump’s Policy Predictions: A five-point strategy detailing how proposed policies may impact the economy, including potential tax reforms and infrastructure spending.

- Market Impacts: Insights into how these political changes could affect your investments over the upcoming four years.

- Investment Opportunities: Recommendations for sectors poised for substantial growth, particularly those benefiting from Musk’s initiatives and Trump’s economic agenda.

The collaboration between these two influential figures presents not just insights, but also potential profit-making avenues. Having dedicated significant time to ensure this presentation is both informative and actionable, I am eager to share it with you.

Click here to watch now and learn to navigate the current political and economic landscape effectively.

As of the publication date, Luke Lango does not hold any positions in the securities mentioned in this article.

P.S. Stay updated with Luke’s market analysis by following our Daily Notes! Be sure to check out the latest insights on your Innovation Investor or Early Stage Investor subscriber site.