BMO Capital Adjusts Exelixis Outlook: Analysts See Potential for Growth

Recent Downgrade by Analysts

On December 20, 2024, BMO Capital downgraded its outlook for Exelixis (LSE:0IJO) from Outperform to Market Perform.

Analysts Predict Significant Upside

The average price target for Exelixis on December 3, 2024, stands at 33.43 GBX per share. Analysts estimate this target could range from 23.31 GBX to 41.08 GBX. If achieved, this average would suggest a considerable upside of 60.26% from its latest closing price of 20.86 GBX per share.

Projected Financial Performance

Exelixis aims for an annual revenue of 2,110MM, reflecting a modest increase of 1.36%. Analysts anticipate the annual non-GAAP EPS to be 0.98.

Investors’ Current Sentiment towards Exelixis

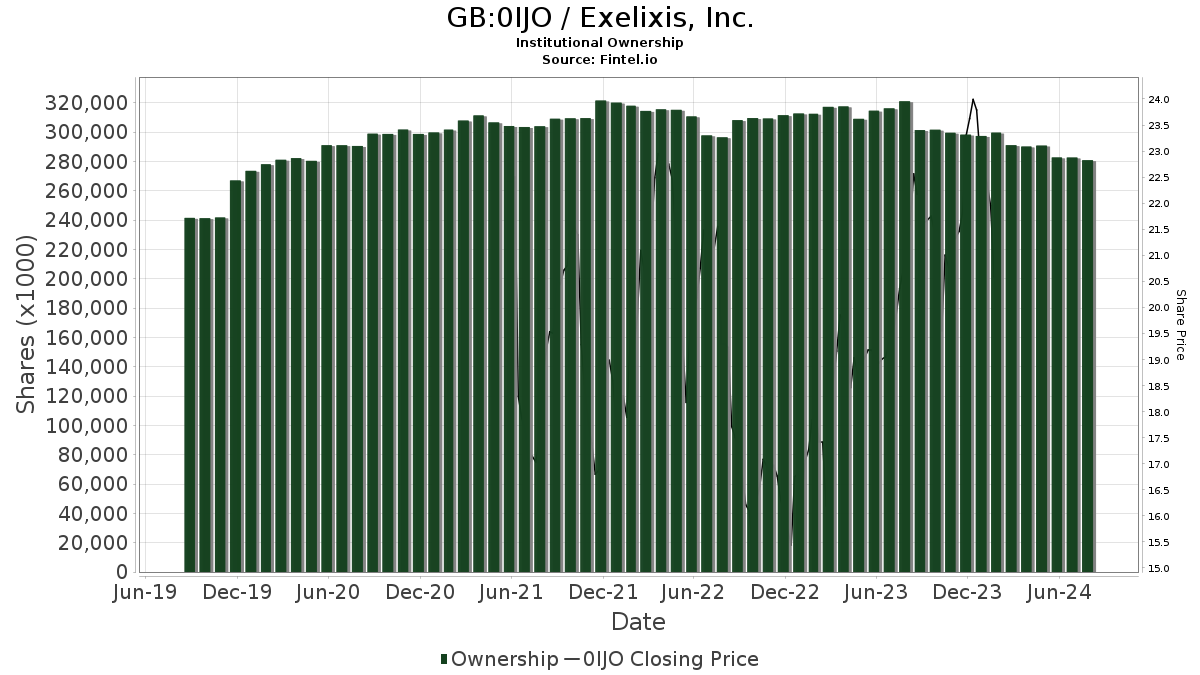

Currently, 1,006 funds or institutions hold positions in Exelixis, up by 47 owners, or 4.90%, in the last quarter. The average portfolio weight for all funds invested in 0IJO is 0.32%, which has risen by 2.00%. Over the past three months, total shares owned by institutions increased by 1.05% to 298,889K shares.

Actions of Key Investors

Farallon Capital Management owns 25,410K shares, representing 8.90% of Exelixis. In its previous report, it owned 27,102K shares, marking a decrease of 6.66%. However, the firm boosted its portfolio allocation in 0IJO by 12.28% over the last quarter.

Renaissance Technologies has increased its holdings, now holding 15,360K shares or 5.38% of the company. This reflects an increase from 15,163K shares, a rise of 1.28%. The firm also raised its portfolio allocation in 0IJO by 3.72% recently.

The iShares Core S&P Mid-Cap ETF holds 8,917K shares for a 3.12% stake, down from 9,061K shares, a decrease of 1.61%. The fund increased its investment allocation by 3.81% in the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares has a 3.02% stake, owning 8,635K shares—a slight decrease from the 8,845K shares previously owned, or a 2.44% decline. They increased their portfolio allocation in 0IJO by 5.89% in the latest quarter.

Lsv Asset Management has notably increased its holdings, now owning 8,102K shares, which represents 2.84% of Exelixis. This is a significant increase from the 5,764K shares previously reported, reflecting a 28.86% rise. This firm also raised its allocation in 0IJO by a remarkable 58.82% in the last quarter.

Fintel serves as a comprehensive research platform that caters to individual investors, traders, financial advisors, and small hedge funds. Our extensive data includes fundamental analysis, ownership statistics, analyst reports, and market sentiments, among other valuable insights.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.