B of A Securities Upgrades Zscaler Outlook to Buy Amid Positive Fund Sentiments

On March 7, 2025, B of A Securities raised their outlook for Zscaler (LSE:0XVU) from Neutral to Buy.

Current Fund Sentiment for Zscaler

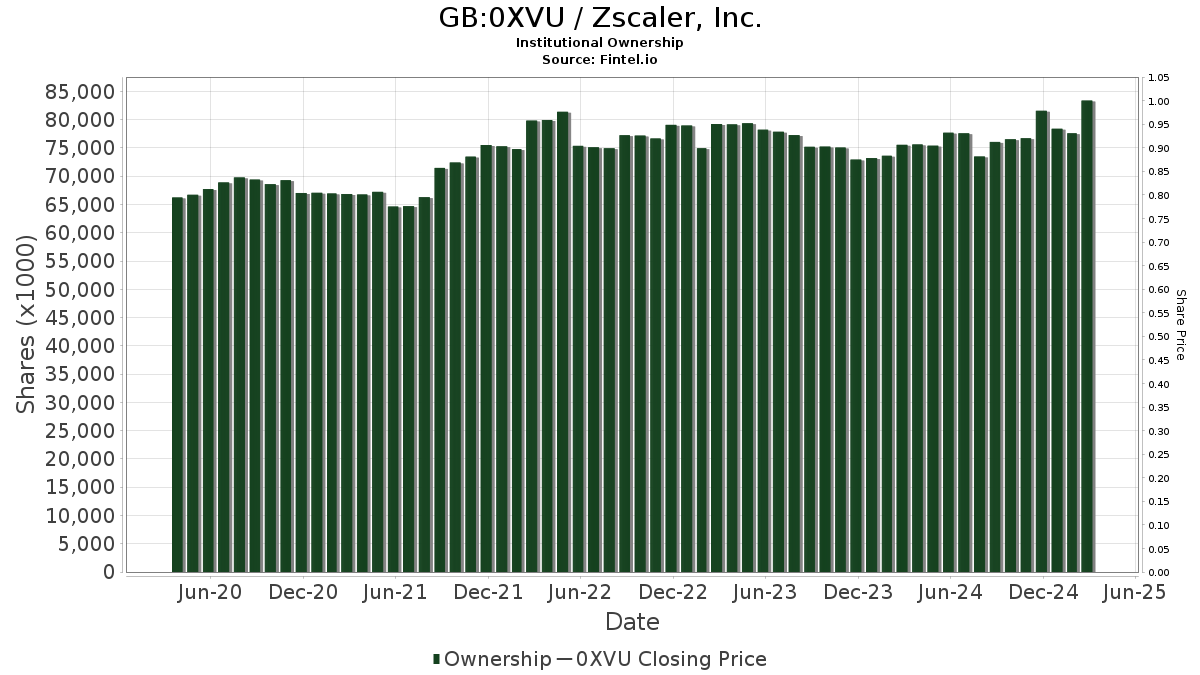

There are currently 1,260 funds and institutions reporting positions in Zscaler, indicating an increase of 79 owners or 6.69% over the last quarter. The average portfolio weight of all funds invested in 0XVU now stands at 0.14%, reflecting a rise of 13.67%. Over the past three months, total shares held by institutions surged by 7.40% to 83,369K shares.

Activity from Other Shareholders

Invesco QQQ Trust, Series 1 owns 3,112K shares, accounting for 2.03% of Zscaler. This marks an increase from their previous holding of 2,935K shares, a gain of 5.68%. The firm bolstered its portfolio allocation in 0XVU by 3.34% in the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 2,889K shares, or 1.88% of the company. This is a slight rise from 2,879K shares previously reported, reflecting a 0.33% increase in ownership. Their allocation in 0XVU increased by 4.35% over the last quarter.

American Century Companies owns 2,862K shares, making up 1.87% of Zscaler. This is a decrease from 2,934K shares reported earlier, representing a 2.53% decline. However, they still increased their position in 0XVU by 1.78% in the last quarter.

UBS Asset Management Americas has increased its stake to 2,601K shares, representing 1.70% ownership of Zscaler, up from 2,236K shares previously—an increase of 14.02%. Notably, the firm decreased its total exposure to 0XVU by 84.17% over the last quarter.

Goldman Sachs Group holds 2,480K shares, or 1.62% of the company. This is an increase of 3.35% from their prior holding of 2,397K shares. However, they reduced their portfolio allocation in 0XVU by 72.21% in the last quarter.

Fintel stands as one of the most comprehensive research platforms available to individual investors, traders, financial advisors, and small hedge funds.

The platform provides extensive data, including fundamentals, analyst reports, ownership details, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. In addition, our exclusive Stock picks benefit from advanced, backtested quantitative models to enhance profitability.

Click to Learn More

This report originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.