Boosting Cash Runway

bluebird bio, Inc. (BLUE) has announced a significant financial move by securing a $175 million five-year loan facility from Hercules Capital, Inc. (HTGC). This facility is expected to extend bluebird’s cash runway by two years, offering the company much-needed financial stability in the near future.

Financial Terms

As per the agreement, bluebird will receive the term loans in four tranches, with the initial tranche of $75 million already drawn. The company will be eligible to draw two additional tranches of $25 million each, contingent upon the accomplishment of specific commercial milestones. If all three tranches totaling $125 million are secured, bluebird’s cash runway is anticipated to extend through the first quarter of 2026.

Expanding Operations

This financial injection comes at a pivotal moment for bluebird as they focus on commercializing their three gene therapies – Lyfgenia, Zynteglo, and Skysona. The loan facility will provide the necessary resources for the company to further develop and market these innovative treatments.

Industry Challenges

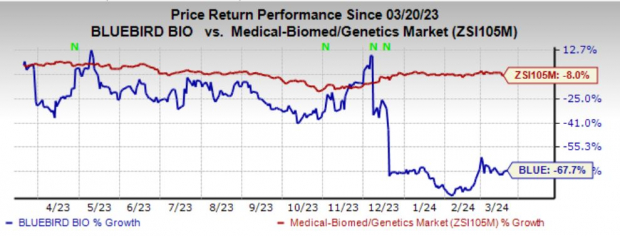

Despite the positive news, bluebird has faced challenges, with their shares plummeting by 67.7% over the past year. Notably, the company’s stock took a hit after it issued additional equity, leading to a decline in market confidence.

Competitive Landscape

Furthermore, the recent FDA approvals of competing gene therapies for similar indications have added to bluebird’s competitive pressures. The approval of alternative treatments, coupled with pricing differentials, poses challenges for bluebird in securing market share and maintaining a competitive edge.

Strategic Considerations

Given the shifting dynamics in the gene therapy market and the pricing variations between different treatments, bluebird will need to strategize effectively to navigate these challenges and continue to innovate in the field.

Investor Outlook

As investors monitor bluebird’s financial stability, market performance, and competitive positioning, the company’s ability to leverage the new loan facility towards sustainable growth will be under scrutiny in the months ahead.

For more information and analysis on bluebird bio, Inc, Hercules Capital, Inc., and the broader market landscape, refer to the attached reports and resources from Zacks Investment Research.