In early 2023, it appeared that cobalt and nickel-laden electric car battery markets were dealt a colossal blow, altering the balance of power in the industry.

A few months later, the burgeoning success of LFP Model 3 stood as a testament to a significant shift in the global EV market, with LFP technology claiming an impressive 5% share and accounting for 21% of Tesla’s battery capacity in vehicles on the road, even before a critical patent expiry set for the following year.

Shifting Dynamics in the Market

It’s January 2024 and unfortunately for the staunch advocates of cobalt and nickel, the impact of LFP batteries has proven to be far more profound than initially anticipated. The emergence of LFP technology, previously overshadowed by NCM and NCA batteries, has now upended the industry landscape.

Just four years ago, when Elon Musk first announced the adoption of LFP batteries, their usage accounted for a meager 50 tonnes of overall battery metal demand. In stark contrast, the batteries of electric passenger cars sold in February 2020 contained nearly 13,000 tonnes of lithium, graphite, nickel, manganese, and cobalt combined. At that time, NCM and NCA batteries dominated the market, exhibiting superior energy and power density, faster charging times, and extended range.

Leap of Faith

Musk’s concerns about nickel supply and the company’s emphasis on reducing cobalt usage prompted the radical shift to LFP batteries. At the time, LFP batteries were primarily associated with small urban vehicles, delivery vans, buses, and specialized vehicles, casting doubts on their compatibility with Tesla’s luxury brand image.

However, the unexpected success of the Wuling Mini EV, China’s best-selling EV in 2020, exceeded expectations, firmly establishing the viability of LFP technology for a broader market segment.

The LFP Revolution

Following Tesla’s move to LFP batteries, the subsequent unveiling of BYD’s Blade batteries in March 2020 added considerable momentum to the ascendancy of LFP technology. The Shenzhen-based manufacturer’s innovative approach compensated for the inherent energy density limitations of LFP batteries, driving widespread adoption and challenging the dominance of NCM and NCA batteries. The safety features of LFP batteries, coupled with BYD’s commitment to transitioning its entire range to LFP, further solidified the technology’s appeal.

Today, BYD’s electric vehicle range outsells Tesla in certain periods, and the company has emerged as a global leader in the EV market, despite its limited international presence outside China.

Reshaping the EV Landscape

With LFP batteries capturing 31% of the global EV battery market by the end of 2023, their market dominance is unmistakable. This transformation has led to a significant decline in the demand for nickel and cobalt-containing batteries, with LFP technology surpassing leading cathode technologies in the global EV market.

Additionally, the cost advantage of LFP batteries has been bolstered by a sharp decline in lithium prices, further solidifying the technology’s position as a cost-effective and efficient alternative.

Redefining the Power Dynamics

What began with a mere 50 tonnes of LFP-induced demand in February 2020 has evolved into a substantial monthly demand of 27,000 tonnes, with the possibility of further integration into hybrid LFP-NCM batteries. This shift has significantly altered the global active battery material demand landscape, spelling a new era in the electric vehicle industry.

