BlackRock (BLK) closed the latest trading day at $805.19, indicating a -0.87% change from the previous session’s end. The stock trailed the S&P 500, which registered a daily gain of 0.09%. Elsewhere, the Dow lost 0.49%, while the tech-heavy Nasdaq added 0.65%.

Shares of the investment firm have appreciated by 8.3% over the course of the past month, outperforming the Finance sector’s gain of 7.41% and the S&P 500’s gain of 5.78%.

The investment community will be paying close attention to the earnings performance of BlackRock in its upcoming release. The company is expected to report EPS of $9.96, up 7.33% from the prior-year quarter. Meanwhile, the latest consensus estimate predicts the revenue to be $4.89 billion, indicating a 9.66% increase compared to the same quarter of the previous year.

For the full year, the Zacks Consensus Estimates are projecting earnings of $41.31 per share and revenue of $20.21 billion, which would represent changes of +9.37% and +13.19%, respectively, from the prior year.

Furthermore, it would be beneficial for investors to monitor any recent shifts in analyst projections for BlackRock. Recent revisions tend to reflect the latest near-term business trends. As a result, we can interpret positive estimate revisions as a good sign for the company’s business outlook.

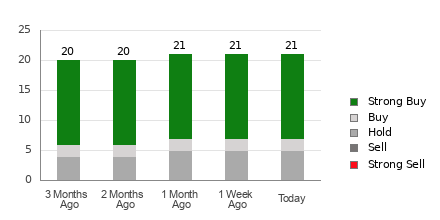

Our research suggests that these changes in estimates have a direct relationship with upcoming stock price performance. We developed the Zacks Rank to capitalize on this phenomenon. Our system takes these estimate changes into account and delivers a clear, actionable rating model.

The Zacks Rank system, stretching from #1 (Strong Buy) to #5 (Strong Sell), has a noteworthy track record of outperforming, validated by third-party audits, with stocks rated #1 producing an average annual return of +25% since the year 1988. Over the last 30 days, the Zacks Consensus EPS estimate has moved 0.29% higher. Right now, BlackRock possesses a Zacks Rank of #3 (Hold).

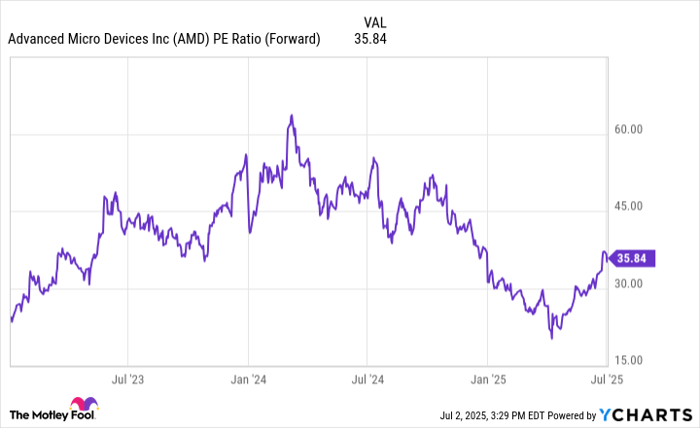

Looking at its valuation, BlackRock is holding a Forward P/E ratio of 19.66. This expresses a premium compared to the average Forward P/E of 10.36 of its industry.

One should further note that BLK currently holds a PEG ratio of 1.68. The PEG ratio bears resemblance to the frequently used P/E ratio, but this parameter also includes the company’s expected earnings growth trajectory. The Financial – Investment Management industry had an average PEG ratio of 0.96 as trading concluded yesterday.

The Financial – Investment Management industry is part of the Finance sector. This group has a Zacks Industry Rank of 148, putting it in the bottom 42% of all 250+ industries.

The Zacks Industry Rank gauges the strength of our individual industry groups by measuring the average Zacks Rank of the individual stocks within the groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

To follow BLK in the coming trading sessions, be sure to utilize Zacks.com.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.