BlackBerry’s Stock Surges Past Competitors, But Caution Remains

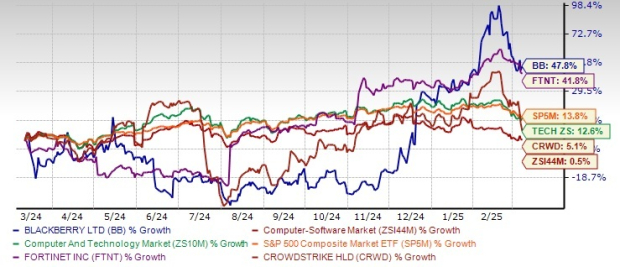

BlackBerry Limited (BB) has shown remarkable performance, surging by 47.8% over the past year. This growth surpasses that of the Computer Software industry, the broader Zacks Computer & Technology sector, and the S&P 500 composite, which saw gains of only 0.5%, 12.6%, and 13.8%, respectively.

Additionally, BlackBerry has outperformed other players in the cybersecurity sector, including Fortinet (FTNT) and CrowdStrike Holdings, Inc. (CRWD), which achieved increases of 41.8% and 5.1% respectively during the same period. Despite gaining 2.5% in the last trading session, BlackBerry’s stock is currently 27.6% below its 52-week high of $6.24.

Price Performance Overview

Image Source: Zacks Investment Research

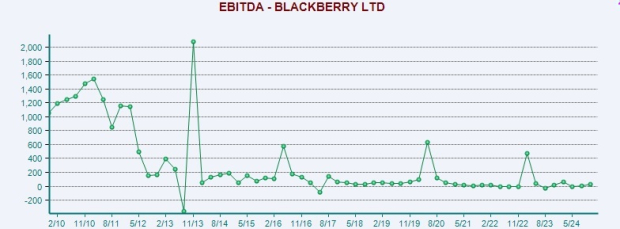

Investor interest in BB has been growing as management focuses on strategic initiatives aimed at increasing revenue and profitability. In the last reported quarter, adjusted EBITDA (from both continuing and discontinued operations) rose to $23 million, up from $18 million in the previous year. Notably, the company had initially anticipated an adjusted EBITDA between $0-$10 million.

Image Source: Zacks Investment Research

Given this strong momentum, investors are weighing whether to settle for gains or continue their long-term commitment to BlackBerry.

Factors Fueling BB’s Growth

Blackberry’s recent sale of underperforming entities and a renewed focus on its core business could lead to further success. The company recently sold its Cylance endpoint security assets to Arctic Wolf for approximately $160 million. This divestiture allows BlackBerry to concentrate on its Secure Communications business, which encompasses BlackBerry UEM, BlackBerry AtHoc, and BlackBerry SecuSUITE products. These initiatives are pivotal for bolstering its position in the secure communications market.

Following the Cylance sale, BB decided to “stand down” from previous cybersecurity guidance and now only provides forecasts for its new Secure Communications division. For fiscal 2026, the expected revenue for this division is between $267-$271 million.

The company has also rebranded its IoT division as “QNX,” responding to input from stakeholders. This rebranding is designed to enhance recognition and reinforce its leadership in the automotive and embedded sectors, particularly in the development of next-generation software-defined vehicles (SDVs) and critical applications.

QNX’s new brand identity includes a fresh logo and website, reflecting its commitment to performance-driven, future-ready solutions.

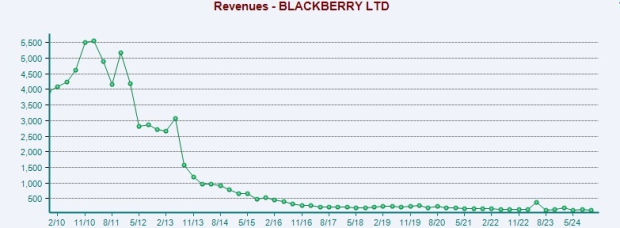

Image Source: Zacks Investment Research

In January 2025, BlackBerry launched the QNX Cabin, an advanced solution, and established several partnerships, including one with Microsoft Corporation (MSFT).

This collaboration aims to assist automakers in developing, validating, and enhancing software solutions within the cloud for SDVs. As part of this partnership, the QNX Software Development Platform 8.0 will be integrated with Microsoft Azure, enabling a comprehensive cloud-based environment for auto manufacturers to foster innovation and minimize development risks. Future collaborations will include the QNX Hypervisor and QNX Cabin.

Additionally, QNX has partnered with Vector and TTTech Auto to create a foundational vehicle software platform, which seeks to reduce the complexity and expenses associated with software integration. Moreover, last month, BlackBerry’s QNX unit teamed up with Pi Square Technologies to implement a multi-year plan aimed at training thousands of software engineers in India, addressing the high global demand for embedded systems developers.

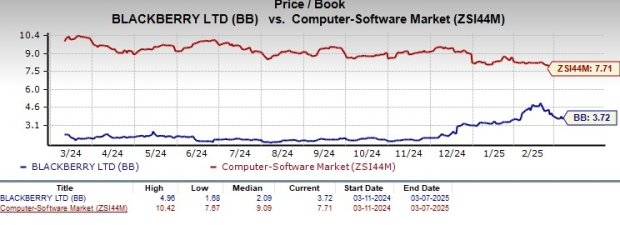

Technical Indicators and Valuation Insights

BB stock is currently trading at a discount, with a trailing 12-month price/book multiple of 3.72 compared to the industry average of 7.71.

Image Source: Zacks Investment Research

Strong technical indicators also support its positive performance. The stock trades above its 100-day moving averages, signaling upward momentum and stability in pricing. This reflects a favorable market perception and strong growth potential.

Challenges Ahead for BB

Despite its successes, BlackBerry faces challenges within the automotive sector. This industry is highly cyclical and has been impacted by wider economic factors, including supply-chain issues and changing consumer preferences. Delays in software development for automakers continue to hinder IoT revenues and extend QNX’s development cycles, which might adversely affect the IoT segment that is heavily reliant on automotive clients.

Furthermore, BlackBerry faces increasing competition in both its IoT and cybersecurity sectors. Rapid technological changes necessitate continuous investment in research and development to create innovative products and stay competitive, which inflates operating costs for the company.

Why BB is a Hold for the Moment

While BlackBerry’s shift towards high-margin fields like IoT and Secure Communications is promising, risks could exert downward pressure on share prices. The company’s dependence on cost reductions to enhance EBITDA, along with vulnerabilities in volatile sectors like automotive and intensifying cybersecurity competition, require careful consideration.

Given these circumstances, investors should proceed with caution and consider waiting for a more opportune entry point. Those holding BB stock should keep a close eye on how BlackBerry implements its strategic initiatives in the upcoming quarters.

Currently, BB holds a Zacks Rank #3 (Hold). For a comprehensive list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

5 Stocks Poised for Big Gains

These stocks have been selected by a Zacks expert as top picks expected to gain 100% or more in 2024. While not every selection will be a winner, historic recommendations have achieved remarkable gains of 143.0%, 175.9%, 498.3%, and 673.0%.

Most stocks in this report are currently under the radar, providing an excellent opportunity for early investment.

Discover these 5 potential winners here >>

For the latest stock recommendations from Zacks Investment Research, download the free report on the 7 Best Stocks for the Next 30 Days. Click here to get your copy.

Microsoft Corporation (MSFT): Free Stock Analysis report

Fortinet, Inc. (FTNT): Free Stock Analysis report

BlackBerry Limited (BB): Free Stock Analysis report

CrowdStrike (CRWD): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.