General Mills Receives Upgraded Rating From B of A Securities

Analysts Predict Potential Value Growth

Fintel reports that on December 13, 2024, B of A Securities upgraded their outlook for General Mills (LSE:0R1X) from Neutral to Buy.

Analyst Price Forecast Indicates 14.55% Growth

As of December 3, 2024, analysts expect General Mills to reach an average price of 75.61 GBX/share over the next year. The forecasts vary, predicting a low of 67.68 GBX and a high of 88.21 GBX. This average target suggests a potential 14.55% increase from the last closing price of 66.01 GBX/share.

For more insights, check our leaderboard showcasing companies with the largest upside in price targets.

Projected Financial Performance

The anticipated annual revenue for General Mills stands at 21,106MM, reflecting a growth of 6.59%. Additionally, the estimated non-GAAP earnings per share (EPS) is expected to be 4.70.

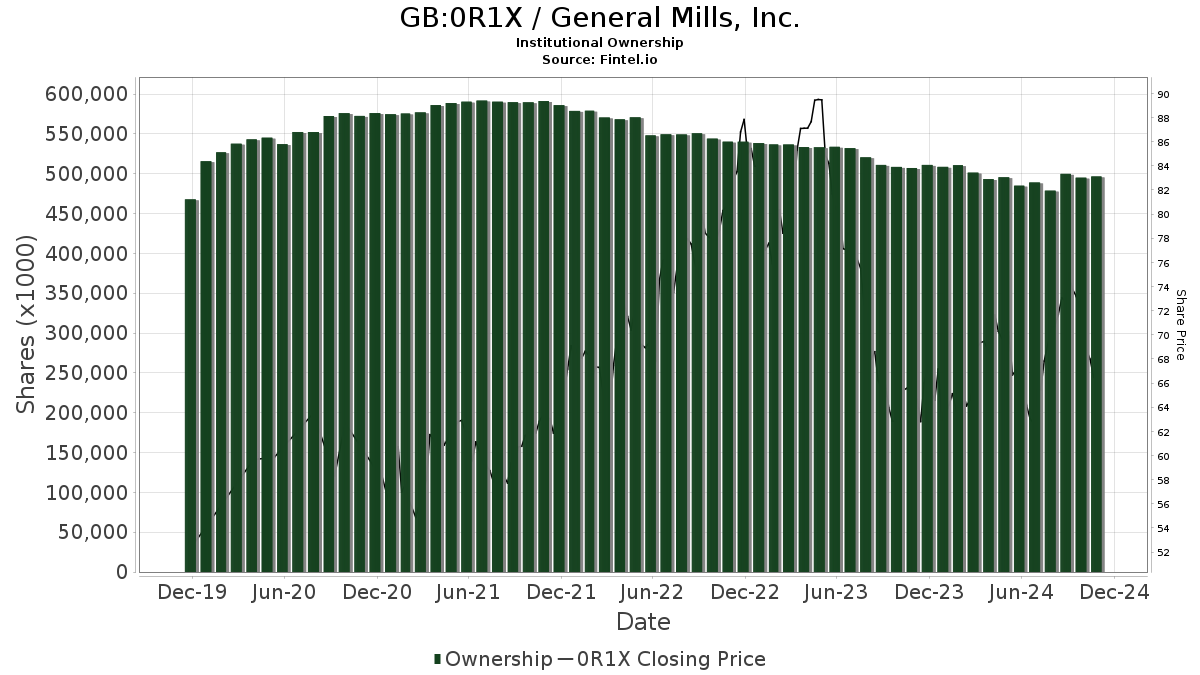

Fund Ownership Trends

Currently, 2,404 funds or institutions report having positions in General Mills. This marks an increase of 72 owners, or 3.09%, compared to the previous quarter. The average portfolio allocation for these funds dedicated to 0R1X is now 0.22%, up 2.64%. However, total shares owned by institutions fell by 2.77% over the last three months to 501,109K shares.

Institutional Shareholder Activity

Capital Research Global Investors holds 18,202K shares, accounting for 3.28% of the company. This is a decrease from their previous holding of 19,637K shares, which is a decline of 7.88%. Nevertheless, their portfolio allocation in 0R1X increased by 2.50% in the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) owns 17,667K shares, or 3.18% of the company. A slight drop occurred here as well, down from 17,861K shares, representing a 1.10% decrease. However, their allocation in 0R1X rose by 8.45% last quarter.

Vanguard 500 Index Fund (VFINX) holds 14,579K shares, which is 2.63% ownership of General Mills. Their previous total was 14,490K, resulting in a modest increase of 0.61% in their stake. Their investment in 0R1X has seen an increase of 8.09% since last quarter.

Geode Capital Management holds 14,352K shares, representing 2.59% of General Mills. This is a slight rise from 14,335K shares, yet they have significantly reduced their portfolio allocation in 0R1X by 43.54% in the last quarter.

The American Mutual Fund (AMRMX) owns 12,645K shares, equating to 2.28% ownership. This marks an 18.94% decrease from 15,039K shares held previously. Their allocation in 0R1X has also decreased by 25.66%.

Fintel offers a plethora of investing research resources suitable for individual investors, traders, financial advisors, and smaller hedge funds. Our comprehensive data includes fundamentals, analyst reports, ownership information, fund sentiment, options activities, and much more. Our exclusive stock selections are powered by sophisticated, backtested quantitative models aimed at enhancing investment profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.