Mohamad Faizal Bin Ramli

As earnings season looms in the healthcare sector, investors are turning their gaze towards pharmaceutical giants. The market’s optimism for the industry has been rekindled after a prolonged period of faltering performance.

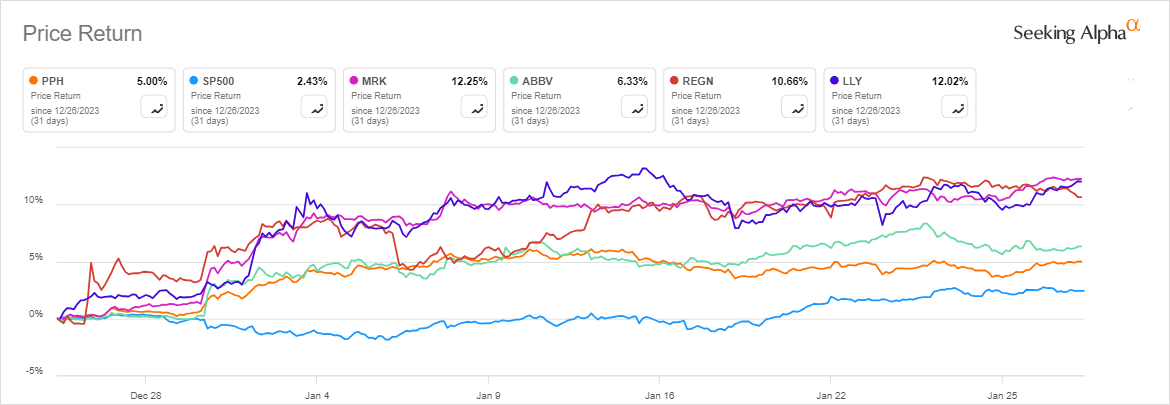

The VanEck Pharmaceutical ETF (PPH), which mirrors 25 major global drug companies, has surged approximately 5% over the past 30 days, outpacing the 2% increase in the S&P 500 (SP500). Nevertheless, PPH concluded the previous year with only a 5% gain, while the broader market soared by 24%.

“U.S. Biopharma enters the 4Q23 earnings season after a seismic positive shift in sentiment from last autumn,” reflected Barclays in its earnings preview last week, sustaining its favorable industry rating. This assertive stance was corroborated by Analyst Carter Gould attributing the recent market outperformance to numerous factors including a broader rotation into healthcare, a supportive macro environment, and a recent surge in deal-making.

Johnson & Johnson Surpasses Expectations

Industry titan Johnson & Johnson (JNJ) exceeded expectations with its Q4 2023 results last Tuesday, propelled by the stellar performance of its pharmaceutical and MedTech segments.

“Despite broadly higher expectations into 4Q prints and ’24 guides, we think most of the group is still set for continued momentum,” Gould added, expressing confidence in the resilience of the industry. He further emphasized the selection of biopharma stocks with robust commercial potential, underlining their advantage over stocks fueled mainly by narratives.

However, Barclays cautioned that the recently announced M&A transactions could obscure expectations due to incurred acquired in-process research and development (IPR&D) charges. Bristol Myers Squibb (BMY) and Regeneron (NASDAQ:REGN) were among the prominent big pharma companies that recently cited IPR&D’s influence on their earnings outlook.

Top Picks and Price Targets

Barclays identified Eli Lilly (NYSE:LLY), AbbVie (NYSE:ABBV), Merck (NYSE:MRK), Regeneron (REGN), and Neurocrine Biosciences (NBIX) as the most favorably positioned stocks in its coverage. Awarded with Overweight ratings, Gould raised their price targets, projecting significant growth for these companies.

Meanwhile, UBS highlighted the strong start for large-cap biotech stocks in 2024, with companies like Amgen (AMGN), Regeneron (REGN), and Vertex Pharmaceuticals (VRTX) all experiencing nearly 9% appreciation. Colin Bristow, an analyst at UBS, emphasized Regeneron (REGN) and Vertex (VRTX) in the firm’s earnings preview for U.S. biotech.

Optimistic Projections and Potential

Displaying confidence in Vertex (VRTX), UBS revised its price target for the company upward to $513 from $443, and similarly increased the target for Amgen (AMGN) to $315 from $268 per share, despite a Neutral rating. Bristow awaited updates from Vertex’s key programs, including its non-opioid pain therapy VX-548 and a three-drug combination regimen targeted at cystic fibrosis.

Despite conservative estimates for Amgen (AMGN), UBS maintained an optimistic outlook on the company’s potential against obesity. The ongoing Phase 2 trial for AMGN’s weight loss therapy, AMG 133, is expected to yield critical data in 2024.

More on Amgen, Vertex Pharma, etc.