Examining Bitcoin’s Resilience and Opportunities Ahead

Q2 Bitcoin Outlook

Since its inception, Bitcoin has emerged as the top-performing asset class globally. Nonetheless, recent market volatility has triggered a decline of over 30% from its peak of $109,000 reached in 2024. Investors should consider capitalizing on this correction. Here are five compelling reasons to view current levels as a buying opportunity:

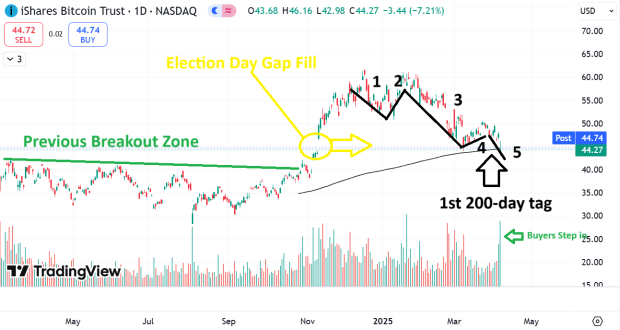

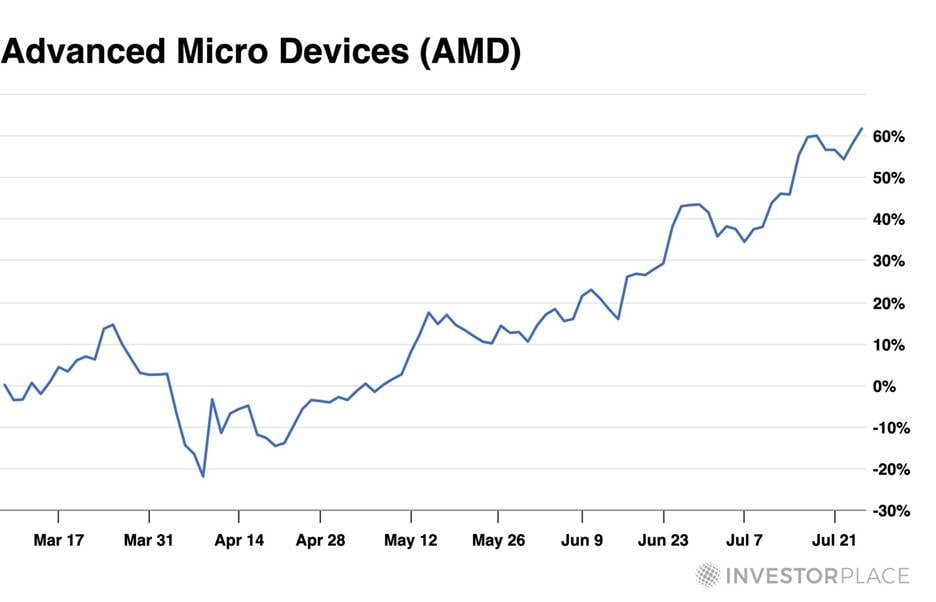

Bitcoin Technical Analysis

In technical analysis, a convergence of signals can increase the likelihood of a favorable outcome. This phenomenon, known on Wall Street as confluence, applies currently to Bitcoin and the iShares Bitcoin Trust (IBIT), which showcase four distinct signals:

· Retest of Previous Breakout Zone: The IBIT is revisiting its breakout zone from November, after establishing a seven-month base. This area can serve as support due to significant “price discovery.”

· Election Day Gap Fill: As an ETF, IBIT exhibits price gaps from overnight trading. Currently, Bitcoin is filling the gap created on Election Day in November, which is expected to serve as support.

· 200-day Moving Average Tag: For the first time, IBIT has tagged its rising 200-day moving average. Historically, the first contact with a rising moving average often attracts institutional buying interest.

· 3 Corrective Waves: According to Elliot Wave Theory, three corrective selling waves can signify that selling pressure may be waning.