Blade runners: How LFP batteries have impacted the global EV metal markets

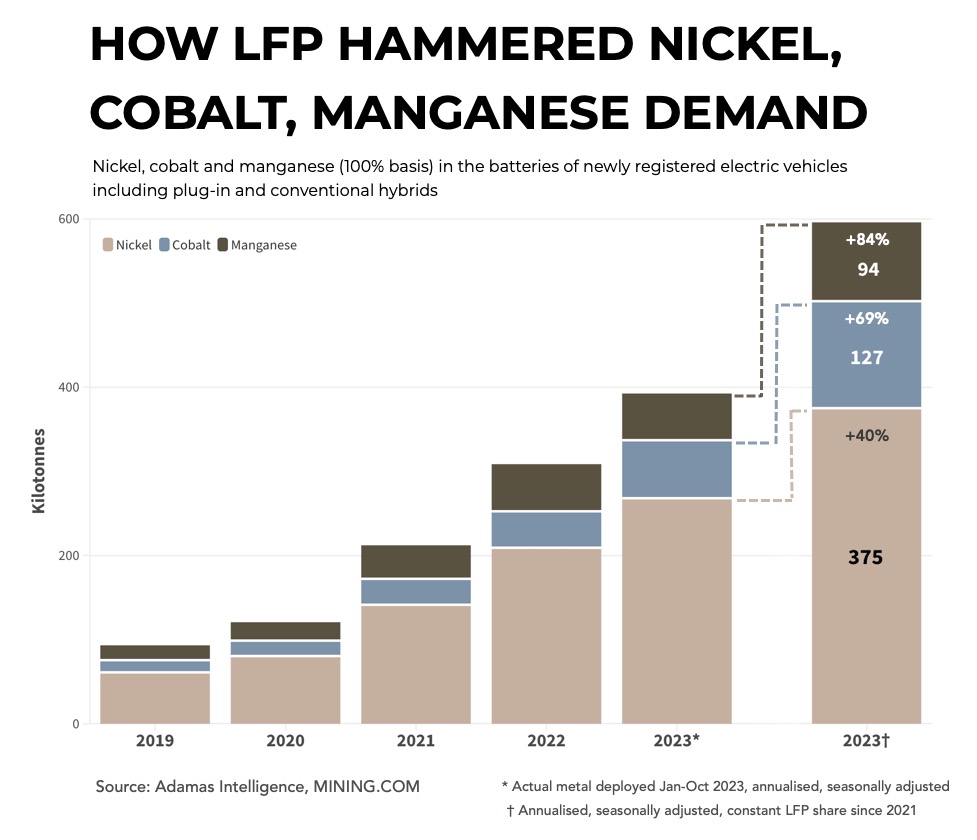

Ensconced in their niche a mere few years ago, cobalt, manganese, and nickel had reached meteoric highs in their respective markets. However, recent years have seen a rather dramatic downturn in their fortunes. Cobalt, which carved a niche of 8% in 2019, now hovers at less than 5%. Meanwhile, manganese has plummeted from nearly 9% to 6%. The battery metal, nickel, too is waning in its market share, despite the rapid adoption of nickel-rich chemistries for NCM batteries. It seems the allure of these metals is fading faster than anticipated.

Shifting trends in the battery metal market

The rapid market shift has resulted in NCM 811, comprising over 80% nickel, cornering more than a fifth of the market in GWh terms, surpassing its predecessor NCM 523. Manufacturers like Tesla-Panasonic have also been incorporating over 80% nickel in their third-generation NCA batteries. Consequently, the demand for cobalt and manganese, traditionally overshadowed by lithium, is now becoming a real contender in the battery market on a 100% metal content basis.

The impact of LFP batteries on metal demand

The surge of LFP batteries, particularly embraced by CATL, the world’s largest EV battery maker, has caused a significant disruption in the demand for metal. It is anticipated that on an annual basis, the demand for nickel would suffer a loss of more than 107,000 tonnes, while cobalt could potentially see more than 38,000 tonnes of unwanted metal due to the rise of LFP. This translates to roughly 20% of global cobalt production in the previous year. Producers of manganese for the battery supply chain would have enjoyed 58,000 tonnes greater annual demand.

It’s crucial to consider that the actual amount of these metals ending up in EVs is only a fraction of what would have been procured upstream. This is due to the low yields in the conversion and manufacturing process.

The bright side for battery metals

Despite the disruptive impact of LFP batteries, there are trends providing a silver lining for nickel and cobalt. The combined battery capacity of EVs sold has surged by 45% this year, well ahead of new registrations, which are up 33% globally. Furthermore, the battery bulge is also keeping cobalt weightings from falling more quickly amid ongoing thrifting. Additionally, the shift to high-nickel batteries still has ground to cover, indicating potential future growth in demand for nickel.

Rethinking nickel’s role in the market

While it might be convenient to attribute today’s situation to LFP batteries, the reality is more complex. The investment in new supply and industrial processes for nickel was based on earlier predictions for significant demand growth from electric cars. Global nickel exploration budgets are up by 19% this year, nearing three-quarters of a billion dollars. Despite lofty expectations, the nickel industry is still relatively small compared to copper. However, the demand from the EV sector has accelerated a pivot in the nickel-pig-iron industry towards battery-friendly products. Nonetheless, weak fundamentals persist, exacerbated by a rapid ramp-up in Indonesia’s nickel mining, which might contribute to further market instability.

Rethinking the Pace: Electric Vehicle Metals in Flux

One of mining’s most precious sweet spots, nickel production in Indonesia, has burgeoned to control half of global output. However, the surge of Chinese investment in the archipelago signals a business landscape that continues to shift and evolve, calling into question the status of other key electric vehicle (EV) metals.

Cobalt Conundrum

In the heyday of the electric vehicle revolution, cobalt appeared poised to reap the greatest rewards. Highly concentrated and with few major players, the market glimmered with sparkling tonnage prices. Glencore first heralded this new era to mining stakeholders in 2017, predicting that even as electric vehicles represented just 2% of new car sales in 2020, demand for related metals would already be significant. However, cobalt’s prospects dimmed after a 2018 spike to over $100,000 per tonne raised concerns among automakers and ESG-focused investors began scrutinizing activities in the Congo, which supplied over two-thirds of the world’s cobalt.

