In a February 19 Barchart article, it was noted:

Bitcoin looks set to challenge the November 2021 high, but make sure you do not get caught holding the bag when the bullish music stops.

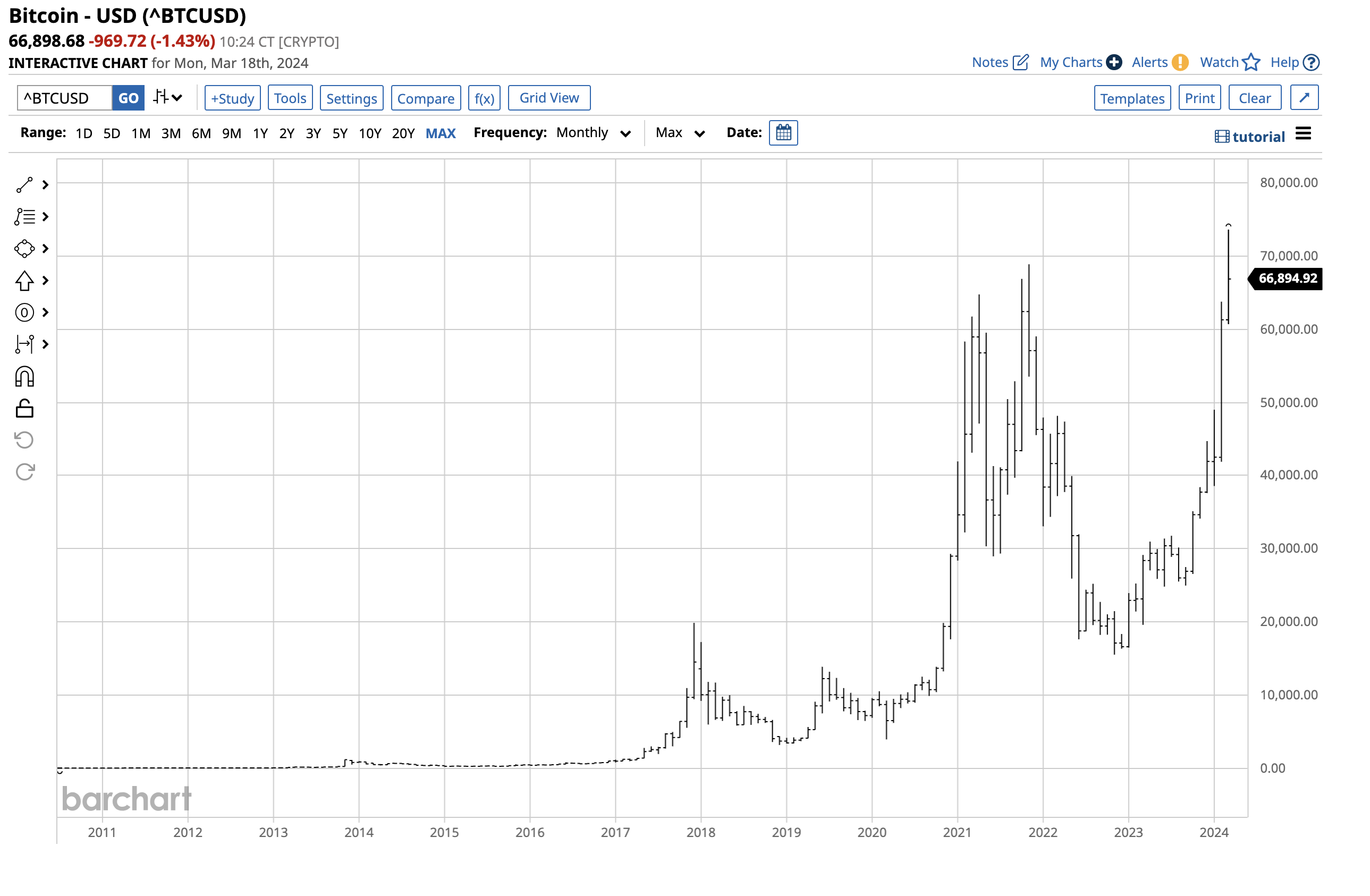

Spot Bitcoin was at the $52,217.70 level on February 19, and the bullish music has not stopped over the past month. It skyrocketed beyond the November 2021 high, reaching uncharted territory.

Bitcoin Makes a New High

On March 11, 2024, Bitcoin soared to a new peak surpassing $20,000 per token, surpassing the February 19, 2024, high.

Notably, the long-term chart showcases Bitcoin’s rally to $73,662.76 on March 14, marking a remarkable 41% increase within less than a month.

Another Parabolic Rally

Bitcoin’s historical price action has witnessed several parabolic rallies over the years.

Over five years, three significant rallies stand out:

- Bitcoin surged 1550% from $3,925.27 in March 2020 to $64,789.27 in April 2021.

- Bitcoin rose 138% from $28,957.79 in June 2021 to $68,906.48 in November 2021.

- The latest rally propelled the leading cryptocurrency 372% higher, from $15,613.01 in November 2021 to the recent high of $73,662.76

With Bitcoin starting at five cents per token in 2010, its exponential growth has been consistently parabolic. However, this surge has been met with dramatic price corrections along the way.

Spot Bitcoin ETFs Provided the Fuel

The recent surge to a new all-time high was fueled by the approval of spot Bitcoin ETF products by the US Securities and Exchange Commission, offering broad access to the investing public.

The initial approval led to a price drop as the SEC raised concerns about Bitcoin’s speculative nature and illicit use. Subsequently, prices soared once the ETF products became accessible in standard equity accounts.

When Do the Regulators and Legislators Get Worried?

Bitcoin, dominating the cryptocurrency asset class, saw its market cap soar to over $2.52 trillion by March 18. With Bitcoin’s market cap accounting for over 52.1% of the entire asset class, concerns are rising regarding systemic risks.

Comparatively, leading publicly traded companies still surpass Bitcoin in valuation, with Microsoft holding nearly $3 trillion in value, outstripping all cryptos. The increasing market cap of Bitcoin and cryptocurrencies may trigger regulatory and legislative concerns globally, especially as governments strive to maintain control over their monetary systems.

Be Careful: Bulls and Bears Can Profit, Pigs Can Get Slaughtered

The astounding price climbs in Bitcoin and other cryptocurrencies have attracted numerous speculative traders seeking substantial gains. While stories of immense wealth abound in the crypto space, losses have been equally devastating.

Practicing disciplined trading and investing strategies is crucial in navigating the volatile cryptomarket. While the allure of significant returns persists, investors must remain vigilant to potential corrections and regulatory challenges that could impact the market’s future.

Volatility in Bitcoin and cryptocurrencies is here to stay, and staying mindful of the risks is paramount to sustainable success in the digital asset realm.

As the market watches, this week’s lows in Bitcoin may very well transform into next week’s highs, underscoring the unpredictable nature of the cryptocurrency landscape.

More Crypto News from Barchart

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.