As we stand on the precipice of a potential approval of a spot Bitcoin (BTC-USD) ETF in the United States, it is imperative to delve into the historical context and future prospects of Bitcoin. The approval of a BTC ETF in the US market is likely to herald a significant shift in the perception and utilization of this digital currency. It is reasonable to expect a surge in BTC prices this year and beyond, driven by the anticipation of higher adoption, liquidity, and credibility associated with an approved ETF.

Bitcoin: A Double-Edged Sword

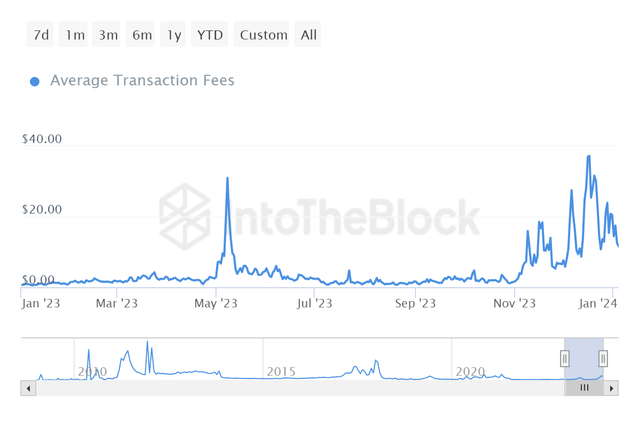

Bitcoin was envisaged as a means for peer-to-peer transactions, akin to digital cash. However, the persistent scalability issues have plagued its growth, particularly exemplified by the surge in average transaction fees during late 2023. The average transaction fee reaching $19 in December rendered the network uneconomical for smaller value holders, posing a significant hindrance to mainstream adoption. Unlike its blockchain peer Ethereum (ETH-USD), Bitcoin’s layer 2 scaling opportunities are relatively limited, leading to the prevalence of custodial solutions as a more viable option for peer-to-peer transactions.

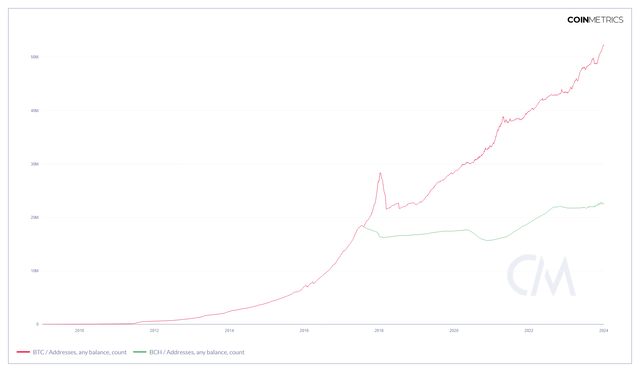

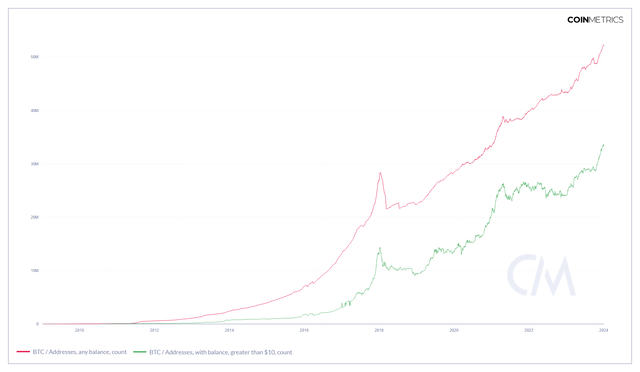

The bifurcation in the Bitcoin community resulting from the scalability debate culminated in the emergence of Bitcoin Cash (BCH-USD) in 2017. While the camp favoring smaller blocks has witnessed a surge in wallet addresses over the years, a startling revelation surfaces: 18.7 million of the 52 million BTC addresses hold less than $10 each, rendering 35% of the wallet addresses effectively dormant. This dichotomy is emblematic of Bitcoin’s intrinsic conundrum – a currency with immense potential, yet mired in operational obstacles.

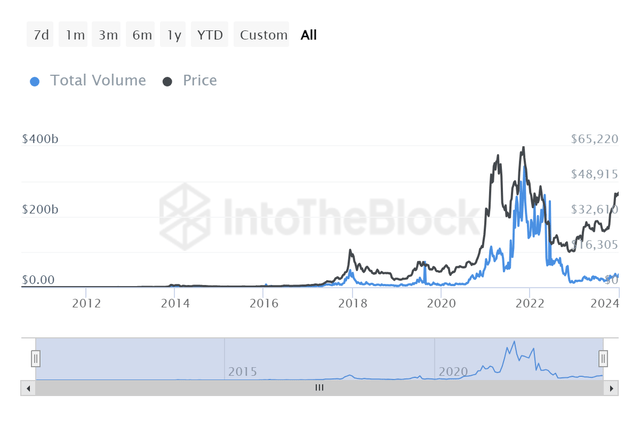

Despite these challenges, Bitcoin functions adeptly as a decentralized ledger and settlement layer, with a daily dollar-denominated value of $32.3 billion traversing the network in December. However, while the recent price surge and ETF optimism have instilled fervor, the transfer volume is yet to reclaim its previous peaks, suggesting a potential discord between anticipation and actual adoption.

