Trump’s Victory Spurs Market Rally: What It Means for Investors

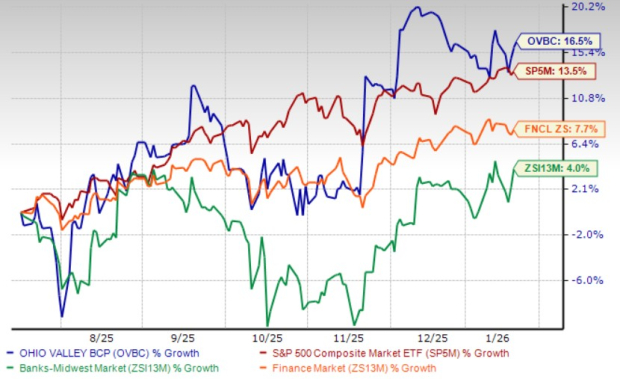

In the wake of Donald Trump‘s re-election this week, financial markets have reacted positively, anticipating policy changes that could benefit businesses.

The stock market surged following Trump’s victory, driven by expectations of lower corporate taxes and a recent cut in interest rates by the Federal Reserve. Both the S&P 500 and Nasdaq Composite indexes reached historic highs as investor confidence soared.

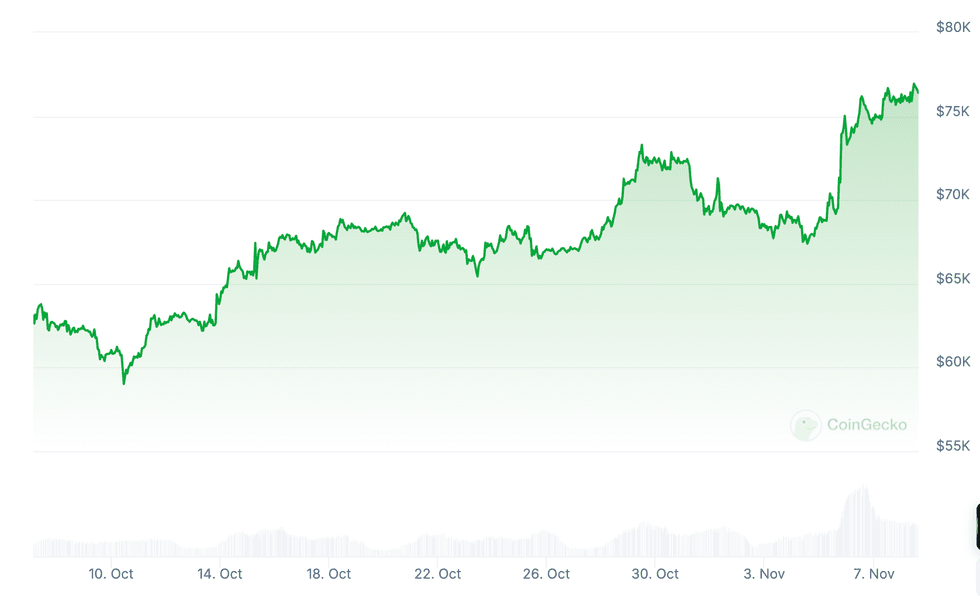

Bitcoin also saw a remarkable increase, hitting a new peak above US$77,000. Republican gains in the midterm elections and control over the Senate could lead to a more favorable regulatory environment for cryptocurrencies come 2025, further boosting investor interest.

As Trump’s second term begins, the long-term impact of his economic policies is yet to be fully understood.

1. Tech Giants Celebrate Trump’s Return

The tech industry has responded positively to Trump’s election on November 6, viewing it as a win for business leaders with strong ties to the administration. His pledges to reduce corporate taxes and ease regulations hint at a potentially more business-friendly climate.

This optimism was evident in stock market movements. Several tech companies registered gains exceeding 5 percent. Notably, after taking Intel’s place (NASDAQ:INTC) in the Dow Jones Industrial Average on November 1, NVIDIA (NASDAQ:NVDA) overtook Apple (NASDAQ:AAPL) to claim the title of the world’s most valuable company for the third time this year.

NVIDIA’s market cap reached US$3.43 trillion, surpassing Apple’s US$3.38 trillion as markets closed on Tuesday (November 5). By Wednesday (November 6), it achieved a remarkable valuation of US$3.6 trillion, with a weekly share price increase of 7.28 percent.

Other tech leaders like Broadcom (NASDAQ:AVGO) and Amazon (NASDAQ:AMZN) also saw notable upward trends in share prices, rising 8.29 percent and 5.87 percent, respectively. In contrast, Apple, Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META), and Taiwan Semiconductor (NYSE:TSM) experienced more modest gains of 2.63 percent, 3.13 percent, 4.47 percent, and 3.87 percent, respectively.

Investor enthusiasm may also stem from a Reuters article suggesting that Trump plans to relax antitrust policies instituted by the previous administration. This sentiment has contributed to a 5.09 percent rise in Google’s (NASDAQ:GOOGL) share price within the week.

