With the end of the first-quarter earnings season, the focus has now shifted to pipeline and regulatory updates. Mergers and acquisitions continue to be in the spotlight as pharma and biotech majors look to bolster their product portfolio/pipeline.

Recap of the Week’s Most Important Stories:

Updates From Biogen: Biogen BIIB entered into an agreement to acquire privately-held clinical-stage biotechnology company Human Immunology Biosciences for an upfront payment of $1.15 billion and up to $650 million in potential milestone payments. Human Immunology Biosciencesn is focused on targeted therapies for patients with severe immune-mediated diseases (IMDs).

The acquisition will add Human Immunology Biosciences’ lead candidate, felzartamab, to Biogen’s late-stage pipeline. Phase II studies have been completed in primary membranous nephropathy (PMN) and antibody-mediated rejection (AMR) indications and are ongoing for the indication of IgA nephropathy (IgAN). Human Immunology Biosciences has plans to advance each indication to phase III. The pipeline also includes izastobart/HIB210, an anti-C5aR1 antibody currently in a phase I study and with the potential for continued development in a range of complement-mediated diseases. Biogen is looking to expand its immunology portfolio with the acquisition.

Last week, Biogen and partner Ionis Pharmaceuticals IONS announced their decision to terminate the development of their investigational amyotrophic lateral sclerosis (ALS) drug, BIIB105 / ION541. This decision was based on top-line data from the phase I/II ALSpire study, wherein treatment with the drug did not slow disease progression. Shares of both Biogen and Ionis were down on this news.

Biogen also announced its decision to opt out of licensing the rights to develop BIIB121/ ION582, an antisense oligonucleotide designed to restore the expression of ubiquitin-protein in patients with Angelman syndrome.

GSK’s Study Data: GSK plc GSK announced its two late-stage studies on pipeline candidate depemokimab in adults and adolescents with severe asthma with type 2 inflammation met their primary goal. SWIFT-1 and SWIFT-2 were replicate 52-week, randomized, double-blind, placebo-controlled, parallel-group, multi-center studies that assessed the efficacy and safety of depemokimab adjunctive therapy in 375 and 380 participants who were randomized to receive depemokimab or a placebo.

The primary endpoint of the studies was a reduction in the annualized rate of clinically significant exacerbations (asthma attacks) over 52 weeks. Positive headline data from the SWIFT-1 and SWIFT-2 studies showed that treatment with depemokimab resulted in statistically significant and clinically meaningful reductions in exacerbations over 52 weeks versus placebo. The safety profile of depemokimab was comparable to that of placebo across both studies. Per GSK, depemokimab has the potential to be the first approved ultra-long-acting biologic with a six-month dosing schedule for severe asthma.

The candidate is also being evaluated in phase III trials across a range of other IL-5 mediated diseases, including eosinophilic granulomatosis with polyangiitis, chronic rhinosinusitis with nasal polyps and hypereosinophilic syndrome.

PTCT Gains on Regulatory Update: PTC Therapeutics, Inc. PTCT announced that the European Commission (EC) has decided against adopting the Committee for Medicinal Products for Human Use’s (CHMP) negative opinion (dated January 2024) on the annual renewal of the conditional marketing authorization of Translarna (ataluren).

Translarna is a protein restoration therapy, designed to enable the formation of a functioning protein in patients with genetic disorders caused by a nonsense mutation. Following the decision, the EC has returned the opinion to the CHMP for re-evaluation. Thus, in the meantime, Translarna remains available in the market for patients with nonsense mutation Duchenne muscular dystrophy (nmDMD) in the EU, per its current marketing authorization.

The EC has also instructed the CHMP to further consider the totality of evidence, including data from patient registries and real-world evidence, in a revised opinion. The PTCT stock gained on the positive update as investors cheered the regulatory development.

PTC Therapeutics currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Larimar Up on Clinical Hold Removal: Larimar Therapeutics, Inc. LRMR announced that the FDA has removed the partial clinical hold on its nomlabofusp (CTI-1601) clinical program following a review of the phase II dose exploration study data. LRMR’s shares gained following the announcement of the news. The company’s lead pipeline candidate, nomlabofusp, is being developed for the treatment of patients with Friedreich’s ataxia (FA).

The abovementioned review by the FDA comprised data from both the 25 mg and 50 mg cohorts in patients who received a daily dosing of nomlabofusp for 14 days, followed by dosing on alternate days until day 28. In February 2024, LRMR completed the four-week, placebo-controlled phase II dose exploration study evaluating nomlabofusp in patients with FA. Treatment with nomlabofusp was generally well-tolerated throughout the four-week treatment period in the study.

Per the company, at day 14, all the patients (with quantifiable levels at baseline and day 14) who were treated with nomlabofusp (50 mg) achieved frataxin levels in skin cells of more than 33% of the average level seen in healthy volunteers, while three patients achieved more than 50% of the average level seen in healthy volunteers. Nomlabofusp (25 mg) is currently being evaluated in the ongoing open-label extension study in patients with FA.

Performance

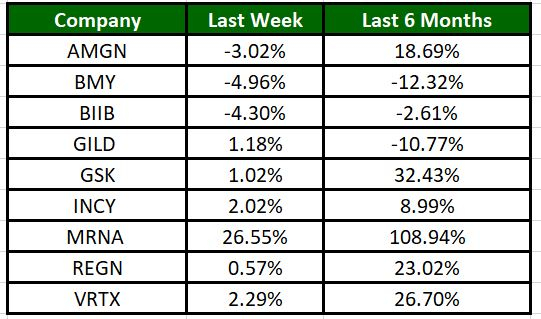

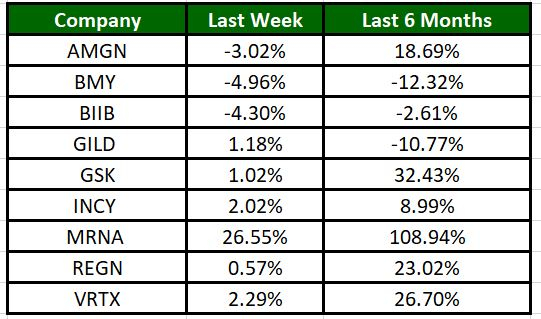

The Nasdaq Biotechnology Index has moved up 0.83% in the past five trading sessions and Moderna’s shares have risen 26.55% during the same time frame. In the past six months, shares of MRNA have rallied 108.94%. (See the last biotech stock roundup here: Biotech Stock Roundup: NVAX, FULC Up on Deals With SNY, Updates From MRNA, BMY)

Image Source: Zacks Investment Research

What’s Next in Biotech?

Stay tuned for more pipeline updates.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

PTC Therapeutics, Inc. (PTCT) : Free Stock Analysis Report

Ionis Pharmaceuticals, Inc. (IONS) : Free Stock Analysis Report

Larimar Therapeutics, Inc. (LRMR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.