Alphabet’s Commitment to Data Centers Boosts Nvidia’s Future Prospects

Listening to earnings calls from companies outside your portfolio can be beneficial. Such calls often reveal insights that may impact companies you do invest in. A recent Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) conference call shed light on key developments concerning Nvidia (NASDAQ: NVDA).

Concerns linger regarding Nvidia’s graphics processing unit (GPU) demand amid potential economic slowdowns. However, Alphabet is moving forward with its data center expansion plans, a positive signal for Nvidia, which may assist in reviving its stock.

Alphabet’s Data Center Plans Remain Robust

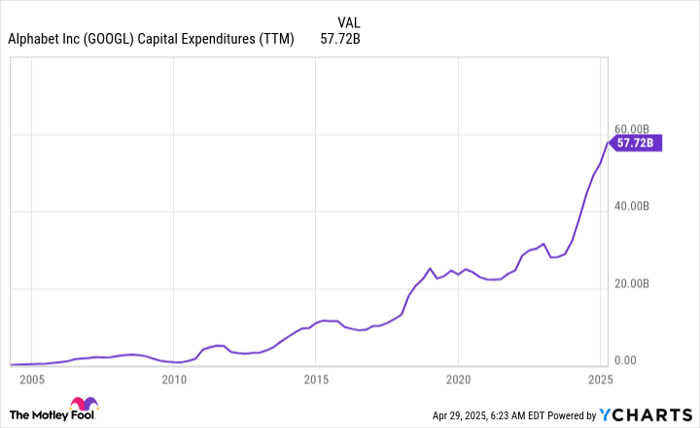

Nvidia’s GPUs are essential for data centers, powering numerous cloud workloads, including AI model training. Despite fears of declining demand due to corporate spending cuts, Alphabet’s outlook appears steady. This year, the company indicated it anticipates $75 billion in capital expenditures (capex) for 2025, significantly surpassing past expenditures.

GOOGL Capital Expenditures (TTM) data by YCharts; TTM = trailing 12 months.

If Alphabet scaled back its capex, Nvidia would be negatively impacted. During Alphabet’s first-quarter conference call, CFO Anat Ashkenazi confirmed that the spending plans are still on track, addressing analyst concerns.

With demand for computing power far exceeding supply, Alphabet cannot afford to reduce its buildout. This unyielding demand for GPUs is beneficial for Nvidia, securing it as a major client with continued procurement needs.

Despite this optimism, Nvidia’s stock remains below its all-time highs, largely due to investor worries about a slowdown in growth.

Market Projections and Nvidia’s Stock Valuation

Nvidia CEO Jensen Huang anticipates sustained data center spending growth. He forecasts capex could hit $1 trillion by 2030, a marked increase from around $400 billion in 2024. Given that Nvidia has generated $115 billion from its data center segment over the last year, it stands to gain significantly from this overall spending increase.

If demand from Alphabet and similar companies continues unabated, Nvidia’s stock could regain its 2023 and 2024 momentum, contrasting with its current lackluster performance in 2025.

Nvidia’s stock is down approximately 20% year-to-date. Nevertheless, analysts project substantial growth for fiscal 2026 (ending January 2026), estimating a 54% increase. This future growth makes Nvidia’s current price tag appealing.

NVDA PE Ratio (Forward) data by YCharts; PE = price to earnings.

With a forward price-to-earnings ratio of 24.6, Nvidia’s stock appears more reasonably priced compared to past valuations. However, this suggests that once current growth is factored in, Nvidia will likely perform at a market-average level afterward.

This outlook conflicts with Huang’s vision for the industry and Alphabet’s assertion of greater data center demand compared to supply. Thus, if future demand remains strong, now could be an advantageous time to acquire Nvidia shares, as only about one year of growth is priced into the stock.

Among market opportunities, Nvidia stands out as a valuable investment, especially before it releases its first-quarter earnings in late May.

Potential Opportunities Await Investors

For those who feel they may have overlooked investment opportunities in top-performing stocks, it’s crucial to stay informed. Market analysts occasionally issue “Double Down” recommendations for companies poised for growth. If you’re concerned about missing out, now might be an optimal time to explore new investments.

Disclosure: Suzanne Frey, an executive at Alphabet, is on The Motley Fool’s board of directors. Keithen Drury holds positions in Alphabet and Nvidia. The Motley Fool advocates for Alphabet and Nvidia and has a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.