Photo by Mathieu Lewis-Rolland

Boeing (NYSE:BA) faced a setback on Tuesday as it was downgraded by Wells Fargo, an esteemed financial-services firm. The aircraft manufacturer’s investment rating was decreased from Overweight to Equal Weight. This news ruffled the feathers of investors and lingered heavily in the morning trading sessions, causing a 2.5% decline in Boeing’s shares.

Quality Issues Amplified

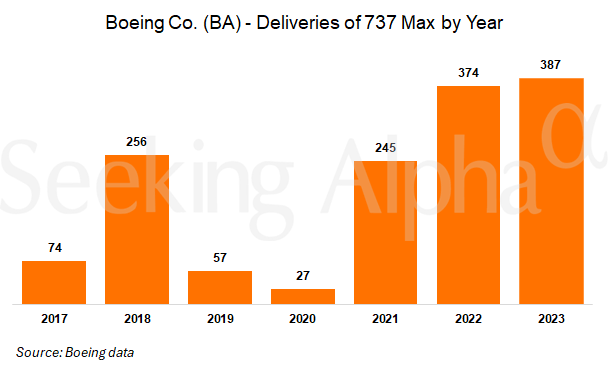

The downgrade was attributed to concerns about Boeing’s ability to meet its plane-delivery targets. The recent midair emergency involving a Boeing 737 Max 9 jet has prompted increased scrutiny from aviation authorities. Wells Fargo analyst, Matthew Akers, expressed that while Boeing has been grappling with quality issues for some time, the heightened inspection from an external party is a new dimension to the ongoing challenges.

FAA’s Audit and Price Target Reduction

An audit by the Federal Aviation Administration (FAA) has been limited to the 737 Max 9. However, there are apprehensions that the findings may lead to a broader scope, encompassing other Max models that share common parts.

Wells Fargo also took the step of reducing its price target for Boeing from $280 to $225 per share. This decision was made based on a projected multiple of 16 times free cash flow per share for 2025. The firm’s analysts adjusted their free cash flow estimates for 2024 downwards to $5.8 billion from $6.8 billion, citing concerns over plane deliveries.

Concerns About Resolution Pace

“We continue to forecast approximately $11 billion in 2026 free cash flow, as we see plenty of underlying demand to reach Boeing’s target production rates, and its fourth-quarter stock move indicates how fast sentiment can shift as production issues are resolved,” the report from Wells Fargo stated. “However, given FAA’s audit and its comment ‘safety, not speed’ determines when Max 9 flies again, we expect a slower resolution this time.”

Boeing’s woes deepened when a 737 Max 9, during an Alaska Airlines flight, experienced a cabin malfunction, further raising concerns about the company’s quality controls. The incident, in which a door plug blew out shortly after takeoff from Portland, Oregon, prompted an emergency landing. While there were no serious injuries, the incident dealt a blow to Boeing’s reputation and confidence in its best-selling commercial plane, the 737 MAX.

Target Production Rates in Peril

Boeing’s 737 MAX is a linchpin of its revenue, making the recent events a significant cause for concern. Investors are now eyeing the company’s ability to address production issues while ensuring its planes meet stringent safety standards.