Bill Ackman’s Netflix Exit: A $400 Million Missed Opportunity

Hedge fund billionaire Bill Ackman made headlines in 2022 when he sold his Netflix Inc. NFLX shares during a difficult time for the company. This decision has since turned into a notable missed opportunity.

A Quick Overview of Ackman’s Investment

In January 2022, Ackman disclosed that his hedge fund, Pershing Square Capital Management, had acquired over $1 billion of Netflix stock—approximately 3.1 million shares—when shares were priced around $400.

This investment came after Netflix stock had already fallen over 65%, driven by concerns about slowing growth and a broad tech sell-off. However, Ackman’s optimism was short-lived.

Declining Stock Prices and Early Exit

By April, Netflix’s stock continued its decline following a disappointing earnings report and uncertainty regarding its ad-based subscription plans.

Three months after his initial purchase, Ackman exited his position when shares were approximately $225, incurring a loss of around 40%. This decision ultimately cost Pershing Square an estimated $400 million.

The Unexpected Turnaround

Initially, the sale appeared justified as Netflix’s stock fell further, reaching a low of about $175. However, both Netflix and the broader tech sector experienced a remarkable recovery. Today, Netflix shares are trading at approximately $1,096.87, reflecting a staggering recovery of over 168% from Ackman’s initial buy-in price.

If Ackman had maintained his holdings, those 3.1 million shares would now be valued at nearly $3.4 billion, transforming what began as a misstep into one of his most profitable trades.

Current Market Position and Expert Insights

Recently, Netflix Co-CEO Greg Peters reassured investors about the company’s resilience, despite turbulence in the market and recession concerns fueled by new tariffs. He emphasized that the entertainment sector typically remains robust during economic downturns, and Netflix is seeing this trend as well.

Co-CEO Ted Sarandos remarked that the company is focused on controllable factors, stating, “We’re not changing anything in the forecast.”

For the first quarter, Netflix reported revenue of $10.54 billion, marking a 12.5% year-over-year increase, which slightly superseded Wall Street’s expectation of $10.52 billion.

Market Trends and Price Action

Global markets have faced increased volatility due to new trade tariffs implemented by President Donald Trump. The S&P 500 has declined by 6.54% year-to-date, and the Nasdaq-100 has dipped 8.40% over the same timeframe.

In contrast, Netflix shares have surged 23.70% year-to-date, with an impressive 94.21% rise over the past year, as reported by Benzinga Pro.

The streaming giant boasts a growth score of 69.79% and a momentum rating of 95.93, based on Benzinga Edge stock rankings.

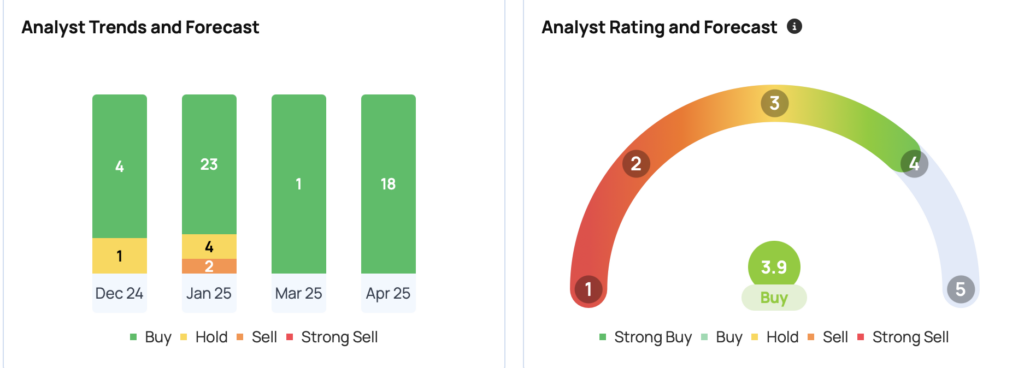

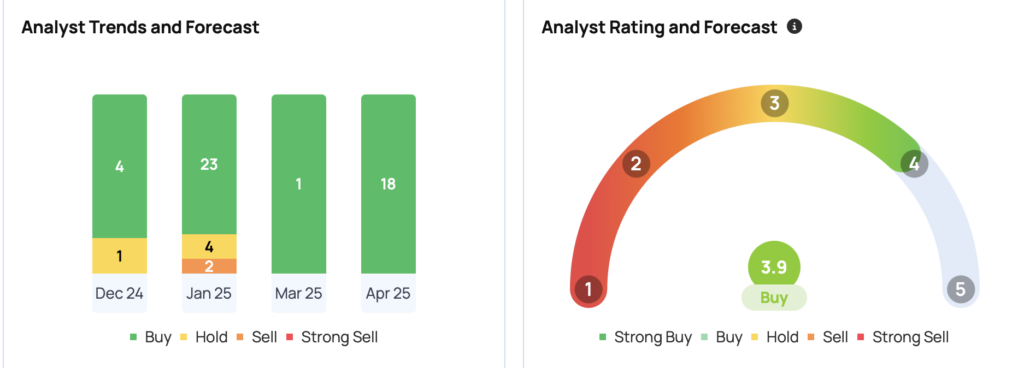

Currently, Netflix has a consensus price target of $1,082.97 from 32 analysts, with the highest estimation reaching $1,514 from Rosenblatt on April 21. Recent evaluations from Evercore ISI Group, Macquarie, and Wedbush suggest an average target of $1,183.33, indicating an 8.17% potential upside.

Conclusion

This series of events highlights both the risks and potential rewards in the stock market. Ackman’s quick exit from Netflix serves as a valuable lesson in the unpredictable nature of investing.

Disclaimer: This content was partially produced with AI tools and reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock