“`html

Key Points

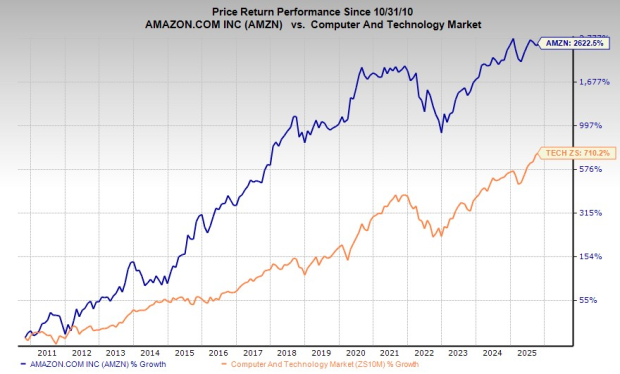

Billionaire Bill Ackman has increased his stake in Howard Hughes Holdings, adding $900 million to build it into a modern equivalent of Berkshire Hathaway. Ackman’s hedge fund, Pershing Square Capital Management, also acquired 5.8 million shares of Amazon and 30.3 million shares of Uber Technologies during the first half of 2025, positioning them as significant parts of his portfolio, with Amazon at 9% and Uber at 21%.

Ackman’s total return on Pershing Square has been 128% over the last five years, outperforming the S&P 500 by 14 percentage points. He sees the potential for Amazon to leverage artificial intelligence in its cloud and retail businesses, alongside Uber’s advancements in autonomous driving technology, both expected to drive growth significantly in the coming years.

“`