Billionaire Stephen A. Schwarzman recently made some intriguing remarks about investment opportunities during his attendance at the Davos World Economic Forum.

In case you are not familiar with Steve Schwarzman, he is the co-founder and CEO of Blackstone Inc. (BX), the largest private equity group globally, managing over $1 trillion in investments with a stellar track record.

Blackstone’s Bet on REITs

Blackstone has been actively investing in real estate investment trusts (REITs) in recent years. In 2022, they acquired 4 major REITs for about $30 billion, and in 2023, they made another significant acquisition with Tricon Residential (TCN). Schwarzman emphasized in a recent Q4 conference call that Blackstone Real Estate has $65 billion of dry powder to invest in this dislocated market, stating, “the best investments are made during times of uncertainty.”

They are investing in REITs because valuations are low. Even as property prices remained stable, REITs crashed in 2022 leading to substantial discounts relative to the fair value of their properties.

Schwarzman highlighted the favorable market conditions for REITs, pointing out that interest rates are expected to drop lower later this year. He believes this will reset the narrative due to its impact on REITs. Consequently, REITs remain heavily discounted, presenting a window of opportunity that may be closing.

Potential Buyout Candidates

Schwarzman indicated a strong interest in European real estate despite the geopolitical situation. He noted that European real estate is compelling due to low valuations and distress caused by overleverage. He mentioned, “We’re one of the few people in the world who have a lot of money and like to buy things.”

To underscore the attractive valuations, Schwarzman referenced the case of Branicks Group (BRNK / OTCPK:DDCCF), a major industrial and office landlord.

Opportunities Abound in European REITs for Investors

In the world of finance, the European real estate investment trusts (REITs) have been largely disregarded, and with good reason. The pandemic has laid waste to commercial and residential property values, especially for firms with major debt maturities coming up in the not-so-distant future. Currently, in Europe, one such company is trading at a staggering 90% discount to its Net Asset Value (NAV) per share, an astonishing figure, to say the least. This discount is so significant that the company might just be facing an existential crisis, teetering on the edge of survival in the hope of witnessing a market recovery.

Seeking Value in European REITs

Despite the prevailing gloom, the legendary investor Steve Schwarzman sees an opportunity. His eagerness to ‘pick up the pieces at low prices’ is telling. It’s no small thing when a titan of Wall Street shows interest in a struggling sector. Schwarzman’s interest in the European REITs bespeaks an optimism that cannot be dismissed lightly. His long-term vision and the depth of his investment acumen are not to be underestimated.

“People approach us w/ portfolios to buy and we say thank you for the opportunity. But we’re actually only interested in buying a few types of real estate. We really want to buy more warehouses, more student loans, one or two other classes. So if you could take this pile of stuff back and just give us what we’d like, we’ll buy it all. And so what tends to happen is they go back and they find all of the stuff of the type we’ll buy and they come to sell it and they often bring their best stuff. So we’re able to buy wonderful pieces of real estate at prices that work for us and they get liquidity. This is the start of distressed cycle for those owners.”

While Schwarzman’s primary interests are industrial and residential real estate, his investment philosophy extends beyond a mere sector focus. It’s a campaign for quality, a crusade to unearth the overlooked and underappreciated real estate gems at prices that, in his own words, “work for us.”