Bitcoin Soars to New Heights Following Trump’s Victory

Bitcoin surged to an all-time high right after Donald Trump was elected as the 47th president of the United States early Wednesday morning.

The presidential race, which was initially viewed as extremely close, saw Trump gaining traction by winning crucial states like North Carolina, Georgia, and Pennsylvania—three out of seven pivotal swing states.

According to the Associated Press, at 5:34 AM EST on November 6, Trump claimed victory in Wisconsin, surpassing the required electoral college votes to be announced as the winner.

As Trump’s electoral prospects improved with every ballot cast, Bitcoin’s price mirrored this trend, jumping from approximately US$68,750 on November 5 to over $75,000 just after 1:36 AM EST on November 6, surpassing its previous record of $73,000 set back in March 2024.

Chart via CoinGecko.

Bitcoin performance from October 10 to November 7, 2024.

At 5:35 AM EST on November 6, shortly after Trump proclaimed his win, Bitcoin was valued at around US$73,000. The price continued to climb as Wednesday’s markets opened, hitting above US$76,000 briefly before settling as Western markets closed. Later, it hovered in the US$74,000 range in Asia before reclaiming the US$76,000 mark around 11:00 AM EST.

What sets this rally apart from recent spikes is Bitcoin’s resilience in maintaining its gains. A Trump presidency is generally viewed as favorable for the cryptocurrency sector, given his campaign’s promise to ease regulations and replace crypto-skeptical regulators like SEC Chairman Gary Gensler.

Meanwhile, Republicans gained a majority in the US Senate and may gain control of the House of Representatives as votes continue to be counted. The political landscape is shaping up to be more accommodating to cryptocurrency innovations, leading insiders to feel optimistic about accelerated adoption and development.

By the end of the week, Bitcoin closed more than 10 percent higher, landing at US$76,739, just shy of its weekly peak of US$77,239 reached earlier on Friday (November 8).

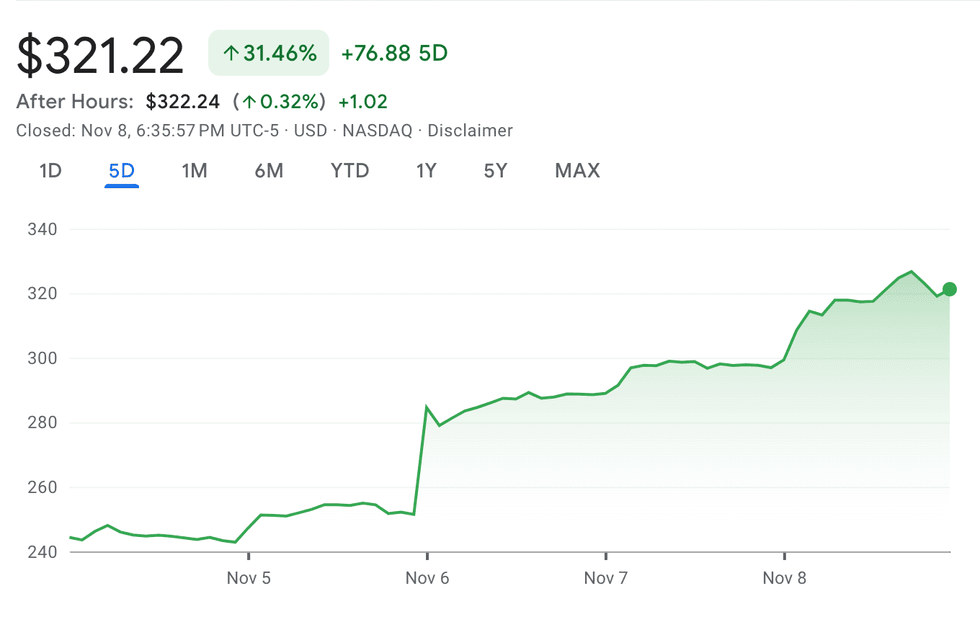

Tesla Shares Climb to Highest Point This Year

In addition to Bitcoin, Tesla (NASDAQ:TSLA) emerged as a major beneficiary of Trump’s election victory this week.

The electric vehicle maker’s stock price shot up over 13 percent on Wednesday and has gained more than 31 percent for the week, now trading at US$321.22—its highest level to date this year.

Chart via Google Finance.

Tesla performance from November 4 to November 8, 2024.

Elon Musk, CEO of Tesla, actively backed Trump in the lead-up to the election, contributing approximately US$130 million to his efforts. In September, Trump even expressed an intention to offer Musk a role in the White House to streamline governmental processes and manage federal spending.

“`html

Elon Musk’s Ambitious Plan to Cut Federal Spending: Will It Affect SpaceX and Tesla?

