Philippe Laffont’s Billion-Dollar Bet on Taiwan Semiconductor Manufacturing

The latest 13F filings reveal how prominent hedge fund managers are investing their wealth. Among them is Coatue Management, led by billionaire Philippe Laffont. In the fourth quarter, the firm purchased 596,000 shares of Taiwan Semiconductor Manufacturing (NYSE: TSM), amounting to approximately $120 million. This significant investment is a testament to TSMC’s potential in the market.

Coatue Management’s Growing Stake in TSMC

Following these fourth-quarter acquisitions, TSMC has become Coatue’s third-largest position, valued at nearly $2 billion. This purchase reflects a strong commitment to TSMC, especially if the company’s growth forecasts materialize.

TSMC: The Leader in Chip Manufacturing

Taiwan Semiconductor is recognized as the largest contract chip manufacturer globally. This means they produce chips based on designs provided by major clients like Nvidia and Apple. Through this arrangement, tech companies can concentrate on chip designs without getting involved in the complex and costly manufacturing processes. TSMC’s participation in this model has allowed it to serve multiple clients, including rivals like AMD, which has contributed to its status as the leading chipmaker.

As the demand for AI technology surges, TSMC’s management forecasts impressive growth in this sector. They predict an astonishing 45% compounded annual growth rate (CAGR) for AI-related chips over the next five years. This growth projection underscores TSMC’s strategic position in the expanding AI market.

Overall, management anticipates a total revenue CAGR close to 20% over the next five years. This is an impressive expectation for a well-established company like Taiwan Semiconductor.

A Value Opportunity Amid Market Trends

The combination of rapid growth and TSMC’s high-quality chips makes it an appealing investment for billionaire investors like Laffont. The company offers a lower-risk opportunity for significant profits in the burgeoning AI industry.

Despite the compelling data presented in the 13F filings, it is essential to note that these reflect activities from over a month and a half ago. Is Taiwan Semiconductor still a favorable investment today?

TSMC’s Stock: A Mispriced Gem

At the start of 2025, Taiwan Semiconductor’s stock has experienced a meager rise of under 3%. The stock price has remained stable, reflecting Laffont’s confidence in TSMC’s value.

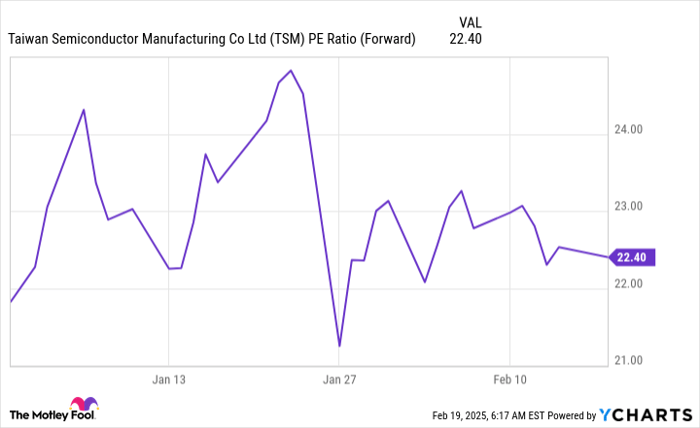

The company’s valuation suggests it is undervalued compared to its potential. Trading at 22.4 times forward earnings, TSMC’s stock is almost on par with the S&P 500, which stands at 22.5 times forward earnings. This comparison indicates that the market perceives TSMC as an average stock.

However, with management projecting substantial revenue growth, TSMC appears anything but average. This discrepancy between market perception and expected performance presents an attractive buying opportunity. Coatue Management’s significant investment in Q4 reinforces this perspective, as they expanded their stake by $120 million. Taiwan Semiconductor remains one of my top stock picks in the AI space, and now might be a good time for investors to consider adding shares.

Should You Consider Investing in TSMC?

Before making a decision, it’s crucial to weigh this insight against expert recommendations.

The Motley Fool Stock Advisor recently selected their top ten stocks for investment, and Taiwan Semiconductor Manufacturing was not included. This list comprises stocks with strong potential for impressive returns in the upcoming years.

For instance, consider Nvidia, which was on this list back on April 15, 2005. An investment of $1,000 at that time would have grown to approximately $858,668!*

Stock Advisor offers straightforward strategies for building a successful portfolio, including regular updates and new stock recommendations each month, with significant returns since its inception.

Learn more »

*Stock Advisor returns as of February 21, 2025

Keithen Drury owns shares in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.