Boeing’s Future Rides on New Aircraft Development Amidst Financial Challenges

The key to Boeing’s (NYSE: BA) long-term sustainability is its capability to design the next generation of narrowbody airplanes that will succeed the 737 MAX. CEO Kelly Ortberg acknowledged this during his first earnings call in October, stating the importance of “restoring the balance sheet so that we do have a path to the next commercial aircraft.” Here’s what you should consider before investing in Boeing stock for the long haul.

Understanding Long-Cycle Investments

Developing a new aircraft typically takes years and requires an investment of billions. Former CEO Dave Calhoun has indicated that Boeing will not unveil a new airplane until the middle of the next decade, estimating a $50 billion investment will be necessary.

Although 10 years may seem distant, investors should pay close attention to Boeing’s financial status now. Generally, long-cycle industries experience heavy investment periods until an airplane’s initial delivery, followed by rising cash flow as deliveries and profit margins increase. This cash can subsequently be reallocated to develop the next generation of aircraft.

Boeing’s Cash Flow Challenges

Unfortunately, cash flow generation from the 737 MAX, which saw its first delivery in 2017, was severely disrupted by its subsequent grounding over safety concerns and the impacts of the pandemic.

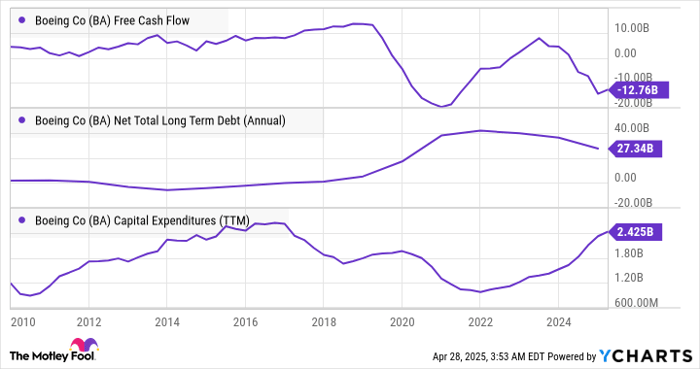

The dynamics at play are illustrated in the following observations:

- Initially, capital expenditures ramped ahead of the first delivery of the 737 MAX in 2017, hindering free cash flow (FCF) generation.

- From 2017 onward, capital expenditures declined, allowing Boeing to enhance FCF while maintaining a healthy debt situation.

- However, the 737 MAX grounding in 2019, followed by the pandemic and additional issues in 2024, combined with losses in Boeing Defense, Space & Security (BDS), resulted in significant cash outflows and increased debt.

BA Free Cash Flow data by YCharts.

This raises a crucial question: how will Boeing finance a potential $50 billion investment when, at the end of the first quarter, it had $53.6 billion in consolidated debt offset by $23.7 billion in cash and marketable securities, resulting in $29.9 billion in net debt?

Strategies for Achieving Financial Goals

One straightforward solution is for Boeing to enhance FCF by effectively managing its substantial $545 billion backlog. Key actions include increasing 737 MAX production, ensuring the timely first delivery of the new widebody 777X in 2026, and returning the BDS segment to profitability. While the success of these strategies is uncertain, they largely depend on Boeing’s operational execution.

Image source: Boeing.

Wall Street analysts are hopeful regarding these objectives. The consensus suggests that FCF will improve from a $3.8 billion outflow in 2025 to an $8.8 billion generation in 2027, with net debt decreasing to $18.8 billion. If Boeing can achieve annual FCF above $10 billion—similar to levels in 2017 and 2018—the company may eliminate its debt by 2029, creating adequate opportunities to support the investment in the new $50 billion aircraft by the middle of the next decade.

Evaluating Boeing Stock Value

Significant hurdles exist for Boeing to reach these milestones, such as tariff uncertainties, improving the delivery rate and quality of the 737 MAX, staying on schedule with the 777X launch, and returning BDS to a profitable state. Nevertheless, early signs of improvement under Ortberg’s leadership provide some encouragement. Boeing essentially represents a self-recovery narrative, bolstered by its substantial backlog.

Image source: Getty Images.

However, it is difficult to assert that Boeing stock is significantly undervalued. Even if FCF reaches $10 billion by 2030, the funding needs for the new narrowbody aircraft will constrain FCF generation until at least the mid-2030s.

This means analysts can’t simply project $10 billion as a stable base for future FCF. With a current market cap of $134 billion, Boeing would require $6.7 billion in FCF through the cycle to achieve a 20x FCF multiple. Given the upcoming challenges and necessary investments, while Boeing may appear undervalued, the scenario doesn’t present itself as a definite buy at this juncture.

Should You Invest $1,000 in Boeing Now?

Before making an investment in Boeing stock, consider the following:

The analysts have identified what they believe are the 10 best stocks for investors right now, and Boeing is not among them. These selected stocks are projected to offer exceptional returns in the future.

Reflect on past recommendations: Netflix, on December 17, 2004—an investment of $1,000 at that time would now be worth $611,271! Or Nvidia, on April 15, 2005—$1,000 invested would be $684,068!

The total average return for these recommendations has been 889%, vastly outperforming the S&P 500, which returned 162%. Don’t overlook the opportunity to examine the latest top 10 list, available to subscribers.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein do not necessarily reflect those of Nasdaq, Inc.