Image Source: Zacks Investment Research

Bitcoin Adoption Among Public Companies

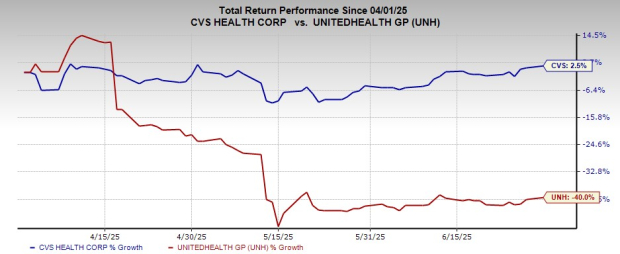

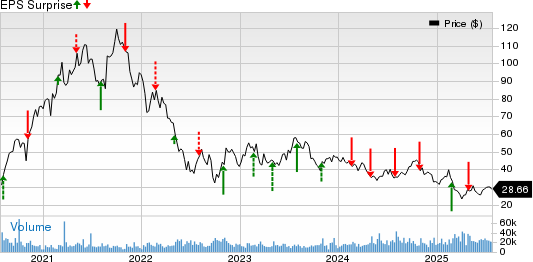

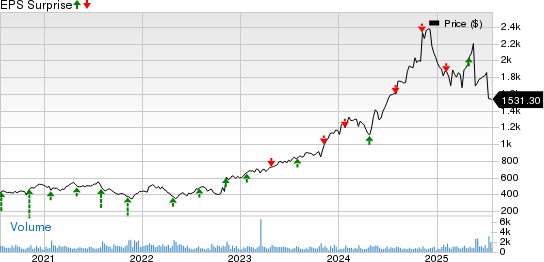

MicroStrategy (MSTR) faced significant criticism when it incorporated Bitcoin into its balance sheet, adopting a “Bitcoin Reserve Strategy.” However, this strategy has proven successful, with MSTR shares soaring over 2,000% in the past five years, significantly outperforming the S&P 500 Index’s 107.9% gain.

Image Source: Zacks Investment Research

Despite ongoing skepticism, MicroStrategy’s example has encouraged other public companies such as GameStop (GME), Semler Scientific (SMLR), and Rumble (RUM) to consider their own Bitcoin strategies. Companies like GME, which have just begun accumulating BTC, are likely to increase their holdings, potentially driving prices higher.

Potential Rate Cuts on the Horizon?

At the recent press conference, Fed Chair Jerome Powell adopted a “hawkish” tone, indicating hesitance in cutting interest rates and voicing concerns over inflation driven by tariffs. However, investors should pay close attention to market pricing, which often reflects real-time expectations. The Chicago Mercantile Exchange (CME) FedWatch Tool suggests that several interest rate cuts may occur in 2025—a potentially bullish outlook for risk assets like Bitcoin.

Bitcoin’s Bullish Seasonal Trends

Historical seasonality data for Bitcoin has proven remarkably accurate in recent years. The current seasonality pattern suggests that Bitcoin could experience a rally leading up to August, followed by a potential decline.

Image Source: Hirsch Holdings (@almanactrader)

Relative Price Strength

In bear markets, identifying relative price strength is crucial. While most major indices and numerous stocks are trading below their 200-day moving averages, Bitcoin remains above this line, signaling notable relative strength.

Image Source: Zacks Investment Research

Bottom Line

Despite a retreat from its 2024 highs, the outlook for Bitcoin in Q2 remains optimistic. Technical indicators show a convergence of bullish signals, and increasing adoption by public companies like GameStop indicates growing market confidence.

Financial Sector Poised for Growth Amid Interest Rate Cuts

Recent interest rate cuts present a bullish macro backdrop, serving as a potential catalyst for market growth. Additionally, historical seasonal trends tend to favor a positive outlook during this period.

Zacks’ Research Chief Unveils Top Stock Likely to Double

A team of financial experts from Zacks has identified five stocks with the highest likelihood of gaining 100% or more in the coming months. Among these, the Director of Research, Sheraz Mian, has spotlighted one stock expected to outperform the rest significantly.

This standout stock comes from among the most innovative financial firms currently. With a rapidly expanding customer base exceeding 50 million and a broad array of cutting-edge solutions, this company is well-positioned for substantial growth. While not all recommended stocks turn out to be winners, this particular selection has the potential to exceed past Zacks recommendations, like Nano-X Imaging, which soared by 129.6% in just over nine months.

Free: Discover Our Top Stock and Four Additional Picks

For those wanting the latest insights from Zacks Investment Research, you can download their report on the 7 Best Stocks for the Next 30 Days. Click here for your free report.

In addition, in-depth analysis is available for individual stocks like CME Group Inc. (CME), GameStop Corp. (GME), MicroStrategy Incorporated (MSTR), and Rumble Inc. (RUM).

For further insights, refer to this article originally published on Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.