Key Facts

Stanley Druckenmiller, the chief of Duquesne Family Office, has exited positions in Nvidia and Palantir Technologies over the past year, as indicated by quarterly Form 13F filings. As of June 30, 2024, the fund oversaw $2.9 billion in assets across 64 holdings.

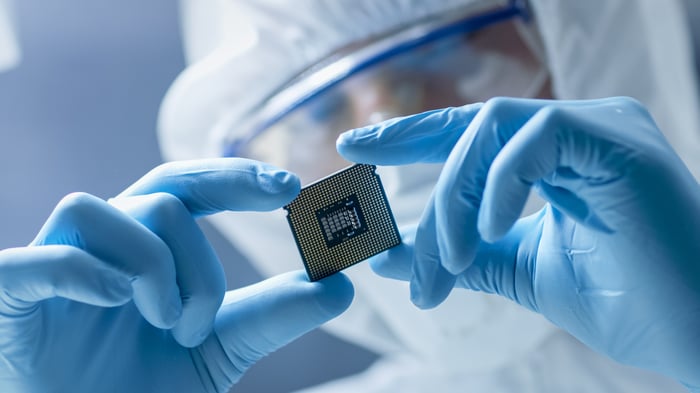

Druckenmiller sold 214,060 shares of Nvidia and 769,965 shares of Palantir by March 31, 2025. While profit-taking appears to be a reason, market conditions suggest other factors may be at play. Meanwhile, Druckenmiller has consistently purchased shares of Taiwan Semiconductor Manufacturing (TSMC), making it the fund’s fifth-largest holding with 765,085 shares accumulated over four consecutive quarters.

TSMC is crucial for AI chip manufacturing, with its monthly capacity projected to double by the end of 2025. The company’s earnings growth rate exceeds 20%, offering a forward price-to-earnings ratio of 21, which suggests a favorable long-term outlook.