Q4 Earnings: A Bumpy Road

Biogen (BIIB) reported fourth-quarter 2023 adjusted earnings per share (EPS) of $2.95, distinctly missing the Zacks Consensus Estimate of $3.16. This signifies a worrying 27% drop in earnings compared to the previous year. Unsettlingly, even when benchmarked against a constant currency basis, earnings remained flat.

Revenue Blues

Total revenues stalled at $2.39 billion, marking a 6% decline on a reported basis (5% on a constant-currency basis) from the same quarter in the prior year. The dip can be largely attributed to diminishing sales of key drugs, particularly the multiple sclerosis (MS) drugs Tecfidera and Tysabri, as well as the spinal muscular atrophy drug, Spinraza. These figures fell short of the Zacks Consensus Estimate of $2.45 billion.

Product sales in the quarter shrunk to $1.83 billion, indicating a 4% decrease year over year. Revenues from anti-CD20 therapeutic programs also took a hit, dwindling by 3% to $435.8 million. The drops in revenue include royalties on sales of Roche’s Ocrevus and Biogen’s share of Roche’s drugs, Rituxan, Gazyva, and Lunsumio.

Challenges in Multiple Sclerosis Sector

The company’s MS revenues plunged to $1.17 billion, reflecting an 8% drop on a reported basis and 6% on a constant currency basis compared to the previous year. This was due to generic competition for Tecfidera and heightened competitive pressure in the MS market. Tecfidera sales plummeted by 17.8% to $244.3 million, while Tysabri sales also experienced a 4.9% decline year over year to $464.7 million.

Impacted Rare Disease Drugs

Sales of Spinraza, a rare disease drug, tumbled 10% to $412.6 million. On the other hand, Skyclarys, arising from the September 2023 acquisition of Reata Pharmaceuticals, generated $55.9 million in sales in the fourth quarter. Biogen also reported that Qalsody, which was launched for amyotrophic lateral sclerosis (ALS) in the second quarter of 2023, chalked up sales of $3.3 million in the same quarter.

Outlook and Industry Performance

The company announced its annual results for 2023, revealing a 3% decline in revenues to $9.84 billion, below the Zacks Consensus Estimate of $9.93 billion. Earnings stood at $14.72 a share, also falling short of the Zacks Consensus Estimate of $14.97.

Looking ahead to 2024, Biogen foresees total revenues declining by a low- to mid-single-digit percentage, representing concerns for the company’s growth trajectory in the coming year.

Stormy Skies

Biogen’s fourth-quarter results underperformed, with earnings hit hard by a 35-cent closeout cost for Biogen’s controversial Alzheimer’s drug, Aduhelm. Coupled with lower revenues, this has led to the company ceasing the development and commercialization of Aduhelm. While there are plans to advance the launch of a new Alzheimer’s drug, Leqembi, and to expedite the development of new treatment modalities for Alzheimer’s disease, the road ahead looks stormy.

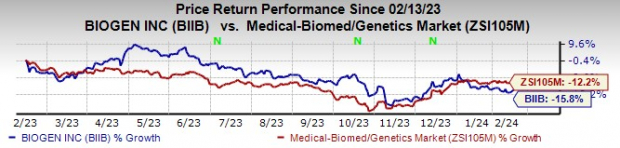

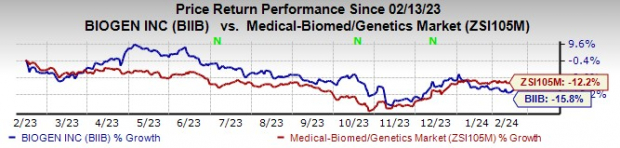

All important medicines such as Tecfidera, Tysabri, and Spinraza experienced declines in sales – a concerning trend for Biogen. Consequently, the company’s stock has taken a hit, dropping 5% in pre-market trading. Over the past year, Biogen’s shares have plummeted by 15.8% compared with a 12.2% decline for the industry.

Biogen’s Hurdles and Hope: A Financial Analysis

Image Source: Zacks Investment Research

Most of Biogen’s key drugs are facing declining sales due to intense competitive pressure. However, Biogen’s new products, such as Leqembi for Alzheimer’s disease, Skyclarys for Friedreich’s ataxia and Zurzuvae for depression, could help revive growth. However, at present, Biogen and partner Eisai are facing continued challenges with Leqembi’s launch. We believe it will take time for some meaningful improvement in Leqembi sales. Other new drugs, Zurzuvae and Qalsody are also not yet generating enough sales to make up for the declining MS revenues.

Biogen believes Leqembi has the potential to generate blockbuster sales following its traditional approval and broader CMS coverage in the United States. Biogen expects sales of Leqembi to start growing from 2024.

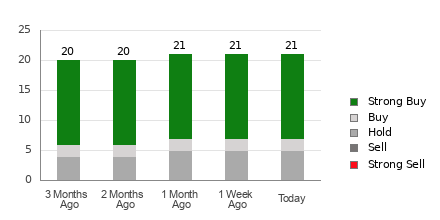

Stock Consideration

Biogen currently has a Zacks Rank #3 (Hold).

Price and Consensus

Biogen Inc. price-consensus-chart | Biogen Inc. Quote

A better-ranked biotech stock is Puma Biotechnology PBYI, with a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Puma Biotechnology’s 2024 earnings per share have improved from 64 cents to 69 cents. In the past year, shares of PBYI have risen 46.5%.

Earnings of Puma Biotechnology beat estimates in three of the last four quarters while missing the same once. PBYI delivered a four-quarter average earnings surprise of 76.55%.

Zacks Names #1 Semiconductor Stock

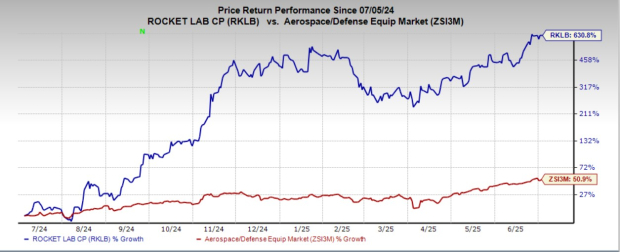

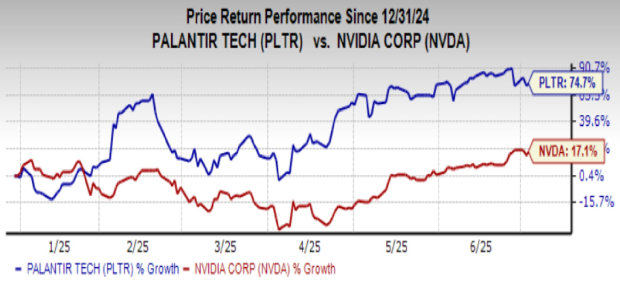

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Biogen Inc. (BIIB) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

Sage Therapeutics, Inc. (SAGE) : Free Stock Analysis Report

To read this article on Zacks.com click here.