BigBear.ai Prepares for Q4 2024 Earnings Report Amid Growth Prospects

BigBear.ai (BBAI) is scheduled to report its fourth-quarter 2024 results on March 6.

Explore Zacks for the latest EPS estimates and surprises on our earnings Calendar.

The Zacks Consensus Estimate anticipates fourth-quarter 2024 revenues to be approximately $54.17 million, reflecting a 33.54% increase from the $40.6 million recorded in the same period last year.

The consensus loss estimate holds steady at 5 cents per share, unchanged over the past 30 days. In the prior year’s fourth quarter, the company reported a loss of 14 cents per share.

BigBear.ai Holdings, Inc. Price and EPS Surprise

BigBear.ai Holdings, Inc. price-eps-surprise | BigBear.ai Holdings, Inc. Quote

In the last four quarters, BBAI’s earnings fell short of the Zacks Consensus Estimate twice, while surpassing expectations twice, averaging a negative earnings surprise of 60.72%.

Key Factors Influencing Q4 Performance

BigBear.ai appears poised to benefit from increasing government investments in its cutting-edge AI solutions.

Significant investments in advanced AI and predictive analytics, particularly in national security and supply chain management sectors, are likely to have fueled performance in the upcoming quarter. Demand for AI-driven decision intelligence solutions, a core strength of BigBear.ai, continues to grow in these areas.

In Q3 2024, BBAI secured a substantial five-year, $165 million production contract to support the U.S. Army’s Global Force Information Management – Objective Environment (GFIM-OE), expected to commence in the fourth quarter of 2024. This contract is projected to boost revenues significantly in the upcoming reporting period.

The company’s commitment to enhancing its product range has allowed it to attract many corporate clients. BBAI’s products are now integrated within industry giants including AutoDesk, Amazon (AMZN), and Palantir.

Amazon Web Services (AWS), collaborating with BBAI, has adopted the integrated ProModel solution to enhance AI-driven warehousing. The advantages deriving from this partnership are likely to be realized in the reported quarter.

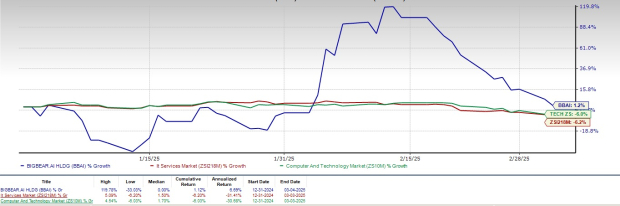

BBAI Shares Outperform Sector and Industry Competition

Year-to-date, BBAI’s shares have increased by 1.2%, contrasting with a 6% decline in the Zacks Computer & Technology sector and a 6.2% dip in the Zacks Computers – IT Services industry.

Year-to-Date Performance

Image Source: Zacks Investment Research

Furthermore, BBAI has managed to outperform notable industry competitors such as DXC Technology (DXC) and ServiceNow (NOW), both of which have seen share price declines of 9.4% and 14.1% respectively during the same period.

However, concerns arise from the current valuation, as BBAI holds a Value Score of F, indicating potential overvaluation.

With respect to the forward 12-month price/sales (P/S) ratio, BBAI is trading at 6.16X—a considerable increase over its historical median of 2.10X and above the Zacks Computer and Technology sector average of 5.95X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Contract Wins Supporting BBAI’s Growth

BBAI’s promising outlook is bolstered by its capacity to secure vital government contracts in the arena of artificial intelligence. The ongoing governmental interest promotes BBAI’s innovation and facilitates its expansion into broader markets.

In February, BBAI was awarded a contract from the Department of Defense (DoD) Chief Digital and Artificial Intelligence Office aimed at advancing its Virtual Anticipation Network prototype. This development is set to enhance the DoD’s capability in analyzing media trends from foreign adversaries, thereby enabling more timely national security decisions based on advanced AI analytics. This venture aligns with BBAI’s strategy to provide impactful AI applications in government.

Earlier, in January, BigBear.ai secured a prime Indefinite Delivery/Indefinite Quantity contract under the U.S. Department of Navy’s SeaPort Next Generation program. This contract is intended for delivering AI-powered systems engineering, process solutions, and critical technologies for both naval and federal applications.

Conclusion: Hold BBAI Stock for Now

Despite its expanding portfolio and strategic alliances, BBAI contends with significant competition within the AI sector. The difficult macroeconomic climate and losses from Virgin Orbit’s bankruptcy may impair the company’s growth trajectory. Furthermore, concerns about valuation persist.

BBAI has a history of volatility, characterized by sharp rises in stock price followed by sudden declines. Such fluctuations might pose a risk for investors.

At present, BBAI is rated Zacks Rank #3 (Hold), suggesting it may be prudent to await a more favorable entry point before accumulating shares of the company. You can view the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to see All Zacks’ Buys and Sells

We’re not kidding.

Years ago, we surprised our members by offering them a 30-day trial to access all our recommendations for just $1. No further obligation required.

Many have taken advantage of this opportunity, while others hesitated, suspecting a catch. Yes, our motivation is simple: to familiarize you with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which have recorded 256 positions with double- and triple-digit gains in 2024 alone.

see Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Get your free download of the 7 Best Stocks for the Next 30 Days. Click to claim this report.

Amazon.com, Inc. (AMZN) : Free Stock Analysis report

ServiceNow, Inc. (NOW) : Free Stock Analysis report

DXC Technology Company (DXC) : Free Stock Analysis report

BigBear.ai Holdings, Inc. (BBAI) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.