If you’re an individual investor wishing to mimic the moves of billionaire fund managers, the road ahead appears paved with fortune. The U.S. Securities and Exchange Commission grants us a peek into the portfolios of big-league investors managing assets exceeding $100 million. In the final quarter of 2023, several titans of wealth dived into the fray of 23andMe (NASDAQ: ME), a stock that has suffered a gut-wrenching plunge from its former peaks.

Prior to allocating any of your precious capital into this genetic testing enterprise, a solemn truth must be acknowledged – even the most astute investors stumble occasionally.

To evaluate if joining the fray and purchasing shares of 23andMe during this downturn seems prudent, a deeper examination of the company seems warranted.

23andMe Captivates Billionaire Investors

The initial three years of 23andMe’s journey as a publicly traded entity specializing in DNA testing for consumers have proven rocky for stakeholders. The stock now languishes about 97% beneath its historical pinnacle, but magnates of the hedge fund sphere are envisioning an upswing.

Over the last quarter of 2023, billionaire fund managers scooped up millions of shares.

| Billionaire Fund Manager(s) | Fund | Shares Acquired in Q4 2023 | Shares Owned on Dec. 31, 2023 |

|---|---|---|---|

| David Siegel and John Overdeck | Two Sigma Investments | 699,669 | 871,795 |

| Jim Simons | Renaissance Technologies | 660,900 | 3,478,061 |

| Ken Griffin | Citadel Advisors | 467,246 | 1,717,743 |

| Jeff Yass | Susquehanna International | 374,705 | 596,862 |

Table by author. Data source: 13f.info

Delving into the Billionaires’ Interest in 23andMe

Familiarity with 23andMe’s consumer-centric model, providing ancestry and medical insights for a mix of upfront and recurring charges, likely resonates with you. Armed with genetic data from a substantial customer base, 23andMe extends an invaluable resource to drug developers, potentially leading to groundbreaking discoveries in drug candidacy.

Recently, powerhouse pharmaceutical company GSK (NYSE: GSK), extended a lucrative five-year partnership with 23andMe to explore drug targets. In this collaboration, GSK disbursed a hefty $20 million upfront for a year-long, nonexclusive data usage license, with potential future payments tied to successful clinical trials of new drugs discovered with 23andMe’s aid. Royalties could further cascade down the pipeline if any of these newfound drug candidates secure regulatory approval.

Moreover, apart from its data licensing portal, 23andMe is fervently developing original drug candidates. A recent milestone involved initiating clinical trials for an experimental cancer therapy tagged 23ME-1473. The outcome, slated for unveiling in 2026, could herald a surge in the stock’s value.

Contrarian Viewpoints on 23andMe

Tempering exuberance towards 23andMe’s data licensing initiative is sage advice. The exclusive pact with GSK concluded last July, leaving GSK as the sole remunerator for access to 23andMe’s data reservoir.

While boasting a customer base exceeding 14 million globally, the dataset likely skews towards affluent and educated demographics. This skewed representation could elucidate the absence of new major pharmaceutical clients in 23andMe’s roster.

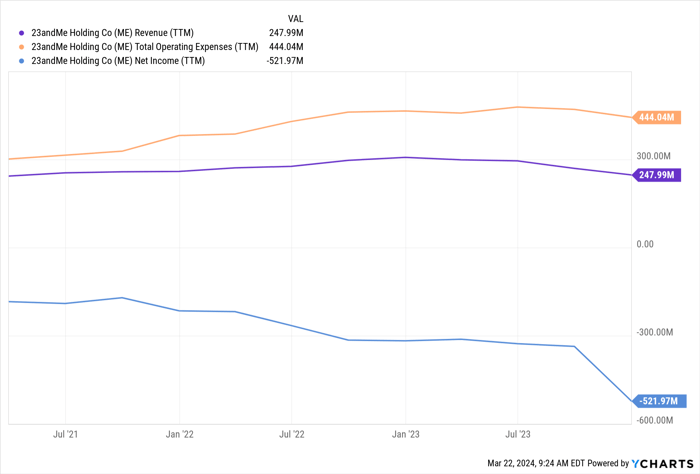

ME Revenue (TTM) data by YCharts

Notably, total revenue in the final quarter of 2023 experienced a 33% dip year-over-year due to diminished fees from the nonexclusive GSK license. Consequently, the hemorrhage deepened for 23andMe, culminating in nearly $522 million in losses for the fiscal year 2023.

Compounded by stagnation in the data licensing sector, 23andMe’s pivot towards subscription genetic testing has also reaped negligible returns. Projections hint towards a downtrend in total revenue, plummeting from $299 million in fiscal 2023 to a projected $215 million to $220 million in fiscal 2024, closing on March 31.

Deteriorating revenue streams from consumer and research arms place a heavy burden on 23andMe’s drug development pipeline. Sadly, the cold reality is that a vast majority of drugs entering clinical trials fail to transition into commercially viable products.

Image source: Getty Images.

Is It Time to Buy?

Trading at current rates, 23andMe boasts a modest $208 million market capitalization. With this bar set so low, a bullish trajectory awaits should impending clinical trials yield positive outcomes.

Yet, before venturing into 23andMe’s territory with your financial stake, heed this caution – the journey is fraught with peril. As the curtains closed on December, the company retained a paltry $242 million in reserves post a $522 million fiscal blow in 2023.

If forthcoming clinical trial results miss the mark, 23andMe’s shares might witness a further downward spiral. Although billionaires have made substantial acquisitions, these stakes constitute a mere fraction of their overall holdings. Should you dare to venture into this high-wire act, it’s prudent to emulate the pros by risking only a fraction of your portfolio.

Would you consider committing $1,000 to 23andMe at this juncture?

As you contemplate an investment in 23andMe, ponder this: The Motley Fool Stock Advisor corps has pinpointed what they believe to be the 10 top stocks currently ripe for investor plucking… 23andMe did not make the cut. The chosen 10 present a prospect of formidable returns in the forthcoming years.

Stock Advisor offers a roadmap to triumphant investing, replete with counsel on portfolio construction, updates from analysts, and a pair of fresh stock picks monthly. Since 2002, the Stock Advisor service has outpaced S&P 500 returns threefold*.

Explore the 10 stocks

*Stock Advisor returns as of March 21, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool recommends GSK. The Motley Fool maintains a stringent disclosure policy.

The perspectives and opinions articulated herein belong to the author and do not necessarily align with those of Nasdaq, Inc.