Bristol Myers Squibb’s Opdivo Approved in Europe for Subcutaneous Use

Bristol Myers Squibb (BMY) received approval from the European Commission (EC) for the subcutaneous formulation of Opdivo (nivolumab) across multiple solid tumor indications. This applies to all 27 EU member states, as well as Iceland, Norway, and Liechtenstein.

Nivolumab, co-formulated with recombinant human hyaluronidase (rHuPH20), is indicated as monotherapy or in combination with chemotherapy or cabozantinib for previously approved adult solid tumors. It is also approved for maintenance following nivolumab plus Yervoy (ipilimumab) combination therapy.

This approval marks Opdivo as the first PD-1 inhibitor cleared for subcutaneous use in the EU. The SC formulation is already available in the U.S. as Opdivo Qvantig.

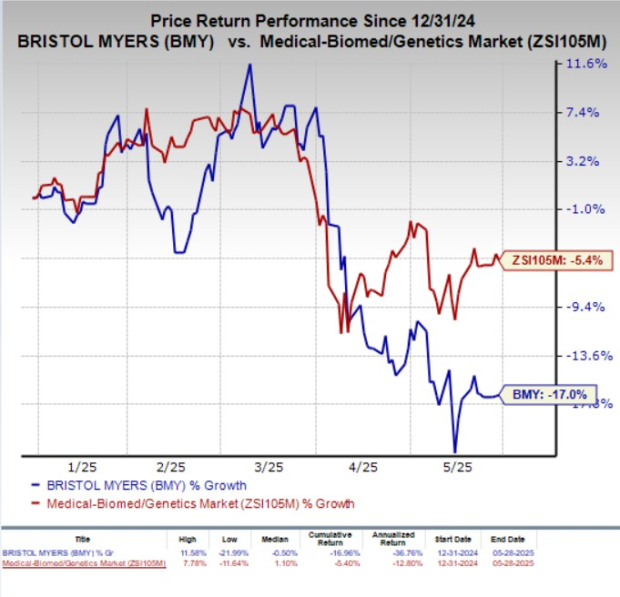

Year-to-date, Bristol Myers’ shares have declined by 17%, while the industry overall has decreased by 5.4%.

Details on the EU Approval

The EC’s approval was supported by data from Bristol Myers’ CheckMate -67T clinical study. This study involved adults with advanced or metastatic clear cell renal cell carcinoma (ccRCC) who had previously received up to two systemic therapies but no immuno-oncology treatments.

In this study, Opdivo SC met its primary pharmacokinetic noninferiority endpoints when compared to intravenous (IV) Opdivo. The geometric mean ratios for Cavgd28 and Cminss were 2.10 and 1.77, respectively. A secondary endpoint indicated an objective response rate of 24% in the SC group versus 18% in the IV group, demonstrating comparable efficacy. The safety profile of Opdivo SC was consistent with that of the IV formulation.

Opdivo is approved as both a monotherapy and in combination with Yervoy for various cancer types in many countries, including the U.S. and EU.

Bristol Myers Squibb Stock Overview

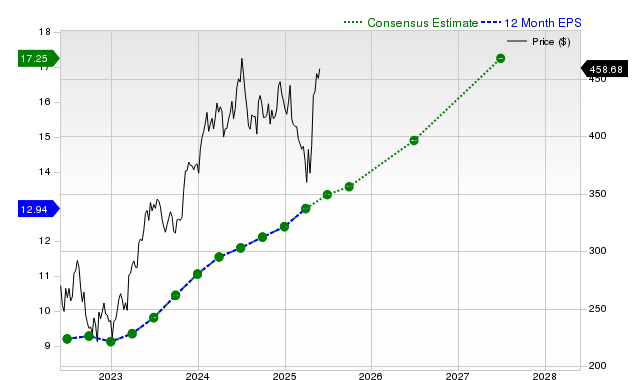

Bristol Myers currently has a Zacks Rank of #3 (Hold).

Well-ranked biotech stocks include Bayer (BAYRY), Lexicon Pharmaceuticals (LXRX), and Amarin (AMRN), each rated Zacks Rank #2 (Buy).

In the last 60 days, Bayer’s earnings per share estimates for 2025 rose from $1.19 to $1.25, with a year-to-date share increase of 43.2%.

Lexicon’s 2025 loss per share estimates improved from 37 cents to 32 cents, with LXRX shares declining by 5.3% year-to-date.

Amarin’s loss per share estimates for 2025 narrowed from $5.33 to $3.48. Year-to-date, AMRN shares increased by 16.4%.