B of A Downgrades Green Plains Outlook; Analyst Price Target Suggests Major Upside

Fintel reports that on April 15, 2025, B of A Securities revised their rating for Green Plains (LSE:0J0P) from Buy to Neutral.

Analyst Price Forecast Indicates Significant Potential Growth

As of April 2, 2025, analysts project the average one-year price target for Green Plains at 10.91 GBX/share. Predictions vary, with estimates ranging from a low of 5.84 GBX to a high of 25.28 GBX. This average price target reflects a substantial potential increase of 192.66% from the company’s most recent closing price of 3.73 GBX/share.

See our leaderboard for companies showing the largest price target upside.

Revenue and Earnings Projections

The anticipated annual revenue for Green Plains is 3,249 million GBP, which indicates a robust increase of 32.14%. Furthermore, the forecast for annual non-GAAP EPS stands at 4.23.

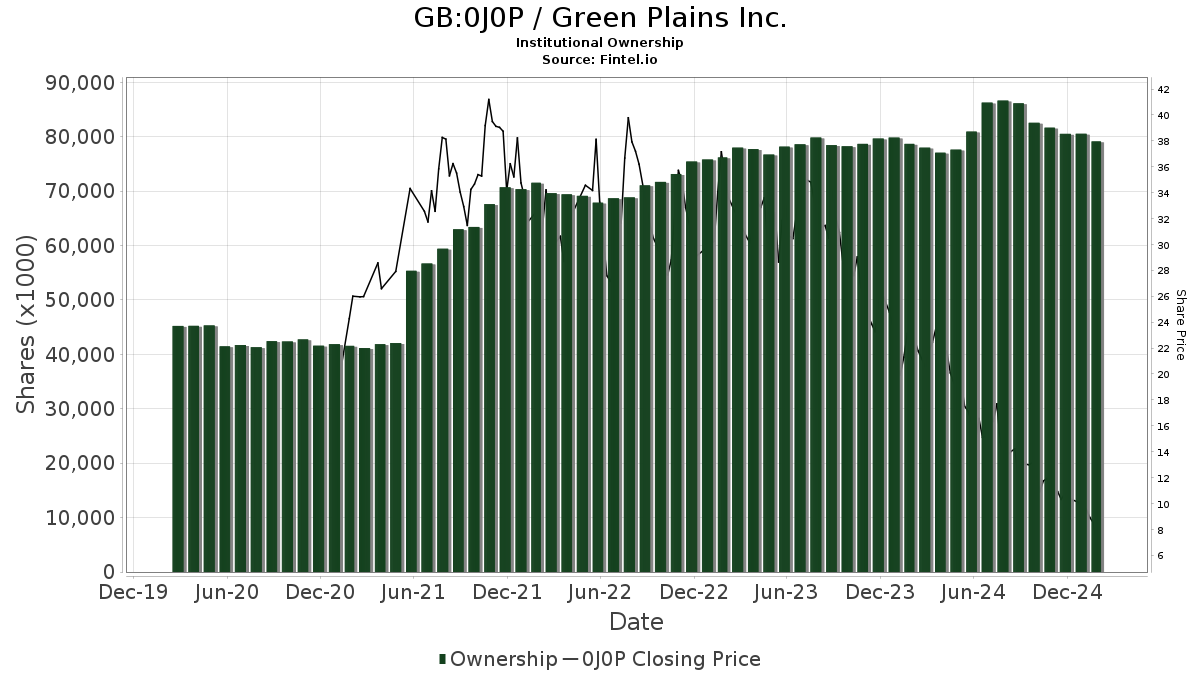

Current Fund Sentiment Toward Green Plains

A total of 485 funds or institutions currently hold positions in Green Plains, marking an increase of 16 owners, or 3.41%, from the previous quarter. The average portfolio allocation dedicated to 0J0P is 0.09%, which is up 26.88%. However, total shares owned by institutions saw a decline in the last three months, decreasing by 3.99% to 77,939,000 shares.

Institutional Shareholder Activity

Grantham, Mayo, Van Otterloo & Co. currently owns 5,249,000 shares, representing 8.11% of the company’s total shares. This is a decrease from their previous holding of 5,650,000 shares, amounting to a drop of 7.64%. The firm also reduced its portfolio allocation in 0J0P by 32.49% over the last quarter.

Similarly, Ancora Advisors holds 4,337,000 shares, reflecting 6.70% ownership. This is a slight decrease from their prior ownership of 4,423,000 shares, or 1.99%. Ancora Advisors cut its portfolio allocation in 0J0P by 32.74% in the same timeframe.

The iShares Core S&P Small-Cap ETF has 4,095,000 shares, which accounts for 6.33% ownership. This is a reduction from 4,129,000 shares, marking a 0.82% decrease in their holding. Their portfolio allocation in 0J0P has dropped by 31.67% over the last quarter.

In contrast, Goldman Sachs Group increased its stake to 2,671,000 shares, now representing 4.13% ownership. This is an increase from 585,000 shares, a substantial rise of 78.10%. The firm boosted its portfolio allocation in 0J0P by 212.98% during the same period.

Broad Bay Capital Management holds 2,210,000 shares, equating to 3.41% ownership, but this shows a decline from their previous total of 2,340,000 shares, down 5.85%. Their portfolio allocation in 0J0P has decreased by 40.84% over the last quarter.

Fintel offers a comprehensive investing research platform, serving individual investors, traders, financial advisors, and small hedge funds. Our extensive data covers global markets and includes fundamentals, analyst reports, ownership statistics, fund sentiment, options trends, insider trading, and much more. Additionally, our exclusive Stock picks are informed by sophisticated, backtested quantitative models to maximize investment returns.

Click to learn more.

This story originally appeared on Fintel.

The views and opinions expressed herein represent the author’s views and do not necessarily reflect those of Nasdaq, Inc.