Unlocking Value: How BlackRock’s Buyback Strategy is Impacting CEF Markets

One often-overlooked strategy for closed-end funds (CEFs) to boost profits is through share buybacks initiated by management.

Most investors are likely familiar with buybacks. For regular stocks, they reduce the number of outstanding shares, which tends to raise earnings per share and overall share prices.

In the case of CEFs, however, buybacks have a different impact. The focus here is on how these buybacks influence the discount to net asset value (NAV), which is the worth of a CEF’s underlying assets.

Managing Discounts Through Buybacks

Members of my CEF Insider service understand the importance of discounts to NAV as they are the key indicators of CEF value. By acquiring discounted CEFs, investors can benefit as the discount narrows, leading to higher fund prices.

Discounts arise because CEFs trade with a fixed number of shares, meaning their market prices can differ significantly from their NAV. Often, these funds sell at discounts.

This discussion is timely because in May, we explored a notable strategy from BlackRock aimed at stabilizing discounts for their CEFs while elevating their market prices.

BlackRock announced a tender offer program earlier this year, designed to repurchase shares of 14 of its CEFs at 98% of NAV, provided that a fund’s discount is at or below 7.5% over a three-month evaluation period.

This is a positive development for investors, as they have the opportunity to sell their shares back to BlackRock at only a 2% discount to NAV. For those who purchased shares at a larger discount, this translates to instant gains.

Since the announcement, we have observed a gradual reduction in these funds’ discounts. More importantly, shareholders are enjoying greater gains and improved downside protection.

BlackRock Sees Discounts Weighing Down Slightly

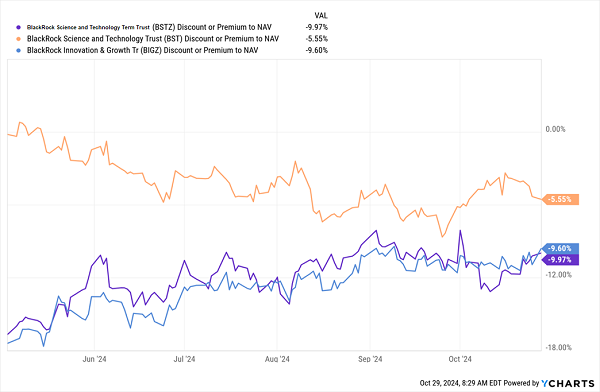

The accompanying chart illustrates the changes in discounts for three BlackRock technology funds since the buyback plan was revealed: the BlackRock Science and Technology Trust (BST) (orange), BlackRock Science and Technology Term Trust (BSTZ) (purple), and BlackRock Innovation and Growth Trust (BIGZ) (blue).

Notably, BST and BSTZ are holdings in the CEF Insider portfolio.

Examining the chart reveals that BST has maintained an average discount of about 5%. This is expected, as it has not met the eligibility criteria set by BlackRock’s buyback program, and it hasn’t dropped below the 7.5% threshold.

However, this stability is beneficial, as investors buying near this discount experience less price volatility. The buyback program has positively impacted BIGZ, resulting in a significant increase in its market price, which has far outpaced its relatively stable NAV return.

BIGZ’s Results Reflect Buyback Program Success

A closer look at the situation highlights the effectiveness of BlackRock’s buyback initiative. As 2023 has been favorable for stocks, particularly growth stocks, one might expect BIGZ’s NAV to have risen considerably.

Instead, its NAV has plateaued, which typically would lead investors to move their assets into better-performing funds like BST, which has seen increases in both its market price and NAV return over the last six months:

BST Shows Resilience Amid Buybacks

While BST is not directly impacted by the buyback program due to its insufficient discount, the closeness of its NAV and price returns indicates stronger performance. Among the three funds, BSTZ has benefited most from the tender offer.

BSTZ’s Impressive Gains as its Discount Narrows

As BSTZ’s discount decreased from 17% to roughly 10%, its total NAV return of 9.7% has resulted in an impressive 19.4% market price return for investors.

This is why I recommended CEF Insider members to acquire BSTZ in May, following the announcement of the tender offer. With BSTZ’s discount lingering near 10%, investors have the potential for profits as the fund reaches its target discount floor of 7.5%.

Understanding the Appeal of BlackRock’s Buyback Strategy

Before we proceed, it’s important to remember why CEFs are appealing: their high yields and significant discounts to NAV. While steep NAV discounts provide good buying opportunities, they can be less favorable for selling. Therefore, it’s ideal for CEFs to have fluctuating discounts, allowing for selling when prices are more favorable.

Buyback programs are instrumental in this regard. BlackRock’s strategy enables fund management to repurchase shares from investors at a fixed discount, making exit strategies more attractive for those wanting to sell while still benefiting those who remain invested.

For example, purchasing BSTZ at a 10% discount and later selling at a 2% discount yields an instant 8.8% profit. Keep in mind that BlackRock’s buyback strategy has its limitations, offering to repurchase only up to 2.5% of outstanding shares each quarter.

While the BlackRock buyback program enhances shareholder value for BIGZ, BST, and BSTZ, it raises concerns regarding BIGZ’s underwhelming performance. The market currently seems unconcerned, as enthusiasm for buybacks continues. If BIGZ’s NAV rebounds, this fund could experience significant upswing.

Capitalizing on AI with CEFs

Surprisingly, CEFs offer one of the few avenues to invest in the growth of AI while receiving an impressive dividend yield.

Individual tech stocks like NVIDIA (NVDA) and Microsoft (MSFT) offer minimal dividends, making them less attractive for income-focused investors.

The four “AI-Powered” CEFs I recommend currently yield an average of 9.8%, all trading at appealing prices, making it possible to invest in AI assets at significant discounts not seen by general investors for months.

Now is an opportune moment to consider these four funds and position ourselves for substantial dividends as AI continues to integrate into our daily lives.

For more information on these 9.8%-yielding AI funds and to download a complimentary special report detailing their names and tickers, click here.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.