Potential Buyout Candidates

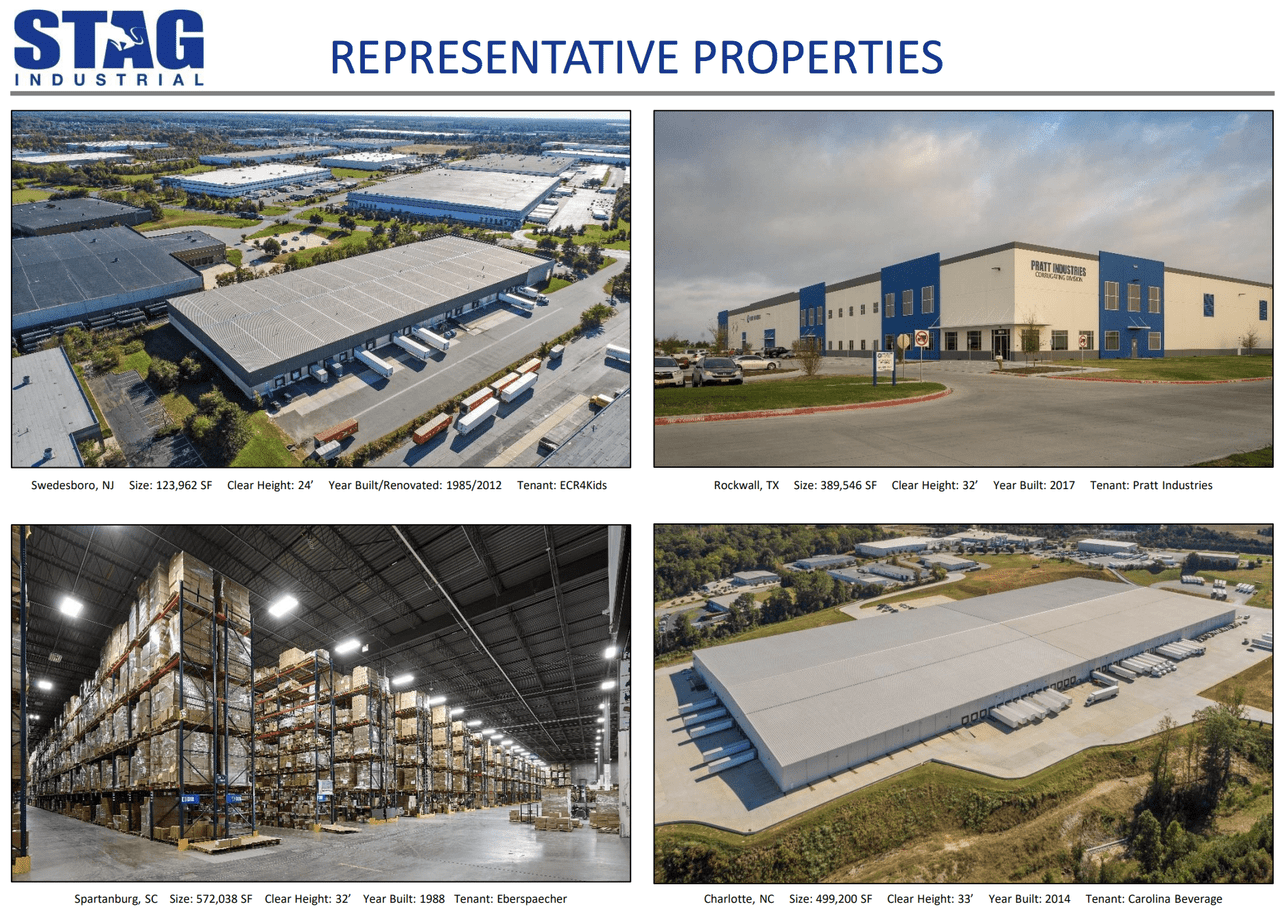

Schwarzman’s discerning eye for value has led to some interesting conjectures. For instance, the possibility of Mid-America Apartment Communities (MAA) being a buyout target based on Blackstone’s past investments in the company. Though MAA’s market cap is sizable, it doesn’t seem to deter Schwarzman, especially in light of Blackstone’s history of significant REIT acquisitions. Similarly, STAG Industrial presents a compelling case, with Schwarzman’s keen interest in industrial properties and the potential for value creation through strategic acquisitions.

These musings are not merely airy predictions but grounded in a deep understanding of the market and the investment landscape. Schwarzman’s focus on value, liquidity, and astute investment opportunities is poised to redefine the European REIT sector in notable ways.

Insights from Schwarzman’s Strategy

If an influential figure like Steve Schwarzman is betting big on REITs, it’s a clear sign that something is afoot in the market. Investors would do well to take note of Schwarzman’s astute assessments and his willingness to pay a premium for the right opportunities. The historically low valuations in the sector present abundant prospects for investors who are astute enough to recognize and capitalize on them. The European REIT market may well be on the cusp of a transformation, and whoever has the foresight to invest wisely stands to gain.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.