I understand the allure of capital gains, but let’s be real here, it’s the income that keeps the lights on. This is why it’s crucial to cultivate a continuously growing income stream that has the potential to make a real difference in one’s financial health.

This is where Business Development Companies (BDCs) shine. Unlike the S&P 500 (SPY), their returns are more diversified across a wide range of portfolio companies and aren’t overly dependent on just a few companies such as Apple (AAPL) and Tesla (TSLA), each of which carries its own risks and wields a disproportionate influence over them.

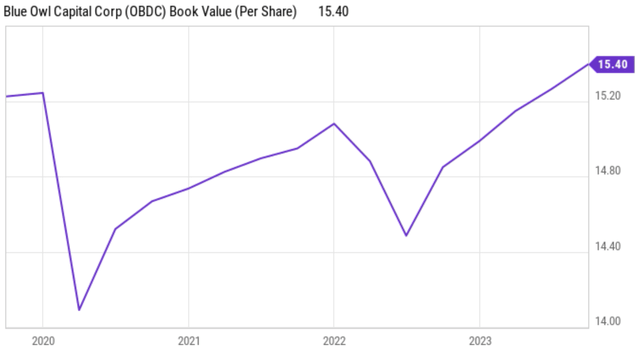

Which brings us to the significant BDC, Blue Owl Capital (NYSE:OBDC). I last delved into this BDC in July last year, highlighting its steady growth in Net Asset Value (NAV) per share and ample liquidity. Impressively, OBDC has surpassed the market average, registering a 12.5% price rise and a 17.9% total return since my previous analysis, outperforming the 5.6% increase in SPY over the same period.

In this piece, I’ll provide an update and expound on why OBDC remains an attractive choice for substantial income and potentially robust total returns, so let’s dive in!

What Makes OBDC Stand Out?

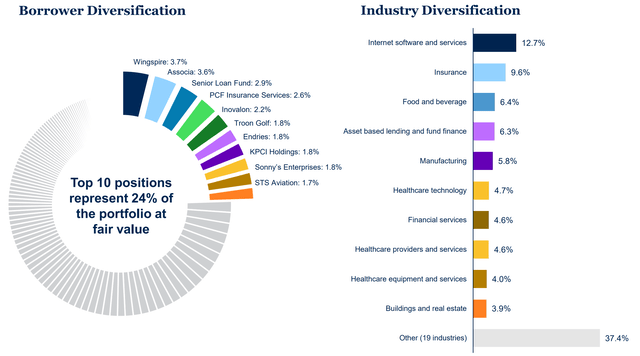

Blue Owl Capital Corp, previously known as Owl Rock Capital, is an externally-managed BDC and the second largest by portfolio size, second only to industry leader Ares Capital (ARCC). Currently, OBDC has investments in 187 companies with a portfolio fair value of $12.9 billion.

OBDC pursues a strategy that balances yield with portfolio safety. The majority (83%) of its investments are in senior secured debt (69% first lien, 14% second lien), with the rest mostly comprised of common equity (9%) for potential future upside to OBDC’s NAV/share if the underlying companies appreciate.

Furthermore, OBDC boasts a well-diversified portfolio, with no single investment representing more than 3.7% of the portfolio value. It also maintains a healthy mix of growth and defensive segments. For instance, internet software, insurance, food and beverage, asset-based lending, manufacturing, and healthcare technology account for 46% of portfolio value.

Importantly, OBDC has a commendable track record of preserving and augmenting its NAV per share, a solid indicator of long-term value. OBDC’s NAV/share has rebounded since declining in 2020 and 2022, now exceeding the value at IPO in 2019 and improving every quarter since mid-2022, testament to its resilience. The latest upswing in OBDC’s NAV/share was fueled by $0.05 per share in realized and unrealized gains in its portfolio, coupled with OBDC out-earning its dividend with net investment income.

Meanwhile, OBDC has reaped the benefits of an elevated interest rate environment. Demonstrated by OBDC’s net investment income Return on Equity (ROE) of 12.7% during the third quarter, a 250 basis points increase from 10.2% in the prior year period. This has empowered OBDC to comfortably hike its regular dividend by 13% since the start of 2022, while disbursing special dividends ranging from $0.04 to $0.08 per share every quarter of 2023. The current regular dividend rate is well-covered by a 71% payout ratio (88% payout ratio when including the special dividend), based on Net Investment Income (NII)/share of $0.49 in the last reported quarter.

