As the cryptocurrency universe buzzes with excitement over the impending Bitcoin halving, investors must grasp the nuances and effects of this programmed event. The halving slashes the number of Bitcoins issued per block mined. A thorough comprehension of the Bitcoin halving is crucial for investors looking to make well-informed decisions and manage their portfolios effectively.

By delving into the historical repercussions of past halvings and dissecting current market trends, investors can prepare for the approaching halving and strategically position themselves in the rapidly changing cryptocurrency realm.

Collaborating with crypto specialist Peter Eberle, the Investing News Network (INN) dives into the intricacies of the halving procedure, shedding light on the potential market fluctuations that may unfold.

Understanding the Bitcoin Halving

Bitcoin comes into existence through mining, a process where miners compete to solve a complex mathematical problem. Upon solving this problem, a new block is added to the blockchain, and the triumphant miner receives a specific amount of fresh Bitcoins. Upon Bitcoin’s inception in 2009, the block reward stood at 50 Bitcoins.

The Bitcoin halving occurs about every four years or after the mining of 210,000 blocks. Unlike clockwork, the halving’s exact timing can vary due to fluctuations in mining difficulty and network hash rate, reflecting the total computational power dedicated to mining Bitcoin.

The upcoming 2024 halving is slated for around April 20th, 2024, following the past halvings in 2012, 2016, and 2020, leading to the current reward rate of 6.25 Bitcoin. The impending halving will further slash the rate to 3.125 Bitcoin per block.

The halving’s rules are embedded in Bitcoin’s network. By curtailing block rewards, the halving decelerates the creation of new Bitcoins. This controlled supply is designed to counteract inflation, ensuring that Bitcoin retains its value over time. As halving events progress, the influx of new coins dwindles until all 21 million Bitcoins are in circulation.

Impact of Halvings on Bitcoin Miners

Bitcoin’s halving exerts substantial effects on cryptocurrency mining activity and supply dynamics, rooted in the mechanics of Bitcoin mining.

The mining process, known as block time, typically runs for about 10 minutes. To uphold a consistent block time, the Bitcoin network adjusts mining difficulty based on hash rate, measuring the computational power devoted to mining Bitcoin and processing transactions. An uptick in hash rate signifies heightened competition among miners vying to earn Bitcoin rewards, leading to a more challenging puzzle. Conversely, reduced miner competition translates to an easier puzzle. This mechanism ensures a steady block creation rate, irrespective of the number of miners in contention.

Leading up to halving events, hash rate has historically surged, only to plummet post-halving as inefficient miners exit the arena.

As Eberle elucidated, “Less efficient miners with outdated, energy-intensive equipment are compelled to exit the industry when the mining reward diminishes.” Presently, record-high hash rates are propelled by industry giants unveiling swifter, more efficient machinery while concurrently utilizing older equipment that may soon become obsolete. Mining firms have already started gearing up for the 2024 halving; for instance, on February 27th, Bitcoin miner Riot Platforms secured new miners in tandem with CleanSpark‘s acquisition of three Mississippi data centers.

This enhanced efficiency benefits investors as miners routinely sell Bitcoin to cover operational expenses and rake in profits when production costs dip below selling prices.

CoinShares’ 2024 Crypto Outlook report suggests that miners may be on firmer footing in 2024, armed with reduced debt, expanded operational scale, and equity financing opportunities. Bitcoin’s price is further buttressed by the approval of spot Bitcoin ETFs and the US Federal Reserve’s forthcoming plans to relax monetary policy later this year.

The report, released in January, foresees 2024 as a “dual cycle year.” Marked by a rebalancing phase at the year’s outset, CoinShares anticipates that this phase will linger until after the halving. Subsequently, the sector will transition into a mining boom phase, with Bitcoin’s value outstripping miners’ pace in deploying new hash rate. CoinShares approximates that mining 1 Bitcoin will cost about US$37,856 following the halving.

“From an investor’s viewpoint,” Eberle added, “the halving holds weight because miners, in funding ongoing operations—whether it’s electricity for warehouses or equipment upgrades—are consistent sellers of Bitcoin. As long as their Bitcoin production costs remain lower than selling prices, they pocket profits. Inefficacious miners will be driven out if they neglect these upgrades.”

Impact of Halvings on Bitcoin Price

Historically, Bitcoin has surged in the run-up to a halving, yet with only three past halvings, pinpointing definitive price trends remains challenging.

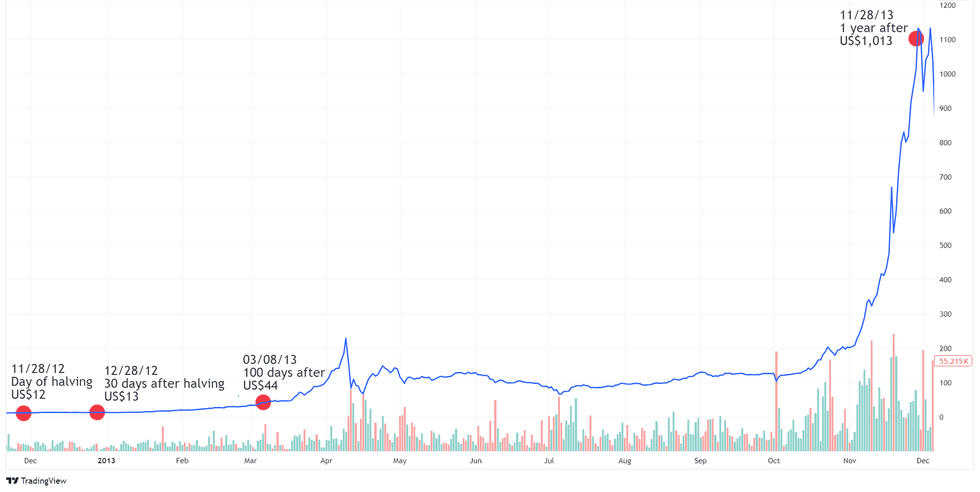

Chart via TradingView

Bitcoin USD price chart 11/21/2012 to 12/05/2013

The inaugural Bitcoin halving on November 28, 2012, saw the mining reward drop from 50 to 25 Bitcoins. Although Bitcoin occupied a niche space then, it had begun attracting mainstream attention, partly attributed to economic uncertainties in Europe. Bitcoin’s value had ascended from about US$5.50

