Exploring the Potential Post-Merger

For dividend investors, Business Development Companies (BDCs) hold a special place. The aftershocks of the banking crisis in early 2023 are expected to make the sector (BIZD) even more appealing over time. Amid my existing BDC favorites, BlackRock TCP Capital (NASDAQ:TCPC) has captured my attention with its recent merger announcement. This development has spurred a comprehensive analysis to ascertain TCPC’s potential to become a major player in the BDC landscape post-merger.

Company Overview

BlackRock TCP Capital is a BDC focusing on debt investments in private, middle-market companies with enterprise values typically ranging from $100 million to $1.5 billion, primarily through first-lien loans. The company is externally managed and, as an investor in the space, I tend to favor internally-managed BDCs like Capital Southwest (CSWC), which often demonstrate values more aligned with shareholders and, at times, pay out more in special & supplemental dividends due to lower associated fees.

Implications of Recent Merger

The agreement with BlackRock Capital Investment (BKCC) for merging into a wholly-owned indirect subsidiary is a strategic move by TCPC. The merging process, anticipated to be completed in the first quarter of this year, is expected to unlock long-term shareholder value through cost synergies, enhanced scale, better access to capital, potential debt financing on more favorable terms, and a projected total assets value of approximately $2.4 billion alongside net assets of around $1.1 billion. These dynamics, essential for sustainable growth, are poised to fuel the BDC’s progress, making the merger a potentially pivotal moment for TCPC.

Shifting Investor Sentiment

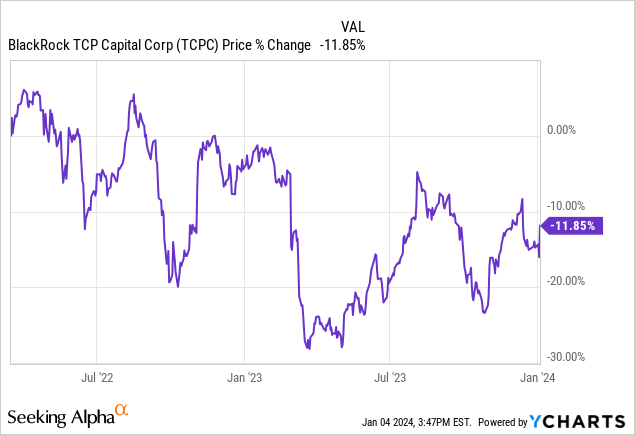

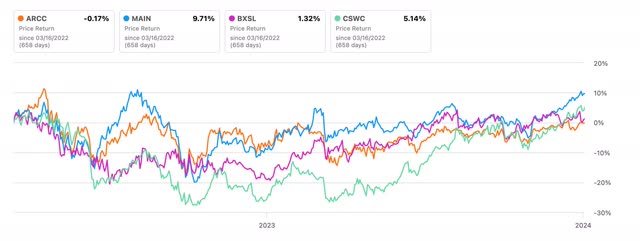

The reduced management fee and other concessions in the merger serve as confidence boosters but fail to overlook TCPC’s slipping net asset value (NAV). Since the start of rate hikes in March 2022, the BDC has experienced a downtrend by nearly 12%, while peers such as Main Street Capital (MAIN) and Ares Capital (ARCC) have painted a more positive trajectory. Trading at a discount to its NAV price, the BDC’s performance may seem lackluster at first glance.

The prevailing discount stems from consecutive NAV declines, driving a near 7% discount to NAV. However, the real potential may lie in the BDC’s ability to reverse this trend post-merger and generate sustained NAV growth, supplementing investor confidence and potentially translating into stock appreciation.

The confidence in the company’s future lies in the potential for sustained NAV growth post-merger, coupled with prudent dividend management and outperforming performance strained by market volatility and isolated challenges. If TCPC can navigate these hurdles, the trajectory may turn in favor of investors following the merger.

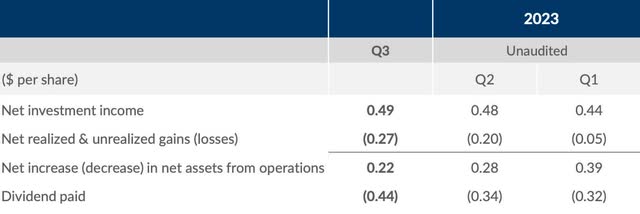

Backing the Dividend with Robust Earnings

The fiscal year has witnessed robust earnings for BlackRock TCP Capital, with both net investment and total investment income showing quarter-over-quarter growth. Despite comfortably out-earning the dividend, challenges like NAV decline and debt investment comprising 95% floating rate warrant a proactive approach. Accumulating this extra income for future rate cuts would protect the sustainability of dividends and fortify shareholder confidence.

BlackRock TCP Capital : A Deep Dive into the Financial Outlook

BlackRock TCP Capital has seen a solid performance, demonstrating resilience in the face of challenging market conditions. The BDC remained diligent in its investment strategy, ensuring prudent decision-making and strategic growth. Let’s analyze the key factors shaping the company’s future.

Strategic Investments

The choice to abstain from adding new portfolio companies during the fiscal year reflects a measure of prudence and discernment. While some may view this as a lack of proactive expansion, it underscores the company’s dedication to sustainable, organic growth. In today’s fast-paced market, the emphasis should be on quality over quantity.

It is imperative to discern between hasty acquisitions and astute investments. The company’s decision to be selective in this regard bodes well for its long-term stability and scalability. It’s akin to tending a well-tended garden; carefully nurtured and cultivated for lasting, robust growth.

Sound Financial Footing

With a BBB- credit rating from Fitch and Moody’s, BlackRock TCP Capital enjoys a robust balance sheet, signifying a robust financial foundation. The upsurge in liquidity and a focus on deleveraging highlight the company’s prudent financial management.

The increase in cash reserves coupled with a favorable debt maturity schedule positions the company favorably to navigate potential challenges. This fiscal fortitude projects a sense of preparedness akin to a ship bolstering its hull before an uncertain voyage.

Navigating Risks

Rises in non-accruals and PIK income have posed challenges. However, the company’s proactive stance in monitoring these risks positions it well to handle potential headwinds. The anticipation of declining interest rates underscores the necessity for vigilance in adapting to evolving financial landscapes.

The company’s ability to navigate these potentially disruptive changes will be crucial. It’s akin to sailing through stormy weather; preparedness and adaptability are essential for a successful voyage.

Looking Ahead

BlackRock TCP Capital’s announcement of an upcoming merger with BKCC suggests a forward-looking approach aimed at enhancing long-term value creation. The synergy and prospects for amplified growth are encouraging indicators of a strategic vision.

While the company faces near-term challenges, the merger could potentially catapult it into a major player in the sector. Observing the company’s trajectory over the upcoming quarters will provide valuable insights into its growth potential.