Challenges Ahead for BigCommerce

BigCommerce Holdings Inc BIGC experienced a significant drop in its stock price during morning trading on Monday.

Critical Downgrade

BofA Securities recently downgraded BigCommerce Holdings, with analyst Koji Ikeda shifting the rating from Neutral to Underperform. The price target was also lowered from $11 to $7.50.

Analysis and Prediction

The rationale behind the downgrade is the lack of potential catalysts to drive BigCommerce’s share prices in the near future, combined with an unappealing forecast for revenue and profit growth in 2024, as outlined in Ikeda’s note.

Revenue Stagnation

Ikeda pointed out that muted demand is likely to hinder BigCommerce’s revenue growth. In the competitive e-commerce software industry, revenue growth is a crucial metric. The analyst projected a meager revenue growth of 5.7% for BigCommerce in 2024, significantly lagging behind both domestic and global peers such as Shopify Inc.

Market Dynamics

Operating in a competitive landscape where rivals such as Salesforce Inc and Oracle Corp pose stiff competition, BigCommerce faces challenges due to tough market conditions and a higher rate of replacement projects. These factors pose risks to the company’s revenue growth potential.

Comparative Analysis

Job postings for BigCommerce have witnessed a significant decline, contrasting sharply with the uptick in Shopify’s job listings. The contrasting trends hint at potential moves by BigCommerce to safeguard profit margins at the cost of sacrificing potential revenue growth.

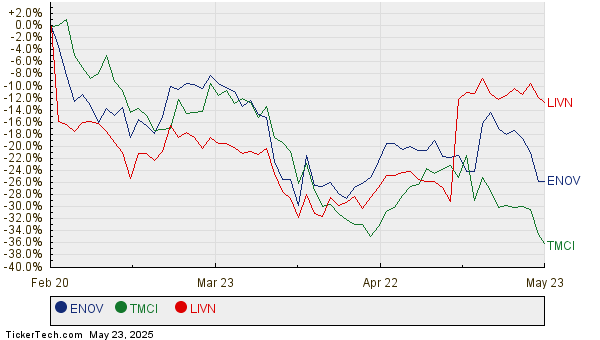

Stock Performance

Current Status: By the time of publication on Monday, BigCommerce Holding’s stock had slumped by 3.71% to $7.01.

Industry Insights

For more on analyst views and market trends, readers can explore a range of stock ratings and analysis to stay informed.

Read Next: Apple Analysts Undeterred By Antitrust Lawsuit: ‘Unmatched Brand Strength’

Photo: Shutterstock