The Unstoppable Rise of Bitcoin: A Journey Through Halvings and Beyond

The Early Days and Bitcoin’s Gradual Surge

Bitcoin’s tumultuous journey began with its humble valuation at fractions of a cent in 2010, climbing steadily to around US$12 by the November halving of 2012. This slow ascent hinted at the burgeoning interest and adoption that lay ahead for the cryptocurrency. Subsequently, the price of Bitcoin experienced significant growth, with its value soaring to US$1,013 within a year after the halving. This surge marked the inception of Bitcoin’s trajectory toward mainstream acknowledgment as a potential alternative asset class. However, this momentum was short-lived, as Bitcoin dipped below US$300 by mid-2015.

The Second Halving: Bitcoin’s Price Triumph

As the second halving approached in 2016, Bitcoin’s value rebounded to US$648. Over the following year, Bitcoin witnessed remarkable growth, fueled by escalating enthusiasm and optimistic outlooks that triggered a fear of missing out (FOMO) among investors. The price skyrocketed past US$2,500 on June 3, 2017, reflecting the mounting interest in the leading cryptocurrency. Furthermore, the acknowledgment of blockchain technology’s potential by major financial institutions contributed to Bitcoin’s price surge, culminating in its then all-time high of US$19,783.21 in December 2017.

The Impactful 2020 Halving and the Crypto Renaissance

The most recent Bitcoin halving in 2020 saw the block rewards reduced, with Bitcoin’s price at US$7,935.10 on that monumental day. Amid a whirlwind of global events, the halving was relatively subdued, with minimal fanfare and price fluctuations. However, 2020 proved pivotal for the cryptocurrency landscape, with Bitcoin emerging as a potential safe-haven asset amidst economic uncertainties sparked by the COVID-19 pandemic and concerns over inflation. The surge in interest in decentralized finance (DeFi) further propelled Bitcoin’s prominence, positioning it as the “gold standard” among digital currencies.

Large corporations such as PayPal and Square ventured into the realm of cryptocurrencies, initiating mainstream adoption and signaling a significant shift in investor sentiment. Veteran investors and financial experts alike recognized the lasting potential of cryptocurrencies, with Rick Rieder of BlackRock affirming the enduring presence of cryptocurrency in the financial landscape.

Anticipating the Next Bitcoin Halving

With the upcoming Bitcoin halving in 2024, the fervor surrounding halvings has reached a peak, particularly following the approval of spot Bitcoin ETFs in January 2022. These ETFs have opened new avenues for risk-averse investors to participate in Bitcoin’s price movements without the complexity of direct ownership. The promising outlook post-2023, marked by legal victories and the advent of spot Bitcoin ETFs, has reignited institutional interest, fostering renewed confidence in the cryptocurrency industry.

Bitcoin’s price escalation following the US Securities and Exchange Commission’s recent ruling underscores the significance of the upcoming halving, propelling Bitcoin to its highest values since 2021. The surge in demand for Bitcoin ETFs, with a record-breaking volume in February 2024, highlights the pivotal role of halvings in driving Bitcoin’s value beyond previous peaks, signaling a promising trajectory for the premier cryptocurrency.

Unlocking Opportunities: Navigating Bitcoin Market Dynamics Ahead of the Halving Event

Seizing the Momentum: Bitcoin ETFs Influence on Market Trends

In the dynamic realm of cryptocurrencies, the impact of Bitcoin exchange-traded funds (ETFs) cannot be overstated. As industry experts like Peter Brandt and Eberle analyze the market, a notable trend emerges. Historically, the lead-up to halving events has seen fluctuations—with miners upgrading equipment and adding supply, exerting sell pressure. However, a unique phenomenon is unfolding this time around.

ETFs are swiftly absorbing this excess supply, paving the way for a potentially explosive market surge post-halving. This early stage absorption could set the stage for remarkable gains in the coming months, fuelled by a combination of miner activity and ETF dynamics.

Strategizing Investments Amid Bitcoin’s Ascendancy

Peter Brandt’s revised projection of Bitcoin’s potential surge to US$200,000 by September reflects a growing consensus among analysts. This optimistic outlook, coupled with Eberle’s forecast of new all-time highs, signals a significant shift in the market sentiment.

As retail FOMO (fear of missing out) gains momentum, driven by the accessibility of Bitcoin ETFs, the stage is set for a remarkable price escalation. While estimates from US$75,000 to US$150,000 abound, the overarching sentiment is one of cautious optimism and a collective anticipation of entering uncharted territory.

Amid this bullish trend, investing in Bitcoin as a portfolio balancing tool gains prominence. With insights into optimizing a standard 60/40 equity bond portfolio by strategically incorporating Bitcoin, Eberle advocates for a proactive approach to managing investments. Emphasizing the role of rebalancing and asset reallocation, he underlines the potential benefits of volatility in enhancing overall portfolio performance.

By integrating a modest 3 to 5 percent Bitcoin allocation in a conventional portfolio, investors can mitigate volatility and potentially boost returns. The unique characteristics of this volatile asset can enhance the rebalancing process, creating opportunities for proactive portfolio management and optimized performance.

Don’t forget to follow us on Twitter @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.