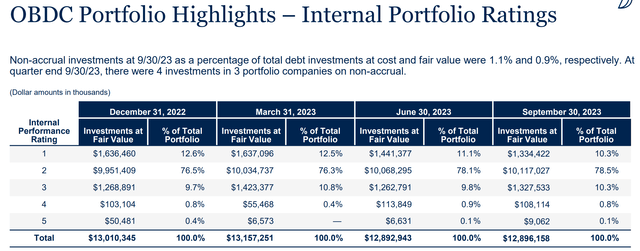

Moreover, OBDC’s portfolio is in solid shape, with non-accrual investments representing just 0.9% of portfolio fair value (1.1% of portfolio cost). Since its inception, OBDC has deployed $25 billion worth of capital and experienced a minuscule net loss ratio of just 15 basis points. The internal performance rating has remained steadfast since the end of 2022, and investments in the lowest quality (Tier 5) have dwindled by 30 basis points to a mere 0.1% of the portfolio.

Looking ahead, OBDC’s portfolio companies are poised to continue thriving on the back of a robust economy, having grown Revenue and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) by 10% and 12% Year-over-Year (YoY), respectively, in the last reported months. The promising outlook is bolstered by the recently released December Jobs Report, revealing a surge of 216,000 U.S. payrolls, surpassing the expected 170,000, resulting in a lower than expected unemployment rate of 3.7%, below the anticipated 3.8%.

This also suggests that interest rates could remain elevated for a while, a boon for OBDC given that 98% of its investments are floating rate. Additionally, OBDC is well-positioned to seize opportune investments, boasting a reasonably safe debt-to-equity ratio of 1.13x, comfortably below the 2.0x statutory limit for BDCs.

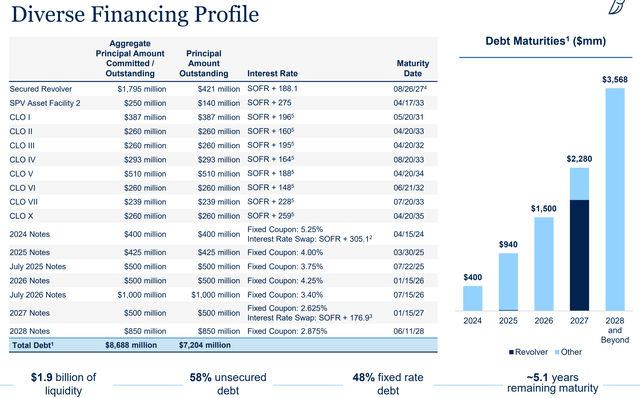

Furthermore, OBDC possesses ample retained capital to fuel growth post-dividend disbursement, while also holding $1.9 billion in liquidity as of the last reported quarter. With limited debt maturities in 2024, OBDC can leverage interest rate arbitrage between what it charges borrowers and what it pays its lenders. Notably, just 52% of OBDC’s debt is floating rate, compared to 98% of its debt investments, marking relatively restrained near-term debt maturities this year.

Risks to OBDC include higher interest rates, which, while boosting its Net Investment Income (NII), also elevate interest expenses for OBDC’s borrowers. This is evident in the weighted average interest coverage ratio of OBDC’s borrowers declining from 2.5x to 1.8x over the past 12 reported months. Management anticipates further decline in interest rate coverage of its borrowers to 1.5x by mid-year, before trending upwards – a development worthy of close observation.

Other risks entail general macroeconomic vulnerabilities, to which non-public companies, the type OBDC invests in, are more exposed due to their smaller size (compared to public companies) and limited avenues to raise capital.

Taking all this into account, I maintain the view that OBDC remains attractively priced at the current $14.96, trading at a discount to NAV with a price-to-book ratio of 0.97x, notwithstanding its consistent NAV/share growth fueled by portfolio appreciation and retained capital post-dividend disbursement. Notably, OBDC is also trading at a discount to Ares Capital, which holds a price-to-book ratio of 1.07x.

Investor Takeaway

In summary, OBDC offers investors a compelling combination of steady NAV growth and dividend income, underpinned by a well-diversified portfolio with low credit losses. Furthermore, its predominantly floating rate investment portfolio is capitalizing on the current higher interest rate environment, with significant retained capital for future investments. Looking ahead, interest rates may not recede as swiftly as some on Wall Street anticipate, particularly post a robust December jobs report – a favorable backdrop for OBDC.

Finally, I reiterate my belief in OBDC being attractively priced, trading at a discount to NAV and yielding an appealing 9.4%, potentially exceeding 10% when including special dividends. With the broader market at lofty valuations, a prudent New Year’s Resolution might be to acquire more quality income stocks like OBDC. As such, I maintain my ‘Buy’ rating on OBDC stock.