Blue Owl Capital Dividend News

Blue Owl Capital announced a regular quarterly dividend of $0.08 per share on February 21, 2024, sticking to the status quo with its earlier payout history. Shareholders tagged as ‘record’ by March 1, 2024, are set to receive their dues on March 15, 2024. At $15.04 per share, the stock offers a 2.13% dividend yield. A glimpse into the past reveals an average five-year dividend yield of 9.66%, hitting a high of 10.99% and a low of 9.18%. Interestingly, the present yield stands remarkably 16.66 standard deviations below the historical benchmark.

The Fund Sentiment Landscape

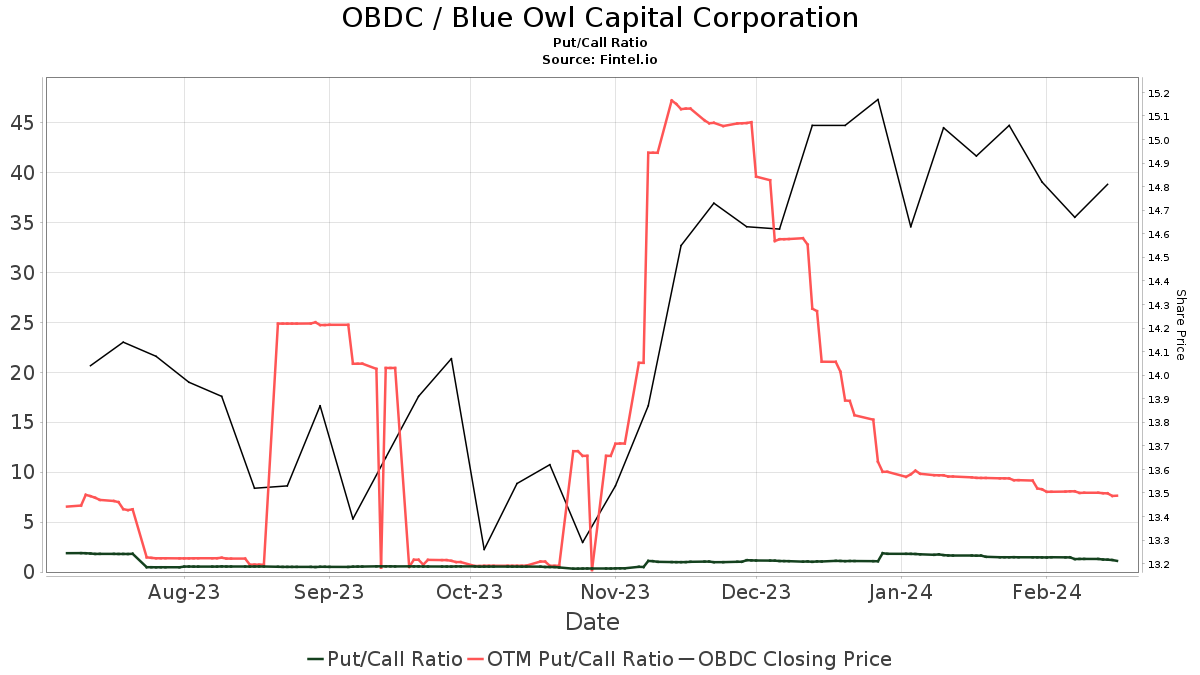

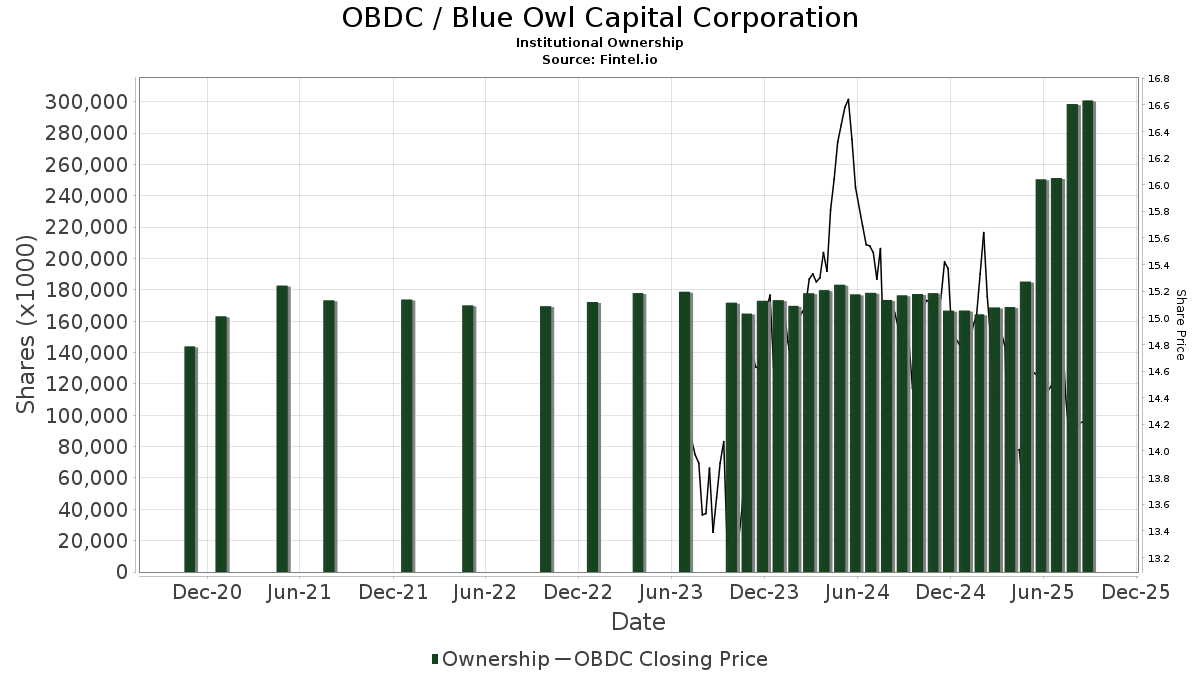

Counting 375 funds or institutions holding positions in Blue Owl Capital reflects an uptick of 28 owners, marking an 8.07% increase in the last quarter. However, while the number of stakeholders rose, the average portfolio weight of all institutions dedicated to OBDC witnessed a 27.27% decline down to 0.75%. Institutions now own a cumulative of 177,799K shares, a 2.75% increase in the past three months. The put/call ratio of OBDC at 1.42 predicts a bearish outlook.

Price Forecast and Shareholder Movements

Analyst price projections hint at a potential 7.10% upside for Blue Owl Capital, with an average one-year price target of 16.11 as of February 24, 2024. Forecasts oscillate between a low of 14.64 and a high of $17.32, painting a mixed picture. Concurrently, the projected annual revenue of 1,482MM signals a modest 6.33% decrease.

Among significant shareholders, State of New Jersey Common Pension Fund E maintains a strong grip with 22,751K shares, a constant from the last quarter. However, Regents Of The University Of California witnessed a 24.25% drop in its OBDC portfolio and portfolio allocation dipping by 16.09%. On the other hand, Bank Of America increased its OA holdings by 6.43% but managed to decrease its portfolio allocation in OBDC by a staggering 72.63%.

Diving into Blue Owl Capital’s Roots

Originally founded in 1989, Blue Owl Capital remains dedicated to facilitating financial interactions online. With a rich legacy of innovation and growth, the company banks on its proprietary payment gateway to link customers and financial institutions. Operating across various US locations, the company prides itself as the largest online-focused financial technology provider in the market.

Before you leave, remember this isn’t the official gospel on Blue Owl Capital; it’s just the word on the street based on recent developments. For a broader perspective, consider consulting verified sources to make informed investment decisions. Happy investing!

The expressed views and sentiments are solely of the author, not representing Nasdaq, Inc.