The BlackRock Enhanced International Dividend Trust unveiled on March 1, 2024, that its board of directors has declared a uniform monthly dividend of $0.03 per share ($0.41 annually), matching the previous payout. Investors must secure shares before the ex-dividend date of March 14, 2024, to qualify for the dividend distribution scheduled for March 28, 2024, to shareholders of record as of March 15, 2024.

Considering the current share price of $5.42 per share, the stock’s dividend yield stands at a notable 7.48%. Reflecting on the past five years with a weekly sampling, the average dividend yield has held at 7.45%, with fluctuations ranging from a low of 6.08% to a high of 10.51%. Notably, the standard deviation of yields registers at 0.68 (n=194), and the current dividend yield places itself 0.04 standard deviations above the historical mean. Despite this consistency, the company has refrained from increasing its dividend over the last three years.

The Big Picture: Fund Sentiment Analysis

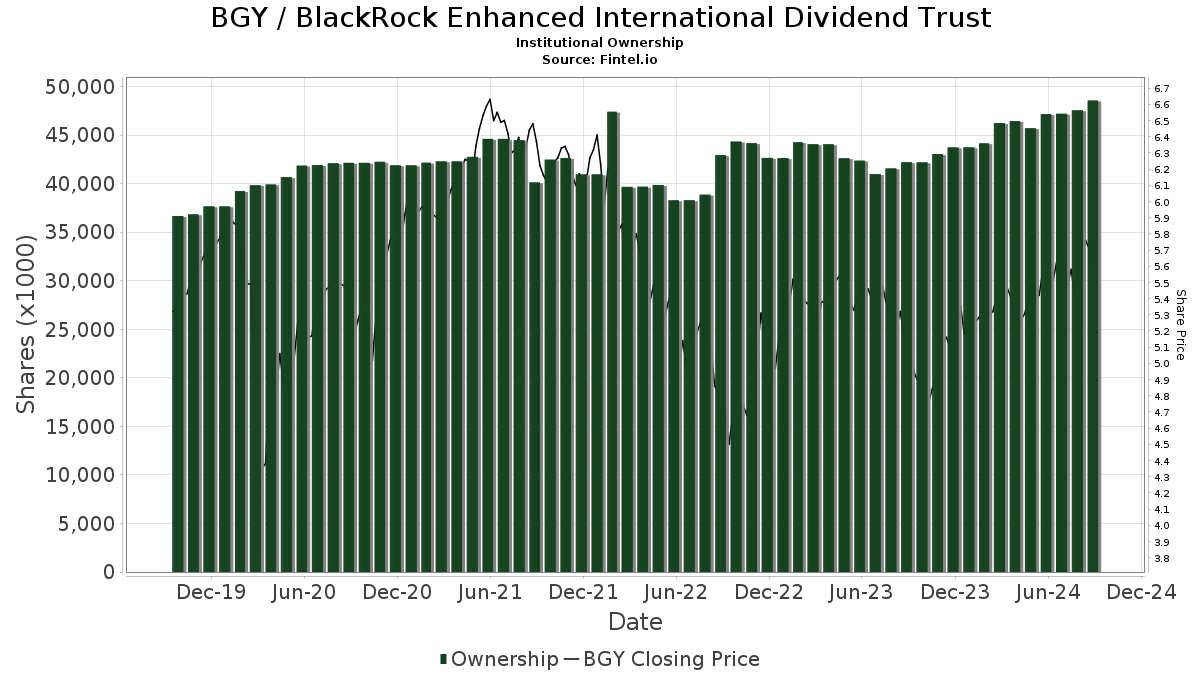

A notable sentiment in the air as 111 funds or institutions disclose positions in the BlackRock Enhanced International Dividend Trust, marking a 4.72% increase in the last quarter. The averaged portfolio weight dedicated to BGY across all funds stands at 0.10%, demonstrating an impressive 9.21% uptick. Institutions have collectively raised their stakes by 6.16% to 46,414K shares over the last three months.

Shareholder Actions in the Limelight

In their strategic moves, Allspring Global Investments Holdings now holds 10,232K shares following a 1.98% increase from their previous filing. Conversely, Karpus Management bolstered their BGY presence by 6.06%, with their holding now at 5,723K shares. 1607 Capital Partners took a significant stride, escalating their share count to 2,389K, a notable 18.01% surge. Saba Capital Management secured 1,832K shares after a 13.00% boost in their holding. Invesco, on the other hand, added 5.29% to their BGY portfolio, albeit reducing their allocation by 91.02% in the last quarter.

Exploring BlackRock Enhanced International Dividend Trust’s Foundation

(Description as provided by the company.)

BlackRock Strategic Municipal Trust’s investment goals aim to deliver current income exempt from regular federal income tax and invest in municipal bonds outperforming the broader market. With a focus on securities exempt from federal income tax (with potential alternative minimum tax implications), the Trust assures at least 80% investment in high-grade securities at procurement. Typically favoring long-term maturities, with an average maturity of 15 years or more, the Trust either directly invests in or uses derivatives to access these securities.

Further Reading:

Fintel offers a robust investing research platform suitable for individual investors, traders, financial advisors, and small hedge funds.

Delving into worldwide data, Fintel’s comprehensive services encompass fundamentals, analyst reports, ownership data, fund and options sentiment, insider trading insights, and more. Enhancing the experience, Fintel’s exclusive stock picks leverage advanced, backtested quantitative models for superior returns.

Click to Learn More

Originally surfaced on Fintel.

The sentiments articulated herein are the author’s opinions and do not inherently mirror those of Nasdaq, Inc.