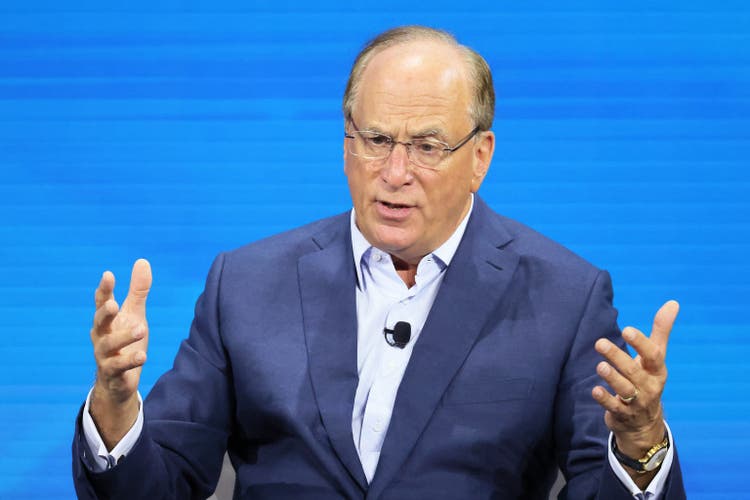

Michael M. Santiago/Getty Images News

“If we can ETF a bitcoin, imagine what we could do with all financial instruments,” expressed Laurence Fink, chairman and CEO of BlackRock, the prime issuer of exchange-traded funds worldwide.

Revolutionizing Financial Instruments

Previously, BlackRock (NYSE:BLK) unveiled a comprehensive reorganization entailing the integration of the company’s iShares ETF and index business across its entire operations. Fink articulated his aspiration to infuse the fundamental philosophy of iShares into all aspects of the company, emphasizing this in an interview on Bloomberg Television.

“We believe we’re halfway there in the ETF revolution. Everything is going to be ETF’d,” Fink proclaimed. He underscored the necessity to ensure the utilization of both active and passive products, including digital products, via the medium of ETFs.

“It’s not the end of mutual funds, but ETFs will become the dominant form,” he added.

The Next Step: Tokenization of Financial Assets

Fink envisages the tokenization of financial assets as the next evolutionary stride, highlighting the manifold benefits it can yield. “That means every stock, every bond will have its own CUSIP. It will be on one general ledger,” he explained.

In this envisioned system, each investor will possess their own identification. Fink projected that tokenization could eliminate issues related to illicit activities surrounding stocks and bonds.

The technology would also empower investors to personalize strategies through tokenization and enable instantaneous settlements. “We believe this is a technological transformation for financial assets,” he emphasized.

Strategic Acquisitions and Financial Performance

Simultaneously, BlackRock (BLK) has agreed to acquire Global Infrastructure Partners for $3 billion in cash and $12 million in common stock, shaping the deal’s value at approximately $13.5 billion based on Thursday’s BLK closing price of $792.61. Additionally, the company posted Q4 earnings per share of $9.56, surpassing the $8.82 consensus.