BMO Capital maintained a Market Perform recommendation for DTE Energy (NYSE:DTE) on April 10, 2023. The average one-year price target for the company is $132.52, suggesting a potential upside of 16.57% from its recent closing price of $113.68. The company’s projected annual revenue is $15.4 billion, representing a decrease of 19.92%, while the expected non-GAAP EPS is $6.33.

DTE Energy declared a quarterly dividend of $0.95 per share, which shareholders of record as of March 20, 2023, will receive on April 15, 2023. This dividend yields 3.35% based on the current share price. The company has a payout ratio of 0.69 and reported a three-year dividend growth rate of -0.11%.

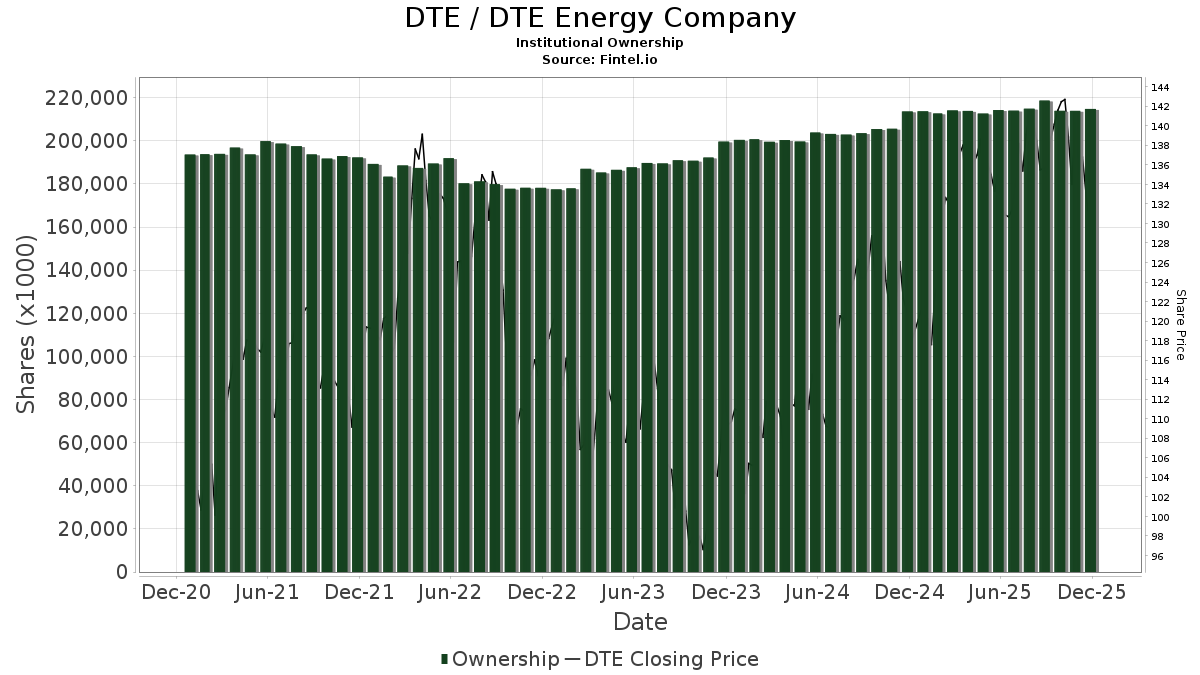

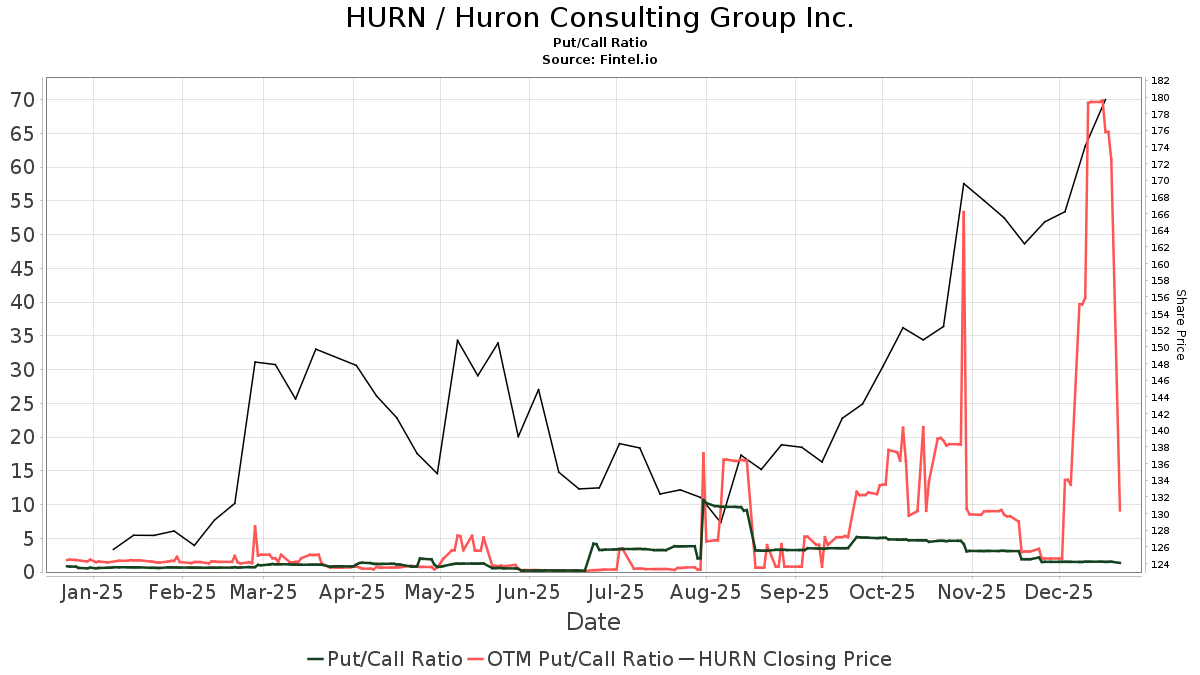

Institutional ownership in DTE Energy has increased by 5.45%, with 1,509 funds reporting positions in the company as of the last quarter. Total shares owned by institutions rose by 4.61% to 185.7 million shares. The put/call ratio stands at 2.27, indicating a bearish outlook.