Crypto Surge Sparks Interest: A Look at Robinhood and Coinbase

A recent surge in cryptocurrency has captured the attention of many investors eager to join the trend. The U.S. election landscape, particularly President-elect Donald Trump’s positive outlook on digital assets, has significantly contributed to this rally.

Investing in crypto can be unsettling due to its unpredictable nature, particularly for conservative investors. However, exposure to this market remains accessible through various stocks, notably Robinhood Markets (HOOD) and Coinbase (COIN).

As companies that facilitate crypto trading, both are anticipated to show strong results thanks to increased trading volumes and fees. Below is an analysis for those interested in adding cryptocurrency exposure to their portfolios.

Robinhood Experiences Significant Growth

Robinhood Markets has revolutionized the financial services landscape by offering commission-free stock trading, making investing more accessible to millions. With a platform enabling trades in stocks, options, commodities, and cryptocurrencies, it provides various tools such as retirement investing and Robinhood Gold for premium features.

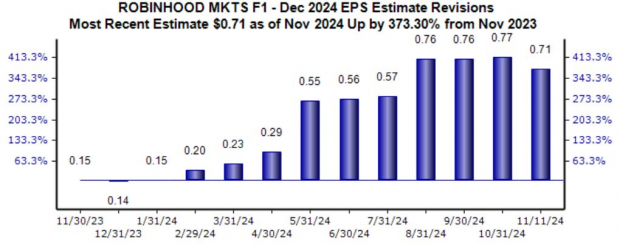

Analysts are optimistic about Robinhood’s current year, projecting earnings per share (EPS) at $0.71, an impressive increase of nearly 375% from the previous year.

Image Source: Zacks Investment Research

In its recent Q3 report, Robinhood revealed generally positive results despite slightly missing EPS and sales forecasts. The company reported EPS of $0.17 and sales of $637 million, marking a 36% year-over-year growth.

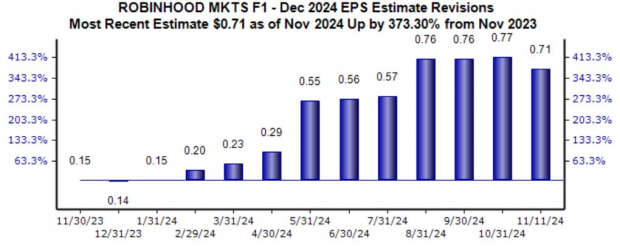

This $637 million in sales was the second-highest in the company’s history, with year-to-date net deposits reaching $34 billion, surpassing previous full-year records. The following chart depicts Robinhood’s quarterly sales performance.

Image Source: Zacks Investment Research

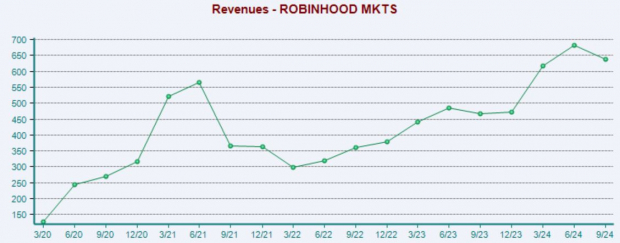

Interestingly, cryptocurrency revenues soared to $61 million, a remarkable 165% increase year-over-year, with crypto trading volumes hitting $14.4 billion, up 112% from the previous year.

These figures indicate a notable rebound in Robinhood’s crypto trading activities, although the company has faced challenges in meeting consensus expectations for cryptocurrency revenues in recent quarters, illustrated below.

Image Source: Zacks Investment Research

Coinbase Rebounds Strongly

As the largest cryptocurrency exchange in the U.S., Coinbase has experienced an up-and-down outlook over the past year, yet maintains a positive trajectory. The anticipated earnings of $5.22 per share signal an increase of almost 850%, indicating a significant recovery from easier comparisons.

Coinbase’s stock has performed well in 2024, gaining approximately 85%, especially following its recent quarterly report.

Image Source: Zacks Investment Research

In its communication about policy engagement, Coinbase stated:

‘We continue to be a trusted partner to policymakers and organizations like Fairshake — one of the largest non-partisan PACs — and StandWithCrypto — an independent grassroots advocacy group with approximately 1.8 million crypto advocates. Looking beyond Election Day 2024, we are prepared to work with either administration and believe the odds of pro-crypto legislation are better than ever.’

Recent quarters have shown mixed results for Coinbase’s transaction revenues compared to consensus expectations. Nonetheless, given the current trading climate, analysts anticipate a solid performance in its next earnings report.

Image Source: Zacks Investment Research

Conclusion

The recent surge in crypto has reignited interest among investors, underscoring a significant momentum shift. For those looking to invest in stocks tied to cryptocurrency, Robinhood Markets (HOOD) and Coinbase (COIN) offer compelling avenues.

Both companies are poised to benefit from increasing trading volumes, and we can expect to see the effects in their forthcoming quarterly results.

5 Stocks Set for Potential Growth

Five stocks have been specifically selected by a Zacks expert as their top picks expected to double in 2024. While past recommendations have included impressive gains of +143.0%, +175.9%, +498.3%, and +673.0%, not all choices will guarantee success.

These stocks represent opportunities primarily under the radar of major Wall Street analysts, providing a unique chance for early investment.

Explore the potential of these 5 promising stocks >>

For the latest insights from Zacks Investment Research, download the report on 5 Stocks Set to Double.

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.