Blueprint Medicines Corporation (NASDAQ:BPMC) blew past expectations with a fourth-quarter 2023 loss of $1.82 per share – outstripping the Zacks Consensus Estimate of a loss of $2.04 and a year-ago loss of $2.65.

At $72.0 million, quarterly revenues also outperformed, surging 85.5% year over year and surpassing the Zacks Consensus Estimate of $67.3 million.

Ayvakit Ascends

Blueprint’s total revenues comprise net product revenues from Ayvakit/Ayvakyt and collaboration revenues.

Ayvakit (avapritinib), an inhibitor of KIT and PDGFRA proteins, is approved for treating PDGFRA Exon 18 mutant gastrointestinal stromal tumors (GIST) and advanced and indolent systemic mastocytosis (ISM).

In Q4, net product revenues from Ayvakit reached $71.0 million, exceeding the Zacks Consensus Estimate of $65.0 million. The drug’s sales surged 83.0% year over year, driven by new patient starts, reduced free goods share, low discontinuation rates, and high compliance rates. U.S. sales accounted for $63.6 million of the revenue total.

For the full-year 2023, Ayvakit sales hit $204.2 million, an 84% leap, due largely to its US launch for the ISM indication leading to substantial revenue growth. With the drug’s approval for ISM in the EU in December 2023, growth potential for 2024 looks even more promising.

Ayvakit, the first and only ISM therapy approved, is poised to become a game-changing multibillion-dollar product, offering a sustained revenue stream for Blueprint for years to come.

Collaboration revenues tallied $0.9 million, missing the Zacks Consensus Estimate of $3.0 million. Blueprint accrues these revenues from engagements with CStone Pharmaceutical and Roche.

The company’s partnership with CStone Pharmaceuticals aims to develop and commercialize its three clinical-stage candidates, avapritinib, pralsetinib, and fisogatinib, in Mainland China, Hong Kong, Macau, and Taiwan, either as monotherapies or combination treatments.

Gavreto (pralsetinib), another of Blueprint’s drugs, received approval for metastatic rearranged during transfection (RET) fusion-positive non-small cell lung cancer (NSCLC) and RET-mutant/fusion-positive thyroid cancer. Blueprint shares profits and losses from Gavreto with Roche. However, in February 2023, Roche opted to dissolve the collaboration agreement, paving the way for Blueprint to regain global commercial rights to Gavreto by late February 2024.

In conjunction with the Q4 announcement, Blueprint revealed that a new partner for Gavreto had been identified, with details to follow in the coming week, coinciding with the Roche termination. Research and development (R&D) expenses trimmed down to $97.5 million, a 17.2% dip from the prior year, attributed to ongoing operational efficiency enhancements across Blueprint’s portfolio and favorable clinical trial material manufacturing timing.

Selling, general and administrative expenses surged 23.9% year over year to $79.3 million, driven by augmented compensation and headcount costs linked to Ayvakit’s commercialization.

As of Dec 31, 2023, Blueprint’s cash, cash equivalents and investments totaled $767.2 million, down from $827.2 million as of Sep 30, 2023.

Outlook for 2024

Blueprint foresees Ayvakit generating $360 million to $390 million in product sales in 2024, marking an astounding 80% growth at the midpoint, chiefly fueled by the ISM indication. The company envisions Ayvakit as capable of achieving peak sales of $2 billion. Collaboration revenue from existing partnerships isn’t expected to have a material impact in 2024.

Operating costs and cash burn are also anticipated to further decrease throughout 2024.

Responding to the robust Q4 results, Ayvakit’s stellar performance, and optimistic forecasts for the year, BPMC shares catapulted 14.0% during Thursday’s trading.

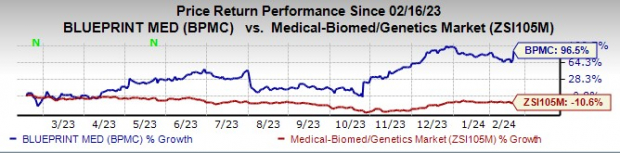

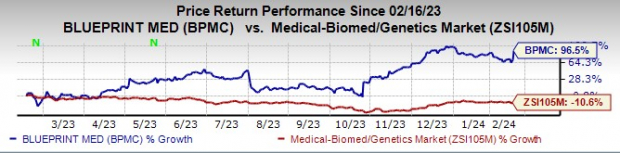

BPMC has delivered a dazzling 96.5% surge over the past year, outshining the industry’s 10.6% decline.

Image Source: Zacks Investment Research

Zacks Rank and Top Picks

Currently, Blueprint bears a Zacks Rank #3 (Hold).

Blueprint Medicines Corporation Price and Consensus

Blueprint Medicines Corporation price-consensus-chart | Blueprint Medicines Corporation Quote

Luminaries in the healthcare sector such as Puma Biotechnology (PBYI) and ADMA Biologics (ADMA) represent better picks. Puma Biotechnology boasts a Zacks Rank #1 (Strong Buy), while ADMA Biologics holds a Zacks Rank of 2 (Buy). More details on today’s Zacks #1 Rank stocks can be found here.

In the last 60 days, estimates for Puma Biotechnology’s 2024 per-share earnings have soared from 64 cents to 69 cents. PBYI shares have seen a 67.4% upsurge over the past year.

Puma Biotechnology outperformed estimates in three of the last four quarters, with an average earnings surprise of 76.55%.

During the last 60 days, 2024 earnings estimations for ADMA Biologics have shot up from 16 cents to 22 cents. ADMA shares have soared 55.6% over the past year.

ADMA Biologics exceeded estimates in three of the last four quarters, posting an average four-quarter earnings surprise of 63.57%.

7 Best Stocks for the Next 30 Days

Experts have curated a list of 7 distinguished stocks from a pool of 220 Zacks Rank #1 Strong Buys.

Zacks’ Handpicked 7 Best Stocks for Early Price Pops

Are you looking for the next big stock market movers? According to Zacks Investment Research, a list of seven handpicked stocks is most likely to experience early price pops. Since 1988, this list has outperformed the market, boasting an average annual gain of +24.0% – more than double the market’s performance. If you’re seeking lucrative opportunities, these seven stocks are worth your immediate attention.

Top Stock Picks:

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Blueprint Medicines Corporation (BPMC) : Free Stock Analysis Report

To read this article on Zacks.com click here

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.