BlackBerry Shares Soar: A Strong Comeback in the Tech Sector

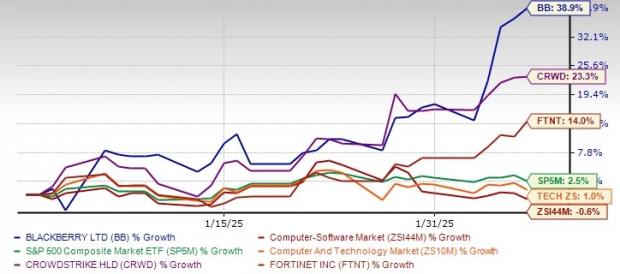

BlackBerry Limited’s BB shares have surged 38.9%, greatly exceeding the Computer Software industry’s slight drop of 0.6% and the S&P 500 composite’s gain of 2.5% year to date.

The company has outperformed not just the S&P, but also the broader Zacks Computer & Technology sector’s 1% return and competitors in the cybersecurity realm, including Fortinet FTNT and CrowdStrike Holdings, Inc. CRWD, which gained 14% and 23.3%, respectively, over the same period.

A Look at Price Performance

Image Source: Zacks Investment Research

The recent rise in BlackBerry’s stock price is attributed to several positive developments. Notable among these is the sale of the underperforming Cylance unit, which has been a significant change for the company. Since the announcement of this sale on December 16, 2024, shares have soared 69.9%. Furthermore, BlackBerry released encouraging third-quarter fiscal 2025 results on December 19, 2024, showcasing solid adjusted EBITDA performance and positive free cash flow ahead of expectations.

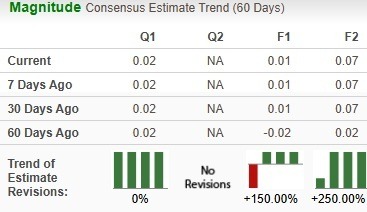

Analysts are optimistic, as seen in the updates to EPS (earnings per share) estimates. Current fiscal year estimates have improved to 1 cent from a previous loss of 2 cents over the last two months. For the following fiscal year, the estimates have increased to 7 cents from 2 cents in the same time frame.

Image Source: Zacks Investment Research

In the last trading session, BlackBerry reached a new 52-week high of $5.34 before closing at $5.25. This performance raises questions for investors about whether there is still room for growth—should they continue holding the stock or consider selling? Let’s explore the best strategies for your portfolio.

Strategic Moves Are Key to BlackBerry’s Success

Recently, BlackBerry completed the sale of its Cylance endpoint security assets to Arctic Wolf for approximately $160 million. This sale allows the company to refocus on its Secure Communications sector, which includes BlackBerry UEM, BlackBerry AtHoc, and BlackBerry SecuSUITE. These solutions will be crucial as BlackBerry strengthens its position in the secure communications market.

With this significant change, BlackBerry now plans to offer revised guidance focusing solely on its new Secure Communications division. Expected revenues for this division range between $267 million and $271 million for the upcoming quarters.

Further, BlackBerry has rebranded its IoT division to “QNX”, which reflects valuable feedback from various stakeholders. This rebranding aims to improve brand recognition and reinforce its leadership role within the automotive and embedded industries. QNX will support the development of next-generation software-defined vehicles (SDVs) and critical applications. The new brand identity includes a new logo and website, highlighting its focus on performance-driven solutions.

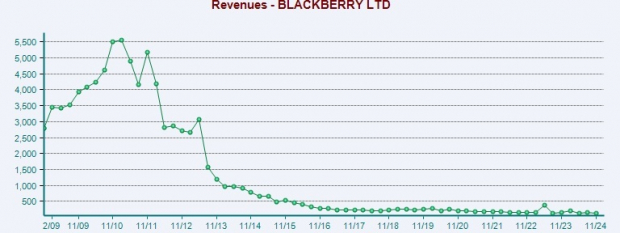

Image Source: Zacks Investment Research

In January 2025, BlackBerry launched the QNX Cabin, showcasing innovative solutions alongside partnerships, including one with Microsoft Corporation MSFT.

This partnership seeks to assist automakers in building and refining software in the cloud, promoting the development of SDVs. They aim to bring the QNX Software Development Platform 8.0 to Microsoft Azure, providing a cloud environment that can accelerate innovation while minimizing development risks. The collaboration will also explore the QNX Hypervisor and the QNX Cabin.

Additionally, in partnership with Vector and TTTech Auto, QNX announced a multi-year collaboration to create a foundational vehicle software platform. This initiative aims to simplify software integration and reduce associated costs.

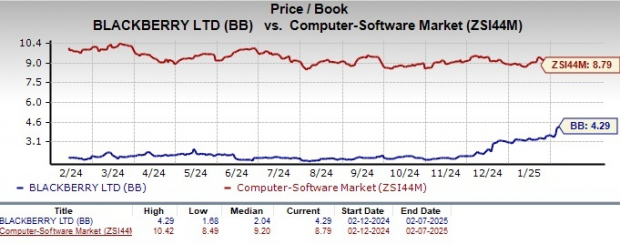

Positive Indicators and Valuation Considerations

BB stock is currently trading at a discount, with a trailing 12-month price/book multiple of 4.29 compared to the industry’s average of 8.79.

Image Source: Zacks Investment Research

Moreover, technical indicators underscore strong performance. The stock is trading above both its 50-day and 100-day moving averages, indicating positive price momentum and stability in its market perception.

Why Investing in BB Stock Makes Sense

BlackBerry represents a strong investment opportunity thanks to its improving financials and solid growth prospects. The company has consistently outperformed the Zacks Consensus Estimate in the last four quarters, with an average surprise of 131.25%. Its strategic initiatives and focus on lucrative verticals such as IoT and secure communications position it well for long-term success.

Currently, BB holds a Zacks Rank #1 (Strong Buy), suggesting that now may be the optimal time for investors to accumulate shares. You can view the complete list of today’s Zacks #1 Rank stocks here.

New Opportunities: Zacks Top 10 Stocks for 2025

Don’t miss the chance to explore our 10 top stocks for 2025, curated by Zacks Director of Research Sheraz Mian. This portfolio has shown stunning performance, gaining +2,112.6% since inception in 2012, effectively quadrupling the S&P 500’s +475.6%. Sheraz has meticulously selected these 10 stocks for their potential in the coming year. Be among the first to discover these newly highlighted investment opportunities.

Get the latest recommendations from Zacks Investment Research by downloading the report on the 7 Best Stocks for the Next 30 Days.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Fortinet, Inc. (FTNT): Free Stock Analysis Report

BlackBerry Limited (BB): Free Stock Analysis Report

CrowdStrike (CRWD): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.