BofA Securities Ups iHeartMedia to Neutral, But Analysts Predict Steep Decline

On November 12, 2024, B of A Securities updated their stance on iHeartMedia (NasdaqGS:IHRT) from Underperform to Neutral.

Analysts Forecast Significant Drop Ahead

As of October 22, 2024, the consensus one-year price target for iHeartMedia stands at $1.70 per share. Predictions vary, with estimates ranging from a low of $1.01 to a high of $3.15. This average price target indicates a potential decrease of 28.87% from the latest closing price of $2.39 per share.

Check out our leaderboard showcasing companies with the highest price target upside.

iHeartMedia’s Revenue and Earnings Projections

Annual revenue for iHeartMedia is expected to reach $4,287 million, marking a 12.73% increase. Additionally, the projected annual non-GAAP earnings per share (EPS) is $1.32.

Fund Sentiment Toward iHeartMedia

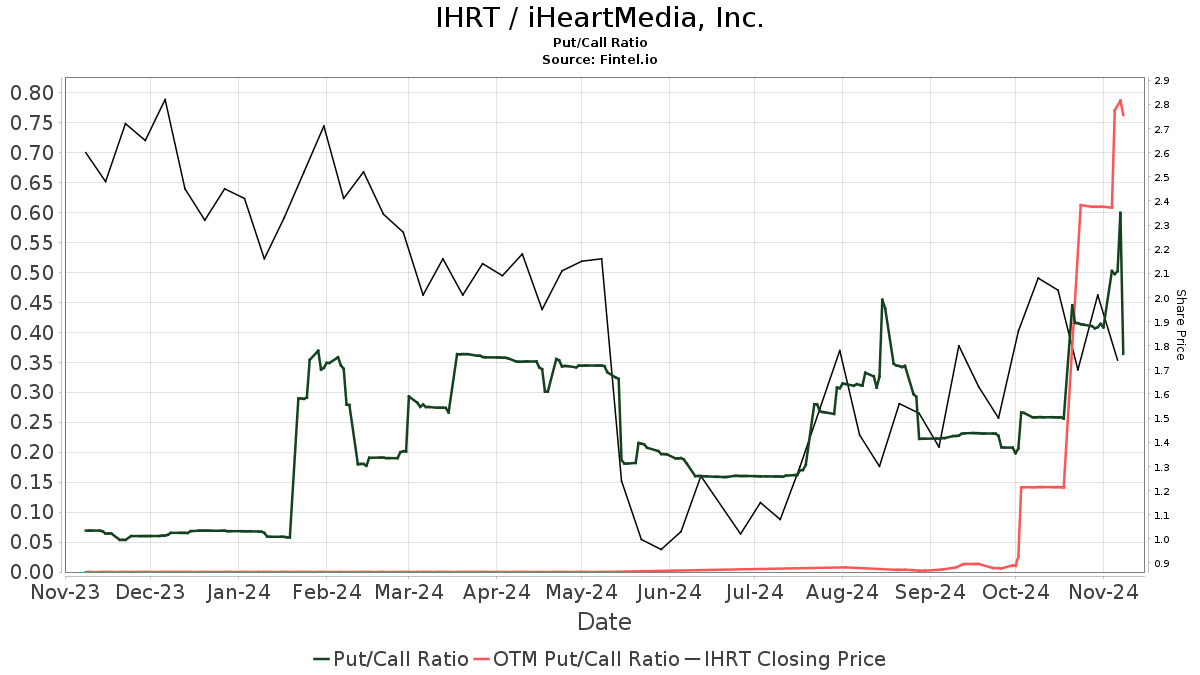

Currently, 300 funds or institutions report holdings in iHeartMedia, showing a loss of 21 positions or 6.54% from the previous quarter. The average portfolio weight allocated to IHRT by these funds is 0.05%, representing a notable increase of 40.66%. Over the last three months, total institutional shares owned increased by 0.80%, totaling 108,219K shares.  The put/call ratio for IHRT sits at 0.36, revealing a bullish sentiment in the market.

The put/call ratio for IHRT sits at 0.36, revealing a bullish sentiment in the market.

Recent Activities of Other Shareholders

Allianz Asset Management retains 22,497K shares, accounting for 17.88% ownership in the company. This reflects a slight decrease of 0.30% from their previous holding of 22,565K shares, and marks a 50.07% reduction in their IHRT portfolio allocation over the last quarter.

PIMCO Income Fund (PONAX) holds 9,028K shares, representing 7.18% of the company’s ownership, with no changes over the last quarter.

Douglas Lane & Associates has 6,913K shares, or 5.50% ownership, down from 7,592K shares, indicating a 9.83% decrease. However, they have increased their allocation to IHRT by 49.54% over the past quarter.

Oak Hill Advisors holds steady with 4,881K shares, maintaining 3.88% ownership. Meanwhile, Aqr Capital Management has raised its stake significantly, now owning 3,910K shares — a 56.98% increase from their prior 1,682K shares, with a 9.13% increase in portfolio allocation over the last quarter.

Background on iHeartMedia

(This description is provided by the company.)

iHeartMedia, Inc. is the leading audio company in the United States, known for its extensive consumer reach. The Company operates over 850 live broadcast stations in more than 160 markets across the nation. Its iHeartRadio service is accessible on over 250 platforms and 2,000 devices, including smart speakers, smartphones, TVs, and gaming consoles. iHeartMedia leverages its national presence to offer targeted advertising solutions for its partners, utilizing its SmartAudio suite for effective data targeting and analytics.

Fintel stands as one of the most thorough investing research platforms tailored for individual investors, traders, financial advisors, and smaller hedge funds, offering a range of data from fundamentals and analyst reports to ownership and options sentiment.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.