Survey Insights: The ETF Conundrum

Bitwise Investments and VettaFI’s survey during Q4 2023 unveiled a compelling narrative. Despite Bitcoin’s price surge during the period, a mere 39% of advisors believed in the approval of a spot Bitcoin ETF in 2024, contrasting sharply with Bloomberg ETF analysts’ optimistic projection of a 90% likelihood. Notably, 88% of advisors eyeing BTC investments await the ETF approval, while only 19% currently have the means to purchase BTC in client accounts.

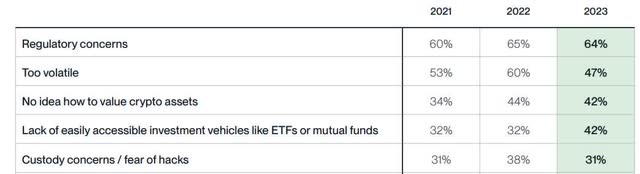

Regulatory concerns surrounding crypto ETFs have emerged as a prominent deterrent among financial advisors, with a significant 42% citing the lack of an ETF as a barrier to larger allocations. This sentiment marks a marked increase from the 2022 survey, signifying a growing impetus for regulatory clarity to underpin augmented crypto investments.

Bitcoin Investment Inflow: The 2024 Financial Landscape

Undoubtedly, the cryptocurrency market continues to intrigue investors and financial advisors, especially when it comes to the kingpin of the market, Bitcoin (BTC). The latest survey of financial advisors has revealed intriguing insights, piquing the interest of the investment community. However, it’s essential to acknowledge the context and recognize the limitations of the revelations, particularly when juxtaposed against historical data.

Survey Insights

With a substantial focus on smaller AUM independents, the survey painted a picture reflective of this subsection. Notably, 60% of the respondents managed less than $100 million, with 41% overseeing less than $50 million. While the perspectives gleaned from these financial advisors are undoubtedly enriching, it’s imperative to maintain a realistic outlook. Even a 2% BTC allocation from these specific respondents might not culminate in a larger inflow than what was witnessed in 2023.

| AUM Mean | AUM x 437 Respondents | BTC Inflow at 2% Allocation |

|---|---|---|

| $50,000,000 | $21,850,000,000 | $437,000,000 |

| $100,000,000 | $43,700,000,000 | $874,000,000 |

Source: Author’s Calculations based off Bitwise/VettaFi AUM Mean

The 437 survey respondents, with a mean AUM ranging between $50 million and $100 million, serve as baseline estimates for anticipated future inflow from these specific financial advisors. Applying a bold 2% BTC allocation universally yields an estimated $437 million to $874 million in BTC investment inflow. Notably, the net flows figures from CoinShares have been a focal point in previous discussions.

Bitcoin’s Investment Landscape

In 2023, Bitcoin dominated crypto investment capital flows, amounting to over $1.9 billion—an impressive feat indicating seven consecutive years of positive net flow into Bitcoin from capital allocators. Looking ahead to 2024, there are compelling indications for this trend to persist, especially with the imminent possibility, as per ETF analysts, of a US-based spot ETF approval.

Risk Assessment

Despite the positive outlook, it’s crucial to note that BTC’s short-to-medium-term price trajectory isn’t guaranteed. The market may anticipate a substantial pullback before the halving, adding an element of unpredictability. Bitcoin’s inherent volatility necessitates a cautious approach, acknowledging the potential for significant price fluctuations. Furthermore, the landscape also underscores challenges in terms of network growth and usability.

Usability and Network Challenges

The usability of Bitcoin, particularly concerning its Lightning Network, has encountered obstacles, with capacity growth stagnating and transaction fees surging. The emergence of high base layer fees has made opening new channels financially burdensome, impeding the network’s accessibility and hindering its scalability. These challenges raise pertinent questions about Bitcoin’s functionality as a peer-to-peer payment network or a digital gold asset.

The Path Ahead

We can have political discussions and theoretical, philosophical discussions off camera and over drinks. When I put this tie on, it’s about making and saving money in financial markets. – Darius Dale, Founder and CEO of 42 Macro via Thoughtful Money

Looking ahead, the outlook for Bitcoin in 2024 hints at a custodial trajectory. While the subsequent debates may focus on the implications of such a transition, the overarching goal for most stakeholders is wealth accumulation and safeguarding assets against fiat currency devaluation. With its finite supply and dominant position in the cryptocurrency market, Bitcoin remains a vital tool for this purpose. However, the prevalence of soaring transaction fees has prompted a reassessment of the feasibility of self-custody for the broader populace. As the community continues to deliberate on these developments, the spotlight remains on the anticipated spot ETF approval, underpinning expectations of substantial demand in the coming year.