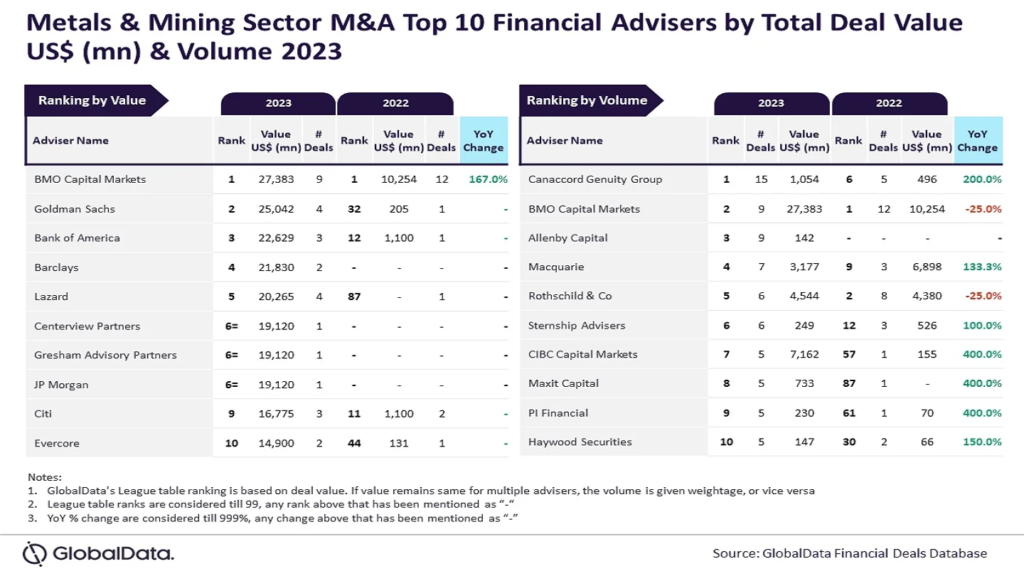

Atop the mountain of mining mergers and acquisitions, a report has hailed BMO Capital Markets and Canaccord Genuity Group as the paragons of advisory prowess in this lucrative corner of the financial world.

Aurojyoti Bose, lead analyst at GlobalData, effusively noted that “Canaccord Genuity Group registered significant growth in the volume of deals advised and ranking by this metric in 2023 compared with the previous year.”

Like the champions of mining M&A alchemy, Canaccord Genuity Group was the only adviser to hit the double-digit deal volume in 2023, a feather in its ever-glistening cap.

Not to be outshone, BMO Capital Markets secured joint second place by deal volume with nine transactions, demonstrating its tenacity in navigating the complex web of mining mergers and acquisitions. Allenby Capital, an underdog vying for victory, matched this volume with nine deals of its own. Macquarie followed closely with seven deals and Rothschild & Co with six.

Reveling in its glory, Bose added, “BMO Capital Markets was the top adviser by value in 2022 and managed to retain its leadership position in 2023 as well. The total value of deals advised by it jumped by more than double-fold in 2023 compared with 2022.” An impressive feat in a field characterized by volatility and unpredictability.

Meanwhile, Goldman Sachs took second spot in this metric, advising on deals amounting to $25 billion, with Bank of America hot on its heels with advisory deals totaling $22.6 billion. Barclays and Lazard also featured prominently, advising on deals worth $21.8 billion and $20.3 billion respectively, demonstrating their formidable presence on the stage of mining M&A advisory.