BHP Group Limited (market cap: $165 billion) and Vale S.A. (market cap: $66 billion) are notable competitors in the mining industry, particularly in iron ore production. BHP achieved a record 263 million tons (Mt) of iron ore in fiscal 2025, with the Western Australia Iron Ore (WAIO) region producing 257 Mt. In contrast, Vale produced around 335 Mt of iron ore in 2025, reaching the higher end of its projection. Both companies are investing heavily in future growth, with Vale projecting copper production to rise to 700,000 tons (kt) by 2035.

In fiscal 2026, BHP anticipates iron ore production between 258-269 Mt and has raised its copper output guidance to 1,900–2,000 kt. Vale expects copper production between 350–380 kt for 2026, with substantial investments in base metals totaling $1.6 billion for 2026 and $2 billion from 2027 onward.

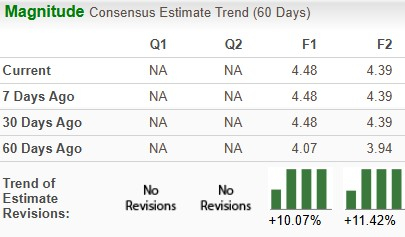

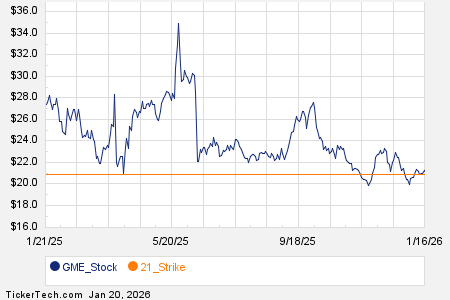

Over the past year, BHP’s stock increased by 36.7%, while Vale’s rose by 92.2%. BHP currently trades at a forward price-to-sales multiple of 3.17X, compared to Vale’s 1.63X, suggesting a more attractive valuation for Vale. Both companies hold a Zacks Rank #1 (Strong Buy), with current earnings estimates reflecting upward revisions for both firms.