BMO Capital Boosts AutoZone with a Strong Rating

On December 13, 2024, BMO Capital began coverage of AutoZone (WBAG:AZO) and assigned it an Outperform rating.

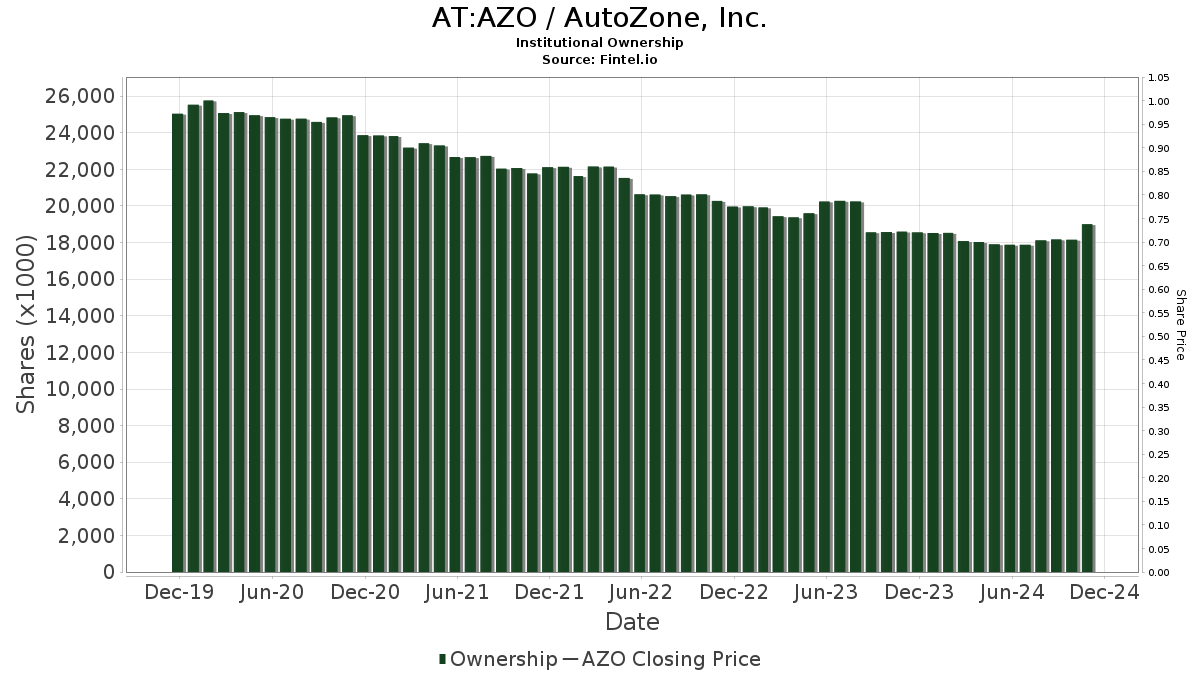

Growing Fund Interest in AutoZone

AutoZone is attracting attention from investors, with 2,020 funds or institutions reporting stakes in the company. This marks an increase of 8 owners or 0.40% compared to the previous quarter. On average, funds have allocated 0.40% of their portfolios to AZO, reflecting a rise of 3.83%. Institutional ownership saw a 4.82% boost, totaling 18,961K shares over the past three months.

Key Shareholder Movements

JPMorgan Chase currently owns 1,360K shares, representing 8.09% of AutoZone. A previous filing indicated they owned 1,331K shares, showcasing a 2.13% increase, although their overall allocation in AZO dropped by 93.21% last quarter.

International Assets Investment Management has 993K shares, giving them 5.91% ownership. Notably, they reported having no shares previously, indicating a significant 99.97% increase, while also reducing their portfolio allocation by 28.83% this quarter.

The Vanguard Total Stock Market Index Fund Investor Shares holds 542K shares, representing 3.22% ownership. This reflects a minor 0.74% decrease from 546K shares owned before. Their allocation in AZO also fell by 0.92% over the past quarter.

Meanwhile, Vanguard 500 Index Fund Investor Shares owns 447K shares, accounting for 2.66% ownership, up from 444K shares, marking a 0.78% increase, despite a 1.43% decrease in their portfolio allocation in AZO.

Finally, Fiera Capital holds 423K shares, which is 2.52% of AutoZone. They previously owned 430K shares, reflecting a 1.74% decrease, while increasing their portfolio allocation by 30.09% this quarter.

Fintel is a comprehensive investment research platform designed for individual investors, traders, financial advisors, and small hedge funds.

Our platform provides global data, including fundamental metrics, analyst reports, ownership data, fund sentiment, insider trading insights, options flow, and more. With exclusive stock selections driven by advanced, backtested quantitative models, we aim to enhance investment profitability.

Click to Learn More

This information originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.