Companies such as BMW’s offtakers pounced on the world’s sole primary cobalt mine back in 2019. Despite the market’s lackluster state, Canada’s Fortune Minerals may soon present an opportunity for enterprising automakers. Ironically, rumors are now swirling that the Swiss miner is contemplating suspending production at Mutanda to shore up cobalt prices. This strategy previously succeeded in 2019, albeit with Mutanda possessing 20% of the market at that time. Now, fresh supply from the Congo and Indonesia could mitigate the potential impact of such a move. With a new railway in the works, logistical hurdles—the traditional underpinning of cobalt prices—seem likely to wane, amplifying the market’s lackluster state.

Manganese Misgivings

Amid the battery metals realm, manganese often remains overshadowed. Even the excitement generated by Volkswagen’s PowerCo battery subsidiary in early 2021 has since dissipated. Although Volkswagen originally contemplated high-manganese batteries for its mid-range vehicles, its recent announcement indefinitely postponing a fourth European battery factory prompted Czech taxpayers to breathe a sigh of relief. Despite Tesla’s prior expression of interest in manganese as an alternative to LFP, the matter has since garnered little attention. Subsequent to the abrupt sputtering of high-manganese chemistries, manganese sulfate in China has not experienced the same fate as lithium, cobalt, and nickel. A decline of 29% over the past year has seen manganese sulfate change hands for under $700 per tonne in China.

US, EU 2. Affordable Chinese EVs 0

Developments ushering Chinese-made EVs into the limelight abroad could forestall the LFP battery’s encroachment on markets beyond China. Mounting geopolitical tensions and a burgeoning mercantilist trade approach in the world’s largest economies may delay the presence of Chinese-made EVs in the US. Conversely, in Europe, the prevalence of Chinese-made EVs continues to grow, posing a noteworthy challenge to domestic automakers. Additionally, new regulations have been set forth in 2024, disqualifying EVs containing any battery components manufactured or assembled by China from the US federal tax credit. The US also aims to heighten duties on Chinese automobiles, effectively restricting Chinese involvement in its automotive industry. Amid these developments, US automakers seek to leverage various partnerships to enhance their EV offerings, a strategy embodied by Ford’s partnership with CATL and Tesla’s venture in Texas with a Chinese behemoth.

FEOC Fears and FOMO

New EV provisions have cast automakers against mining firms, as the former contend that preventing Chinese involvement in the US mine-to-megawatt supply chain would be nearly impossible and could impede EV adoption by Americans. Complementing these rules, the Inflation Reduction Act requires a minimum percentage of domestic or US free trade partner-sourced material inputs for any EV subsidy. This threshold is set to rise to 80% in 2027, signifying an evolving and more stringent framework for the EV sector.

The Unwelcome Surge of LFP Batteries in the Electric Vehicle Market

An instance of justified frustration looms large over the global mining industry as the electric vehicle (EV) market undergoes a paradigm shift. Western miners are experiencing an unwelcome surge in demand for LFP (lithium-iron-phosphate) batteries, primarily due to stringent regulations aimed at curbing the influence of the Chinese government on the supply chain.

The missed opportunity

Contrasting the current reality of the EV market with what could have been raises poignant reflections. The predominance of nickel-rich EV batteries persists, yet the soaring potential for LFP batteries remains largely unexplored. Although the future seemed bright with the promise of selling 20 million workhorse EVs per year, the reality paints a different picture altogether, with unwanted tonnes of Ni-Co-Mn piling higher and higher.

While China’s lead in LFP technology remains a topic open for discussion, the soaring deployment of LFP batteries in electric cars last year, surpassing the combined efforts of the next 50 countries, is a testament to their pivotal role in the market.

Sodium’s surprise emergence

The surge of interest in LFP batteries unveils a crucial facet of the mining industry’s adaptability and inherent vulnerability to technological shifts. This inadvertent dent in nickel and cobalt prospects underscores the precarious nature of metal pricing, intrinsically tied to the latest technological developments. The emergence of sodium-ion batteries, heralded by former Tesla executives, looms on the horizon as a potential disruptor, signifying a possible shift akin to the impact of LFP batteries on nickel and cobalt.

An abrupt shift in the energy paradigm

Unlike the mining industry, the oil and gas sector is shielded from inherent demand destruction due to technological progress. The malleability of oil and gas demand over a short period is a far cry from the swift transformation witnessed in mining due to the advent of cobalt and nickel-free cells. However, the growing influence of LFP batteries presents an uncomfortable yet inevitable reality.

The global mining landscape is grappling with the implications of these shifts, compelled to adapt to the burgeoning demand for LFP batteries despite the grievous blow dealt by their impact on nickel and cobalt. The steady rise of LFP batteries, alongside the looming prospect of sodium-ion batteries, serves as an unwelcome reminder of the industry’s vulnerability to the capricious tides of technological change.

As the mining industry navigates these uncharted waters, the unwelcome surge of LFP batteries in the EV market stands as a compelling testament to the industry’s resilience amid disruptive forces that threaten to upend well-established paradigms.