The latest quarterly earnings have brought some big news from our leading tech giants. Spoiler alert: they’re all killing it. Microsoft, Alphabet, Amazon, Apple, and Meta Platforms (labeled as the ‘Magnificent 7’) have stepped into the ring, and their financial punches hit hard.

On Tuesday, we saw Microsoft rise to the occasion, promptly followed by a stellar performance from Alphabet, and later in the week, Amazon, Apple, and Meta Platforms joined the earnings frenzy. Such a whirlwind of events has left investors wondering – which titan deserves their hard-earned capital?

Image Source: Zacks Investment Research

Earnings Peek

Each titan’s earnings report is like a star-studded movie premiere – glittering with eye-popping stats, unleashed potential, and gripping narratives. Let’s delve into the highlights.

Microsoft: Q2 2024 witnessed a soaring 18% revenue growth and a 33% EPS jump. Their cloud product, Azure, put on a dazzling show with a 30% surge while doubling its AI integration, signaling a bold vision for the future. However, a lower-than-expected Q3 revenue forecast sprayed cold water on the excitement. Yet, Microsoft stands tall with a Zacks Rank #2 (Buy), showcasing robust performance in the cloud arena and unwavering commitment to AI integration.

Alphabet: Despite topping EPS estimates by 2%, ad revenue fell just short, triggering a slight stock price dip. With a Zacks Rank 3 (Hold), Alphabet may need another compelling act to woo the audience, given concerns about growth in its core advertising engine.

Amazon: Investors’ ears were serenaded with Q4 2023 earnings, as Amazon outstripped estimates for revenue and EPS. The crescendo continued with their cloud computing arm, AWS, setting a melodious tune for growth, and advertising revenue also hitting the high notes. Such a symphony led to a harmonious stock price rise, cementing Amazon’s Zacks Rank #2 (Buy).

Apple: Q1 2024 shattered analyst expectations, with revenue scaling 2% and EPS crescendoing 16% YoY. While iPhone sales slightly missed their cue, Services revenue took center stage, hitting an all-time high and hinting at a shift towards recurring income streams. The company also made waves with a record number of active devices, earning a Zacks Rank #3 (Hold).

Meta Platforms: Q4 2023 set the stage on fire, with both revenue and EPS outshining analyst estimates, leading to a stunning 25% YoY revenue growth. As the company announced its inaugural quarterly dividend and a $50 billion stock buyback, the audience couldn’t help but cheer. Meta Platforms strides confidently with a Zacks Rank #2 (Buy).

Valuation Chronicles

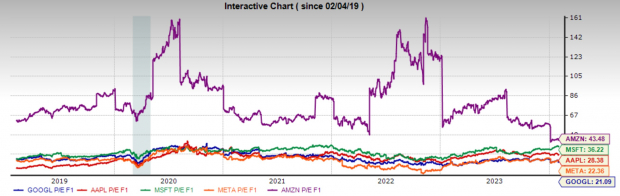

Peering into the crystal ball of forward earnings multiples, we see a riveting tale unfold.

The stock market opera unfolds with GOOGL and META boasting the lowest valuations, around 20x, while AMZN takes the stage with the highest at 43.5x.

With AAPL and MSFT taking their place in the middle of the pack at 28.4x and 36.2x, respectively, the plot thickens.

It’s also worth noting that AMZN, META, and GOOGL flaunt valuations below their 10-year median, whereas AAPL and MSFT appear to be in the limelight, shining above theirs.

Image Source: Zacks Investment Research

Parting Shots

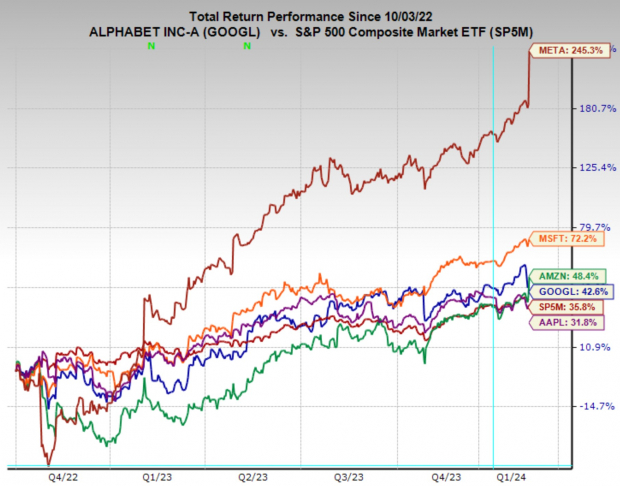

As we steer through this maze of financial intrigue, it’s quite the conundrum. Amazon and Meta Platforms are shining brightly on the horizon, their potential shimmering like a pot of gold at the end of a rainbow. Amazon’s growth, with AWS expanding at a blistering 20% and the ad business swiftly generating $60 billion in sales annually, is nothing short of magical.

Meta Platforms, with its colossal 250% rally in the past year and a half, still stands at the gate with a very reasonable earnings multiple. The introduction of a $50 billion buyback plan and a new dividend unveiling a sincere desire to share the spoils with shareholders.

Alphabet, though having some concerning growth data around its ad business, is plodding along. It might not offer the best growth prospects, but being the cheapest of the Magnificent 7 makes it a worthy contender in this investment quest.

Apple and Microsoft are indeed heavyweight champions in the business realm, a safe bet for any investor’s portfolio. However, at this juncture – well, the plot thickens.

Big Tech Giants Dominate Earnings Report: How Should Investors React?

Big Tech companies, including Apple, Microsoft, Alphabet, and Meta Platforms, have recently released their earnings reports which have left investors both thrilled and concerned. These tech giants, known for their ever-expanding dominance in the market, have witnessed a surge in profits, laudable innovation, and a display of unparalleled resilience even in the face of global economic upheaval.

Apple’s Disappointing iPhone Sales Growth

Unfortunately, Apple’s earnings report revealed a slowdown in iPhone sales growth, triggering unease among investors. The once-thriving iPhone sales have hit a stumbling block, raising questions about the company’s future strategies and adaptability in the ever-evolving tech landscape. The decline in iPhone sales, a product that once acted as the golden goose for Apple, has sent ripples across the investor community. Nonetheless, the company has shown its mettle by continuing to demonstrate robustness in other areas of its business.

Microsoft’s Encouraging AI Gains

Meanwhile, Microsoft’s earnings report has unveiled tremendous gains in the realm of artificial intelligence (AI). However, this has prompted fears of the perhaps-excessive pricing of future news already being factored into the market. The premium valuations are a concern, as investors worry about the sustainability of such growth. Despite this, Microsoft’s foray into AI indicates its relentless pursuit of innovation and diversification of revenue streams, promising some semblance of future-proofing against market fluctuations.

Thriving Amid Economic Uncertainty

These revelations from the top Big Tech companies offer a profound insight into the state of the U.S. economy. At their colossal sizes, these giants continue to thrive, showcasing a remarkable resilience that reverberates across the entire financial landscape. This further reinforces the narrative that the U.S. economy, despite facing its fair share of challenges, stands unwavering at a steady rate, much to the relief of investors.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.