Elon Musk has made a bold claim that he could reduce federal spending by at least US$2 trillion. While Musk has not detailed which areas would see these cuts, reports indicate that he and former President Trump might focus on agencies that oversee sectors where Musk operates his companies. Potential targets include the Federal Aviation Administration (FAA), the Federal Communications Commission (FCC), and various environmental agencies.

During his campaign, Trump signaled intentions to undo tax incentives and rebates for electric vehicle (EV) purchases that were put in place by the Biden-Harris administration. This might seem detrimental to Tesla, but Musk’s interests could align more closely with SpaceX, which has established significant partnerships with federal defense agencies.

In March, it was revealed that SpaceX had inked a contract worth US$1.8 billion in 2021 to develop spy satellites for the National Reconnaissance Office. Furthermore, the company secured numerous contracts for nine launches as part of the National Security Space Launch (NSSL) Phase 3 Lane 1 program on October 18.

However, rising tensions between SpaceX and the FAA cannot be overlooked. In September, the FAA imposed a US$633,009 fine on SpaceX for procedural violations tied to Falcon 9 launches. Additionally, the agency delayed the upcoming test launch of SpaceX’s Starship mega rocket, further straining relations.

Musk may be particularly invested in reducing the FAA’s regulatory control over SpaceX. Lowering the agency’s budget could allow for broader commercial space exploration.

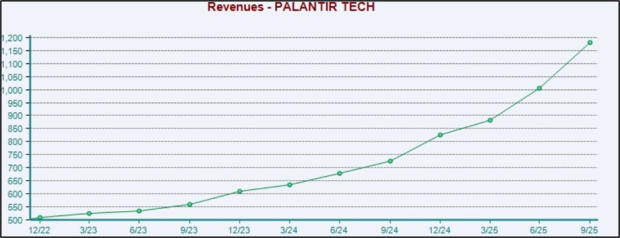

Super Micro Reports Earnings and Audit Findings

Super Micro Computer (SMCI) (NASDAQ:SMCI) shared its preliminary Q1 2025 results on Tuesday (November 5), updating its net sales forecast to between US$5.9 billion and US$6 billion. This falls short of analysts’ expectations of US$6.79 billion and is below the previous guidance range of US$6 billion to US$7 billion.

For Q2, the company anticipates net sales between US$5.5 billion and US$6.1 billion for the quarter ending December 31, 2024. This disappointing news resulted in a share price drop of more than 24 percent on Wednesday morning.

Additionally, an independent Special Committee investigating accounting concerns raised by EY found no evidence of fraud or misconduct within management or the Board of Directors. The committee suggested SMCI undertake “a series of remedial measures to strengthen its internal governance and oversight functions.” A comprehensive report is expected next week.

SMCI is also in the process of filing its overdue Form 10-K to remain compliant with Nasdaq listing standards. After receiving a notice of noncompliance, the company has 60 days to file the Form 10-K or propose a plan to regain compliance. If SMCI fails to do either, it risks being delisted from Nasdaq, which could trigger early repayment of up to US$1.725 billion in convertible notes due in March 2029.

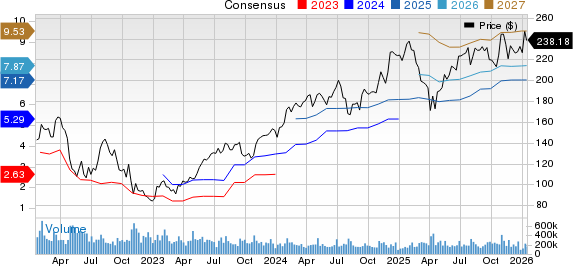

Arm Holdings Faces Slower Revenue Growth

Arm Holdings (NASDAQ:ARM) published its Q2 FYE25 results on November 6 (Wednesday), revealing a slowdown in revenue growth to just 5 percent for the September quarter, compared to 39 percent in the previous quarter.

This decline is largely attributed to a significant drop in licensing revenue, which is the income Arm generates from companies utilizing its intellectual property to design their own chips. In Q2, licensing revenue stood at US$330 million, a decrease of 43 percent from US$472 million in Q1.

“`

Arm Holdings Sees Mixed Results Amid Rising Royalty Revenue

Chart via Google Finance.

Arm Holdings performance, November 4 to 8, 2024.

Arm Holdings recently reported a financial decline; however, this drop was somewhat balanced by a notable increase in royalty revenue, which rose over 10 percent to US$514 million. Royalty revenue comes from the fees Arm charges companies that incorporate its intellectual property into their consumer products.

Following the release of this report, Arm’s share price dipped briefly but then quickly bounced back, showing an increase of nearly 10 percent by midday on Thursday, November 7. This recovery demonstrates strong investor confidence in Arm’s pivotal role within the technology sector. The company partners with prominent industry players, including Apple, Samsung (KS:5930), and NVIDIA, providing crucial chips for a variety of consumer and industrial electronics. By the end of the week, Arm’s stock had risen by 5.16 percent overall.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.